da-kuk

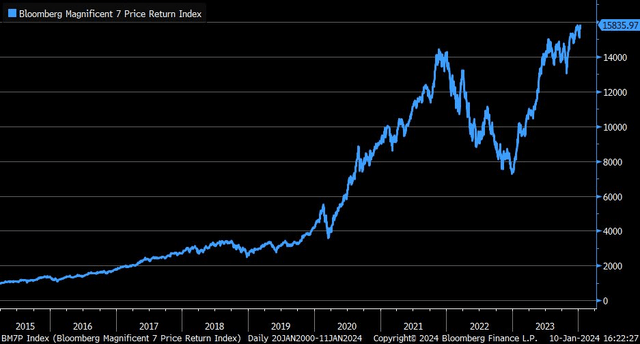

The flip of the calendar didn’t lead to high-growth tech shares and the AI theme taking a again seat to worth, as some had suspected. Thus far in 2024, what labored through the first seven months of 2023, such because the Magnificent Seven and AI equities, has returned to favor. With bitcoin ETFs making headlines and AI nonetheless capturing the eyes of traders, shares of Tremendous Micro Pc (NASDAQ:SMCI) have rallied sharply after a months’ lengthy consolidation interval.

I’m upgrading the inventory from a maintain to a purchase. I see the valuation as improved from final 12 months as earnings progress has verified effectively. Furthermore, the technical state of affairs seems to be higher because the inventory encroaches on all-time highs. Gross sales progress dangers are a priority, although.

Magazine 7 Climbs to New Highs Following A Pause within the Development Theme

In response to In search of Alpha, SMCI develops and manufactures high-performance server and storage options based mostly on modular and open structure in america, Europe, Asia, and internationally. Its options vary from full server, storage techniques, modular blade servers, blades, workstations, full racks, networking units, server sub-systems, server administration software program, and safety software program.

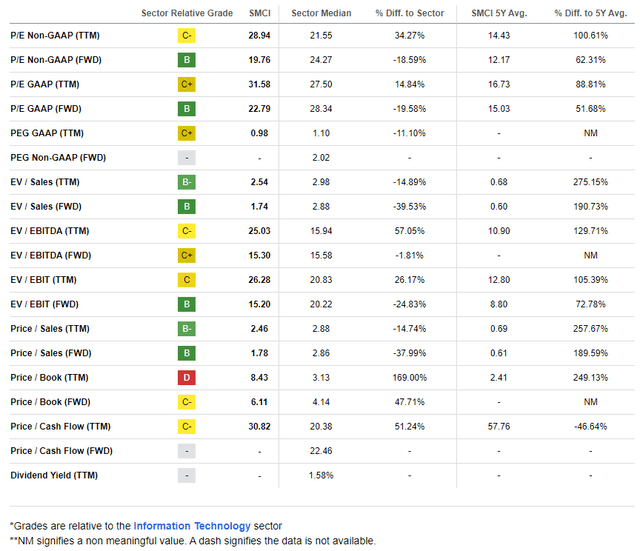

The California-based $19.1 billion market cap Know-how {Hardware}, Storage, and Peripherals trade firm inside the Data Know-how sector trades at a near-market 19.8 ahead price-to-earnings a number of, a big low cost to the Data Know-how sector’s P/E, and doesn’t pay a dividend. Implied volatility forward of its earnings report due out later this month is excessive at 78%, and quick curiosity on the inventory is elevated at 9.5% as of January 10, 2024.

It was a considerably robust few months following SMCI’s inventory value surge to close $360 final summer time. Recall late final 12 months there was a slew of detrimental headlines. First, on December 1, 2024, the corporate introduced a $524 million securities offering comprised of two.1 million shares of widespread inventory at a value of $262.

SMCI dipped following that issuance information, after which got here the headline that each Tremendous Micro’s CEO Charles Liang and CFO David Weigand sold important quantities of inventory. Monitoring insider transaction tendencies is a key a part of forming an funding outlook, and promoting, whereas not inherently bearish, can solid clouds on a inventory that has run up.

Lastly, analysts at Susquehanna cut their rating on SMCI to detrimental, citing considerations that margin pressures are intensifying amid heightened competitors and rising prices for reminiscence and storage. The inventory is up greater than 30% since that decision, nonetheless. Regardless of these seemingly bearish catalysts, value motion has instructed a unique story.

