imaginima

Funding Thesis

Tremendous Micro Laptop (NASDAQ:SMCI) delivered new fiscal Q2 2024 steerage that took buyers abruptly. The enterprise is guiding for such a robust fiscal Q2 2024 that buyers are in awe.

Extra particularly, SMCI with a web money place of roughly $400 million, is anticipating its revenues in fiscal Q2 2024 to develop by greater than 100% y/y to roughly $3.7 billion.

Based on my estimates, this leaves this hyper-growth enterprise priced at 14x non-GAAP EPS. At the same time as we take into account some notable danger elements going through this enterprise, I nonetheless consider this inventory gives buyers a compelling risk-reward.

Fast Recap

Again in September, in a bullish analysis, I wrote,

I discover Tremendous Micro Laptop to be a compelling funding alternative on account of its specialization in high-performance and energy-efficient laptop techniques, catering to AI markets.

[…] Regardless of this optimistic outlook, there are challenges to contemplate, together with the potential commoditization of their {hardware} and competitors on pricing.

Moreover, whereas profitability has room for enchancment, the corporate stays assured in its skill to generate robust money flows. With AI’s continued progress and Tremendous Micro’s innovation capabilities, I see robust prospects forward for this funding.

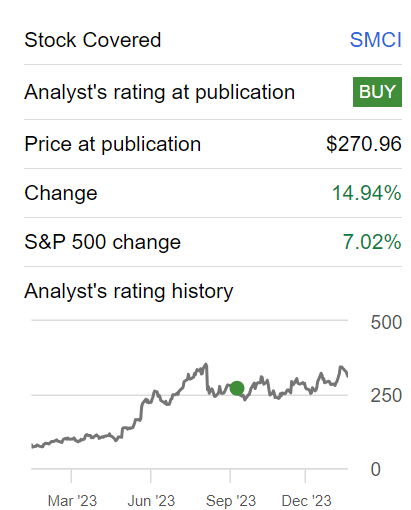

Writer’s work on SMCI

Since I penned these phrases, the share value has moved barely greater, however I do not consider buyers have been anticipating SMCI to ship such a robust return. Due to this fact, I stay bullish on this inventory.

Why Tremendous Micro Laptop? Why Now?

Tremendous Micro Laptop makes a speciality of designing high-performance and energy-efficient laptop techniques for numerous markets comparable to information facilities, cloud computing, and AI. Their product vary consists of servers, storage techniques, and blade servers. The corporate stands out for its fast growth and testing of latest computing platforms utilizing frequent constructing blocks. Collaboration with main {hardware} and software program suppliers helps combine cutting-edge applied sciences into their merchandise.

A particular function is their dedication to resource-saving structure, aiming to cut back information middle working prices. This structure helps unbiased refresh of CPU and reminiscence sources, reducing refresh cycle prices and minimizing digital waste. Tremendous Micro Laptop additionally gives area and power-efficient merchandise by enabling the sharing of computing sources in information facilities.

The vast majority of their enterprise revolves round server and storage techniques, with a notable success in offering full rack-scale options to main AI innovators, together with Nvidia. This strategic focus positions them effectively within the rising AI market, with potential for growth to further shoppers past Nvidia.

Given this background, let’s talk about SMCI’s new steerage.

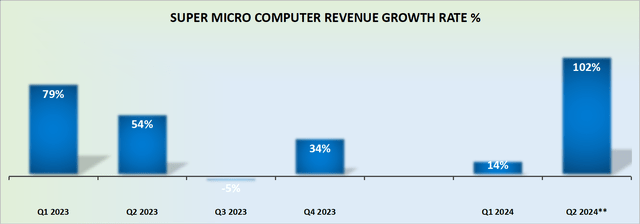

Income Progress Charges Astound

There was at all times the expectation that Tremendous Micro Laptop was going to ship a robust fiscal Q2 2024 consequence for the reason that firm had beforehand guided on the excessive finish for greater than 60% CAGR.

However I do not consider many buyers would have anticipated the corporate to earnestly ship greater than 100% CAGR on the excessive finish of its revenues. Notably once we take into account that fiscal Q2 2023 was a reasonably powerful quarter to beat, in and of itself.

What’s extra, fiscal Q3 2024 and monetary This autumn 2024 are each up in opposition to dramatically simpler comparables. Consequently, given the corporate’s newly discovered progress, it seems doubtless that fiscal H2 2024 ought to ship round greater than 80% CAGR.

This is the maths – for fiscal Q2 2024 the excessive finish of its steerage factors to $3.7 billion. This is a rise of 72% sequentially from fiscal Q1 2024. Due to this fact, with a purpose to present me with a margin of security, I count on that fiscal Q3 2024 grows by 10% sequentially every quarter.

