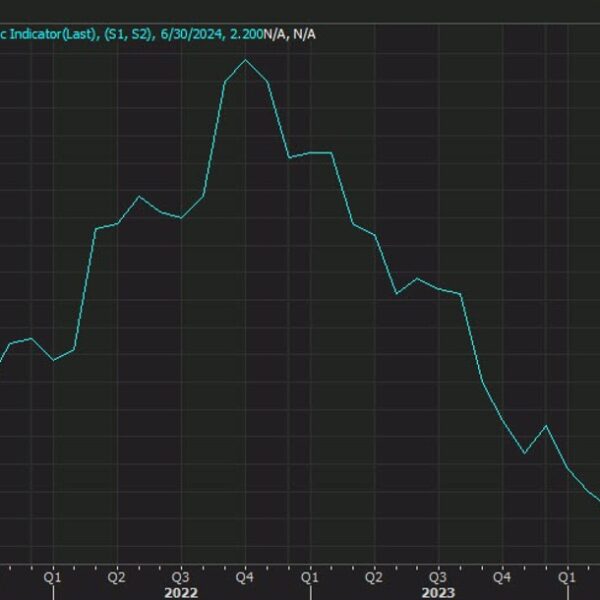

US 10 year yields

The days of high yielding safe investments may be over for a generation.

Jamie Dimon is continuing to warn about inflation but the bond market has moved on. Breakeven rates are below 2%, implying that the Fed is more likely to undershoot its target and nominal rates continue to fall, despite swelling deficits.

US 10-year yields are down another 3 bps today to 3.62%.

I will refer back to what I wrote in early June with 10s at 4.35%:

I believe this is a rare moment to lock in investments with high rates

for a long duration in the same way that the pandemic was a

once-in-a-lifetime to lock in low borrowing rates.

That chance has now largely passed.

The next leg in bonds will be driven by the growth outlook. There are some big warning signs on global growth, particularly in China but the US still looks solid. However it could import some of that weakness or feel the lagged effects of monetary policy. The political situation in the next 50 days is certainly a challenge but I tend to think that once the dust clears in early November, people will go about their jobs.

The super-trend though is in AI and the latest model from OpenAI is impressive. That should keep the downward pressure on prices and boost productivity, potentially causing massive disruption in business and the labor market. Ultimately, I think that drives overnight rates below 1% again but the timeline on that is uncertain.

For now, there are still some high yields out there but it requires going a bit further down the risk curve.