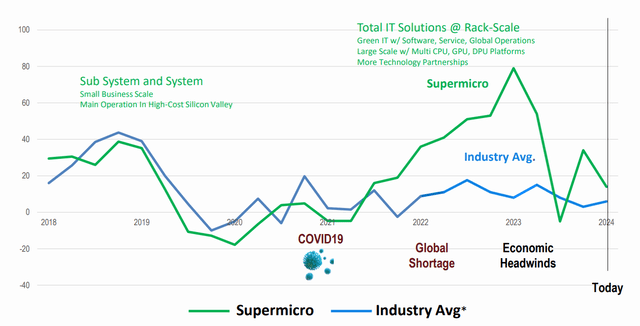

SMCI Development Versus Its Business

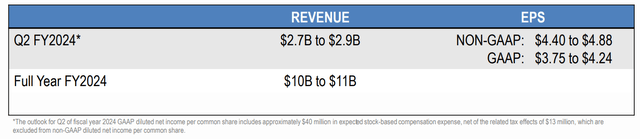

Larger image, Tremendous Micro reported a robust set of Q1 2024 outcomes again in early November final 12 months. Non-GAAP EPS of $3.43 topped the Wall Road consensus estimate of $3.25 whereas income of $2.1 billion, up 15% from year-ago ranges, was a modest beat. The administration sees FY 2024 internet gross sales between $2.7 billion and $2.9 billion, with Q2 2024 non-GAAP EPS within the $4.40 to $4.88 vary.

SMCI: Steering Launched in November

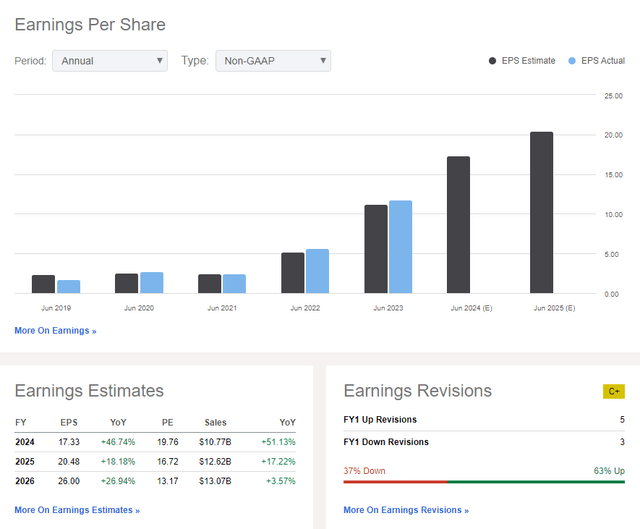

On valuation, with present consensus EPS forecasts above $17 this 12 months and above $20 for the out 12 months, the inventory is just not all that costly. The numerous threat is that gross sales progress is slowing from a excessive 51% fee this 12 months to simply 4% by 2026. Thus, I assert {that a} very excessive earnings a number of is just not warranted. Slightly, if we apply a 20 a number of on $18.50 of non-GAAP EPS over the approaching 12 months, then shares ought to commerce close to $370 essentially. That’s up about 10% from my previous outlook provided that earnings growth has materialized. There are upside dangers to that valuation, and a robust technical state of affairs warrants an improve.

SMCI: Rising EPS Traits, Gross sales Development Slowing

SMCI: A Ahead P/E Below 20

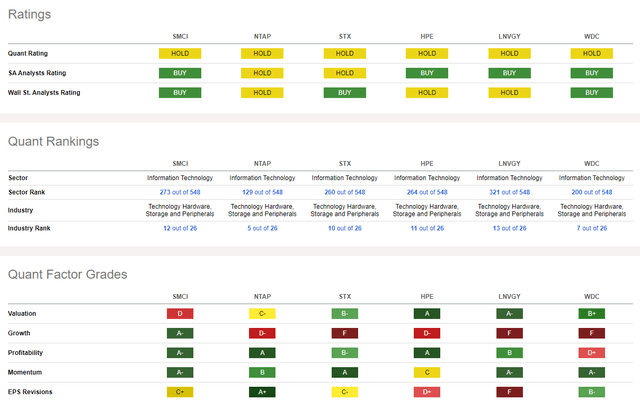

In comparison with SMCI’s peers, the corporate sports activities very wholesome progress metrics, whereas the valuation view is just not as sanguine. I discovered {that a} excessive price-to-book ratio on SMCI would be the offender bringing down the valuation score (a price-to-book ratio is just not an particularly helpful metric for a high-growth tech firm, nonetheless).

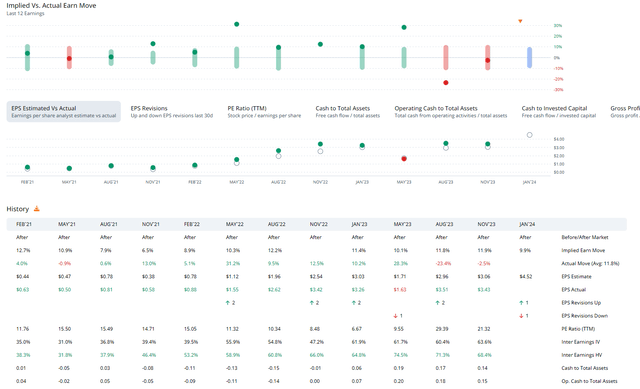

Nonetheless, profitability tendencies are sturdy whereas share-price momentum with SMCI is stout – I’ll element that later. Lastly, EPS revisions have been lackluster currently, however one other earnings beat later this month, ought to it happen, would doubtless trigger some bearish analysts to rethink their outlook. SMCI has topped bottom-line estimates in 11 of the previous 12 quarters.

