Merchants are on edge, eagerly watching the Federal Reserve assembly for clues about potential rate of interest adjustments.

Amid eventful monetary dynamics, US Treasury yields edged increased earlier right this moment, whereas the crypto market, particularly Bitcoin (BTC), is experiencing a downturn with the coin’s value plummeting to $42,000.

The simultaneous rise in Treasury yields and the drop in Bitcoin’s value prompts discussions concerning the relationship between conventional and crypto markets. Traditionally, these markets have exhibited a level of inverse correlation, with traders usually transferring funds between conventional safe-haven property and riskier, extra unstable cryptocurrencies.

Treasury Yields and the Fed Assembly

In line with reviews, the yield on the benchmark 10-year Treasury word inched barely increased at 4.2563%, whereas the yield on the 30-year Treasury bond rose just below a degree to 4.3339%. The motion in yields comes as traders eagerly await alerts from the Federal Reserve concerning potential rate of interest cuts.

Merchants are on edge, eagerly watching the Federal Reserve assembly for clues about potential rate of interest adjustments. The end result may need far-reaching penalties for a lot of areas of the economic system. Traders are on the lookout for hints on when authorities would begin slicing rates of interest, prompted by latest financial statistics and the sudden discount in unemployment introduced in November’s US jobs report.

Nevertheless, the College of Michigan’s shopper knowledge, launched on Friday, supplied a lift to danger sentiment. The report indicated resilient financial exercise and cooling inflation, fostering hopes of a much-desired “soft landing” situation within the US. This optimism adopted the shock drop in unemployment and added to the rising confidence within the US financial restoration.

As a part of the monetary ecosystem, auctions for Treasury payments and notes are scheduled for later right this moment, December 11 with $75 billion of 13-week Treasury payments, $68 billion of 26-week payments, $50 billion of 3-year notes, and $37 billion of 10-year notes up for grabs.

Bitcoin’s Correction Amid Revenue-Taking

Regardless of the joy in conventional monetary markets as showcased by the Treasury Yields, the crypto market affords a special image. Bitcoin (BTC), the main cryptocurrency, is experiencing a downturn, with its value plummeting to $42,000. This decline is attributed to profit-taking amongst traders, following Bitcoin’s latest surge to a excessive of $44,705. The 5.7% drop from Friday’s peak suggests a correction or revenue reserving, as highlighted by CoinDCX Analysis Group.

Edul Patel, CEO of Mudrex, commented on the state of affairs, stating that “Bitcoin is facing increased take-profit and sell orders, triggering market-wide liquidations after reaching a new yearly high of US$44,700 last week.” Patel notes that the market motion is essential, suggesting {that a} break above $44,700 might signify a continuation of the uptrend, whereas a drop beneath might discover assist at $40,600.

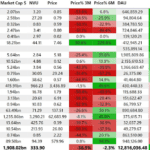

The broader crypto market displays this volatility, with the full quantity in Decentralized Finance (DeFi) standing at $8.88 billion, comprising 13.68% of the full crypto market 24-hour quantity. Stablecoins proceed to dominate, with a quantity of $56.69 billion, constituting 87.38% of the full crypto market’s 24-hour quantity.

Within the final 24 hours, Bitcoin’s market capitalization fell to $829 billion, in response to CoinMarketCap. Notably, BTC’s quantity within the final 24 hours noticed an 84.69% enhance, reaching $26.97 billion.

subsequent