Key Notes

- Trump stated Congress is advancing crypto market structure legislation to prevent China from dominating the digital asset space.

- Coinbase CEO Brian Armstrong identified critical issues including tokenized equity bans and DeFi prohibitions in the current bill.

- Bitcoin dropped below $90,000 amid regulatory uncertainty, triggering significant liquidations across the cryptocurrency market.

Speaking at the World Economic Forum (WEF) in Davos, United States President Donald Trump signals he expects to be able to sign the CLARITY Act soon. The Act is the crypto market’s structure bill that has been involved in public controversies due to fears of killing innovation in favor of traditional banks.

“To unleash innovation and savings and financing, I’m also working to ensure America remains the crypto capital of the world. And to that end I signed last year the landmark GENIUS Act into law. Now, Congress is working very hard on crypto market structure legislation. Bitcoin, all of them. Which I hope to sign very soon, unlocking new pathways for Americans to reach financial freedom,” President of the United States Trump said.

He then continued his speech mentioning the two reasons behind these acts. First, given crypto’s political strength, with millions of voters looking for a crypto-friendly candidate. Second, to prevent China from becoming the crypto capital of the world, which Trump recognizes as a risk.

“Number one [reason], I thought it was politically good and it was. I got tremendous political support. But more importantly, China wanted that market too, just like they want the AI. And we’ve got that market, I think, pretty well locked up. (…) Once they [China] have that role we will not be able to get it back.”

JUST IN: 🇺🇸 President Trump says he hopes to sign the crypto market structure bill (CLARITY Act) soon. pic.twitter.com/2tQQqeefwP

— Altcoin Daily (@AltcoinDaily) January 21, 2026

In a follow-up post, Senator Cynthia Lummis shared and agreed with a clip from the video above, saying “It’s time to get the Clarity Act across the finish line.”

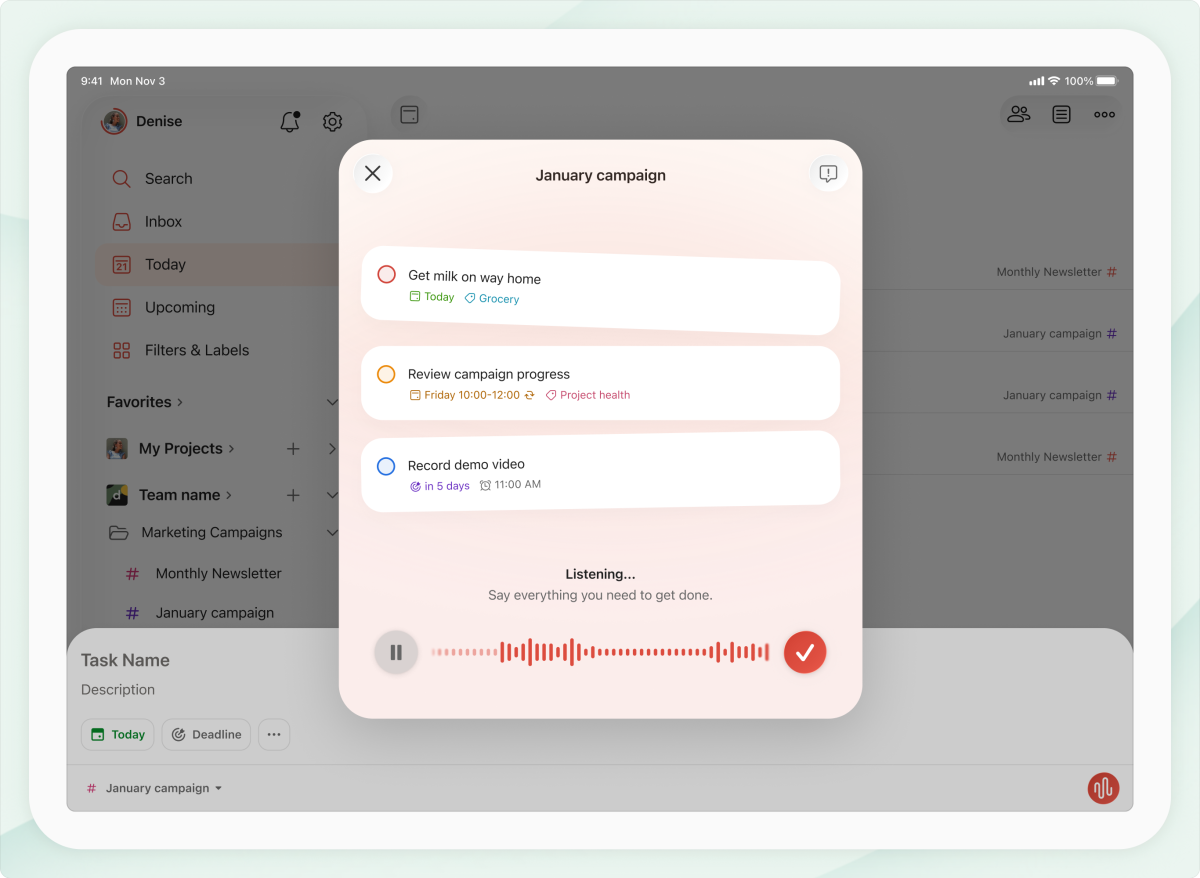

Coinbase Steps Back, Raises Concerns on the CLARITY Act

However, a group of crypto industry businesses seems to disagree with the “unleash innovation” and “financial freedom” part of the structure legislation in its current form. Controversy rose after Coinbase CEO Brian Armstrong posted on January 14 on X that “Coinbase unfortunately can’t support the bill as written.”

In the post, Armstrong listed a series of identified issues in the bill, including a ban on tokenized equities, DeFi prohibitions and anti-privacy attributes, “erosion of the CFTC’s authority, stifling innovation and making it subservient to the SEC” and prohibiting the possibility of stablecoins rewarding users with yield, “allowing banks to ban their competition,” in his words. On January 21, the Coinbase CEO doubled down on his positioning but demonstrated optimism while summarizing the controversy in a CNBC appearance.

Here’s a quick summary of what happened last week with the CLARITY Act.

Now we’re all working together to find a win-win scenario for everyone, especially the American people. pic.twitter.com/Wcry97B3qf

— Brian Armstrong (@brian_armstrong) January 21, 2026

Bitcoin crashed below $90,000 yesterday amid the uncertainty, causing massive liquidations in the market, as Coinspeaker reported. This was the second day in a row of significant long-position liquidations, following the nearly $900 million-liquidations from Jan. 19.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.