Competitor Evaluation

Merchants have priced in a excessive 9.9% implied transfer after the January 30 earnings report, based on Possibility Analysis & Know-how Companies (ORATS).

Earnings Historical past: 11 Out of 12 Beats, 9.9% Implied Transfer For the January 30 Report

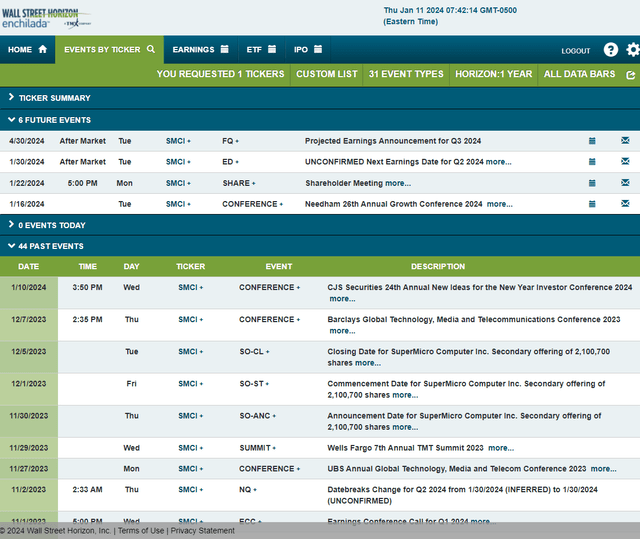

Wanting forward, company occasion knowledge supplied by Wall Road Horizon exhibits an unconfirmed Q2, 2024 earnings date of Tuesday, January 30 AMC. The corporate holds its annual digital shareholders’ meeting on Monday, January 22 and the agency’s administration workforce is slated to current on the Needham 26th Annual Development Conference 2024 in New York from January 11 by means of 19. It’s not shocking why implied volatility is so excessive given this set of key occasions on faucet.

Company Occasion Danger Calendar

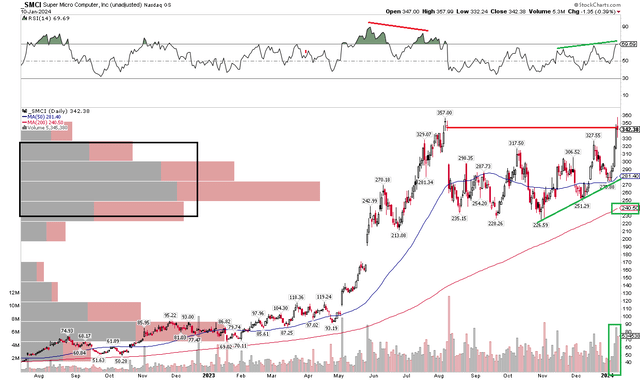

The Technical Take

SMCI lastly made a transfer again towards all-time highs. Earlier this week, shares approached the $357 peak from early August, filling a spot that happened shortly after the market’s near-term peak in late July. Amid the S&P 500’s and Nasdaq’s Q3-This fall correction, SMCI fell to key assist round $230 – a degree I highlighted in my earlier evaluation two quarters in the past. Given a big churn within the $230 to $330 vary, an ample quantity of shares traded now exists in that zone, which is bullish from a technical perspective now that value has rallied by means of it. That vary ought to act as a zone of potential consumers.

What I additionally like about SMCI at present, one thing that would not have been mentioned of the high-growth inventory again in Q2 2023, is that the RSI momentum gauge on the high of the chart is making new highs together with value (relative to the previous couple of months). There was a bearish RSI divergence final summer time, against this. Furthermore, I like that quantity has ticked up together with the share-price appreciation currently. Large image, with a rising long-term 200-day shifting common, the bulls seem in management. SMCI has continued to carry an uptrend assist line, buttressing the bullish technical thesis.

Total, I see technical upside forward and assist could also be discovered close to $280 with long-term assist within the $225 to $235 space. A bullish breakout above $357 would portent a technical goal of close to $490 based mostly on the peak of the current consolidation sample ($357-$227).

SMCI: Improved RSI Momentum, Shares Testing All-Time Highs After A Consolidation

The Backside Line

I’m upgrading SMCI from a maintain to a purchase on stable earnings progress verification and improved technicals. Momentum has ticked up, and a key set of occasions is on faucet for the steadiness of the month.