Regardless that 10% sequentially on the again of this fiscal Q2 2024 steerage appears to me so conservative that it borders on being inaccurate, for the sake of our dialogue, let’s simply use this estimate.

Which means that SMCI is now on a path in the direction of $17 billion in revenues within the coming 12 months.

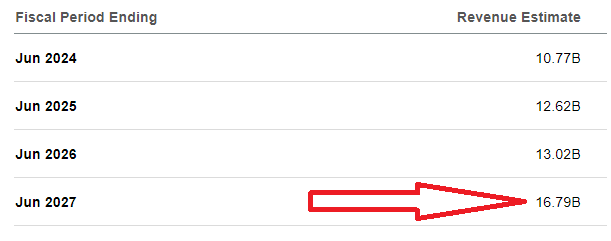

What’s extra, take into account what analysts had anticipated from SMCI.

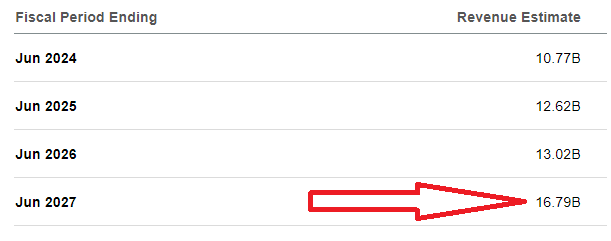

SA Premium

The Avenue wasn’t anticipating SMCI to ship $17 billion of revenues till 2027. Put one other manner, SMCI has pulled ahead 3 years value of revenues.

SMCI Inventory Valuation — 14x Ahead EPS

Beforehand, on the again of fiscal Q1 2024, SMCI was anticipating to see round 4.90 of EPS on the excessive finish. This might have meant that SMCI was rising at 43% y/y.

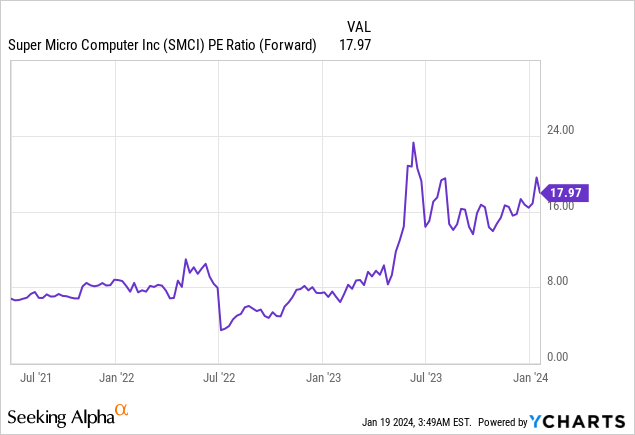

That was clearly a beautiful progress price, which buyers have been beforehand paying about 17x ahead EPS.

And now, on the excessive finish, SMCI is guiding for $5.55 of EPS. Consequently, on a ahead run-rate, it seems doubtless that SMCI might ship $25 of EPS over the subsequent twelve months.

Which means that SMCI is priced at about 14x ahead EPS. Even when we take into account the truth that SMCI’s lately ignited progress charges are usually not going to be sustainable, as a result of this form of progress by no means lasts lengthy, having to pay 14x ahead EPS for a enterprise that I estimate to develop by +80% over the subsequent 12 months looks like a really compelling funding.

Threat Components

This isn’t a inventory that has traded at significantly excessive P/E ratios previously. Which means that regardless of this inventory’s progress charges, this inventory is not more likely to re-rate considerably greater.

SMCI predominantly collaborates with NVIDIA (NVDA), AMD (AMD), and Intel (INTC). This implies, that as its buyer base continues to scale greater, there’s going to be elevated buyer focus with these clients. Extra particularly, as of final quarter, fiscal Q1 2023, one buyer accounted for 25% of the online gross sales for that quarter.

Which means that SMCI is very contingent on that buyer for its progress charges, and it is rather a lot at this buyer’s mercy in relation to renegotiating contracts.

Alongside this key danger issue, there’s the corollary to it, which is, how lengthy can buyers count on SMCI to develop at these breakneck charges? Naturally, I’ve no skill to foretell that, and it is a danger that readers want to concentrate on.

The Backside Line

In abstract, I’m impressed with Tremendous Micro Laptop’s new fiscal Q2 2024 steerage, which have defied expectations and sparked investor awe.

With a considerable web money place of roughly $400 million, the corporate anticipates a outstanding over 100% year-over-year income surge to succeed in round $3.7 billion in fiscal Q2, 2024.

Whereas I acknowledge sure danger elements, comparable to buyer focus and the sustainability of this accelerated progress, the sturdy monetary place and the inventory’s valuation at 14x ahead EPS make SMCI an attractive funding. Contemplating the anticipated +80% progress over the subsequent 12 months, this surprising acceleration in income trajectory positions SMCI as a compelling and thrilling prospect out there.