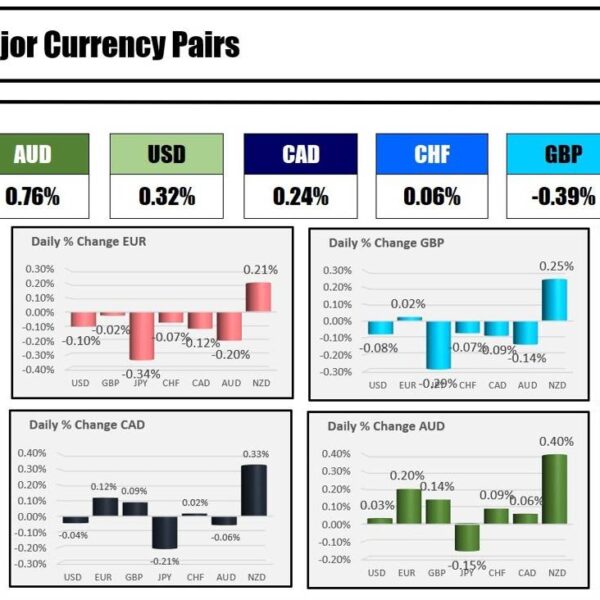

The promoting in bonds is continuous as yields are step by step popping increased in European morning commerce. This wasn’t purported to be a part of the script for 2024, in case you look again at what merchants have been positioning for again in November and December final 12 months. But, right here we at the moment are as Treasury yields are reversing a big chunk of that transfer.

US Treasury 10-year yields (%) every day chart

For some context, we have seen a major pullback by way of Fed fee reduce pricing over the previous few months. And that’s what is being confirmed by the motion within the bond market right here.

The primary fee reduce was initially set for March, then moved to June. Now, it’s pushed to September and even that’s not essentially a given in case you take the inflation outlook into consideration.

When it comes to how market pricing has shifted particularly, we noticed merchants worth in 156 bps price of fee cuts for this 12 months on the finish of December final 12 months. Presently, merchants are solely pricing in a measly 42 bps price of fee cuts.

So, the place can we go from right here?

All of it comes all the way down to the inflation image for essentially the most half. If inflation continues to stay cussed, there’s nonetheless room for an extra pullback in pricing. And which means the next greenback with yields additionally to remain underpinned till the narrative modifications.

For this week, an extra push increased in Treasury yields will hold USD/JPY in focus. The pair is buying and selling up 0.2% to 154.55 now with a detailed watch on the 155.00 mark. That is perhaps a possible intervention set off level for Japan.