Now that incoming US President Donald Trump is warming up for his second administration, many in the crypto industry expect big things for tech and crypto. According to Cathie Wood of Ark Investment Management, Trump’s win will spur innovation in artificial intelligence, tech, and cryptocurrencies.

In an interview with CNN’s Inside Politics Sunday, the Ark Investment CEO shared her thoughts about Securities and Exchange Commission Chairman Gary Gensler’s restrictive policies on crypto, which, according to her, nearly knocked the country from the global cryptocurrency map.

Wood said that the US lost its footing in digital currency, and Trump’s presidency will create meaningful developments in various sectors.

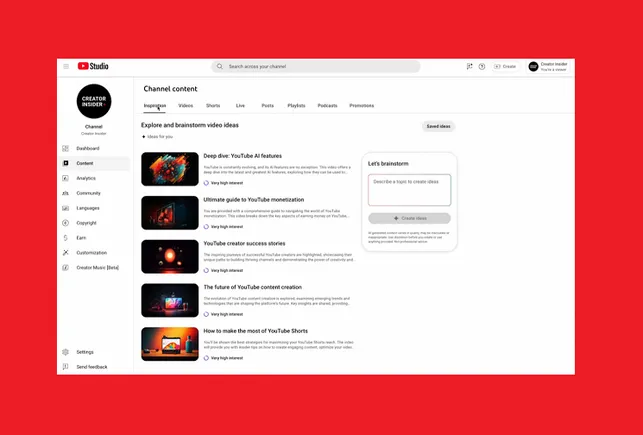

US Must Focus On Top Technologies, Like Crypto And AI

Cathie Wood states that overregulation is the country’s primary enemy of tech and innovation. She argues that Gensler’s aggressive regulation policy on crypto has caused many talents to leave the country. She adds that this is about to change, with the new administration approving friendly regulations on bitcoin and generative AI.

Image: ReBlonde

Wood shared that five major technologies are shaping our world: cryptocurrency, energy storage, and multiomics. She explained that the US must develop and lead these technologies.

In the same CNN interview, she shared that the concentration was on a few stocks in the last four years. However, with Trump returning to office, she expects more significant gains for companies pushing innovation.

A Regulatory Reset Will Help US Tech & Crypto

According to Cathie Wood, the SEC’s overregulation has particularly damaged cryptocurrency. Gensler’s approach and public statements have stifled innovation, according to Wood. And with the possibility of loose regulations on the horizon, Wood expects that smaller players in emerging industries can have their chances.

As of today, the market cap of cryptocurrencies stood at $3.32 trillion. Chart: TradingView

Wood used the interview to highlight crypto’s experience under Gensler’s policies. She shared that the industry faced challenges, and the US needed to harness the technology before other countries left it out.

However, a second Trump presidency will diminish the SEC’s influence. The administration is looking to expand the role of the Commodity Futures Trading Commission (CFTC) to reverse the SEC’s overregulation.

Public Should Expect Changes Under Trump’s Second Term

Wood also discussed other possible economic issues and policies, including Trump’s tariff threats. These tariffs, while aggressive, she says, still make sense, especially if combined with tax cuts that will allow businesses to remain competitive. The combination of tariffs and tax cuts can help boost innovation in different sectors.

The market responds positively to these plans, with many investors shifting their investments to smaller, high-growth companies. On the digital currency side, Bitcoin continues to lead the market, with price testing the $100k mark.

Featured image from The Australian, chart from TradingView