Summary:

-

U.S. considering plan to control Venezuelan state oil output and sales.

-

Aim to influence global oil prices and curb Russia/China leverage.

-

Strategy includes partnerships with majors like Chevron.

-

Substantial investment needed to revive decayed oil infrastructure.

-

Plan faces domestic political pushback and geopolitical risk.

The U.S. administration under President Donald Trump is reportedly exploring an ambitious plan to exert significant control over Petróleos de Venezuela SA (PdVSA), the state-owned oil company of Venezuela — part of a broader effort to reshape global energy markets and advance strategic objectives in Latin America. The plan, detailed in a Wall Street Journal report, envisions the U.S. acquiring and marketing a large share of Venezuela’s crude production, effectively placing the country’s vast oil reserves under U.S. stewardship.

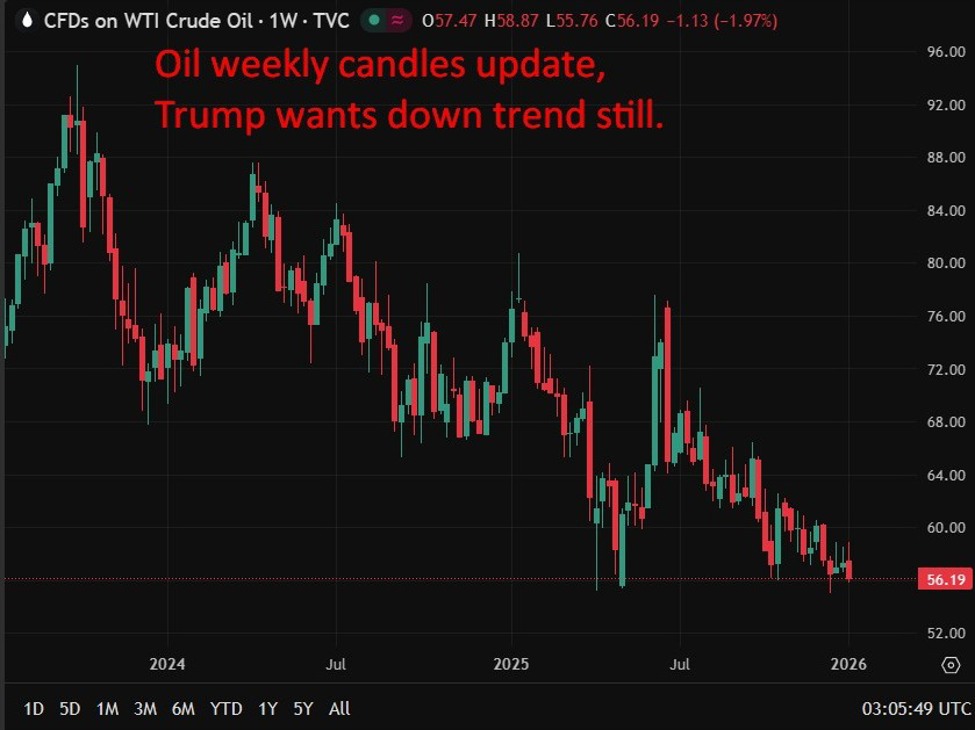

If implemented, the strategy could give the United States control over a substantial portion of proven oil reserves in the Western Hemisphere — factoring in holdings and influence in Mexico, the U.S. and other allied producers. White House officials view this as a lever to limit Russian and Chinese influence in Venezuela and to pressure global energy prices down toward Trump’s political target of around USD 50 per barrel, though Brent and WTI prices have recently traded above that level.

The initiative has multiple components, including selectively lifting U.S. sanctions on Venezuelan crude to facilitate acquisitions and resales, and leveraging existing or future joint ventures with major energy companies such as Chevron. The U.S. would potentially sell Venezuelan oil on international markets while controlling revenues through U.S.-held accounts, with proceeds earmarked to support reconstruction and stabilization efforts — and to benefit Venezuelans.

The approach reflects a blend of energy policy and geopolitical strategy: securing a cheap and reliable supply of heavy crude for U.S. refiners, weakening adversary access to Venezuelan resources, and realigning Caracas’s political and economic orientation in Washington’s favour.

However, major hurdles remain. Venezuela’s oil infrastructure has suffered decades of underinvestment, and reviving production would require significant capital — a challenge compounded by international legal and political risks. Some U.S. oil companies have expressed caution about deepening involvement without strong protections, and domestic shale producers warn that prolonged sub-$60 oil could undermine their economics.

Moreover, the plan has drawn sharp criticism from political opponents in Washington, who describe it as overreach and warn of the risks of prolonged U.S. entanglement in Venezuelan affairs. Nonetheless, the proposal underscores how energy security and great-power competition continue to shape U.S. foreign policy in 2026.