Key Notes

- Crypto income derived from $463M in World Liberty Financial tokens and $336M from $TRUMP meme coin sales during investor roadshows.

- Foreign investors dominated purchases with 36 of 50 largest wallets linked to overseas buyers including Justin Sun and Bobby Zhou.

- Administration reversed crypto policies post-inauguration while Rep Khanna proposes banning officials from cryptocurrency trading.

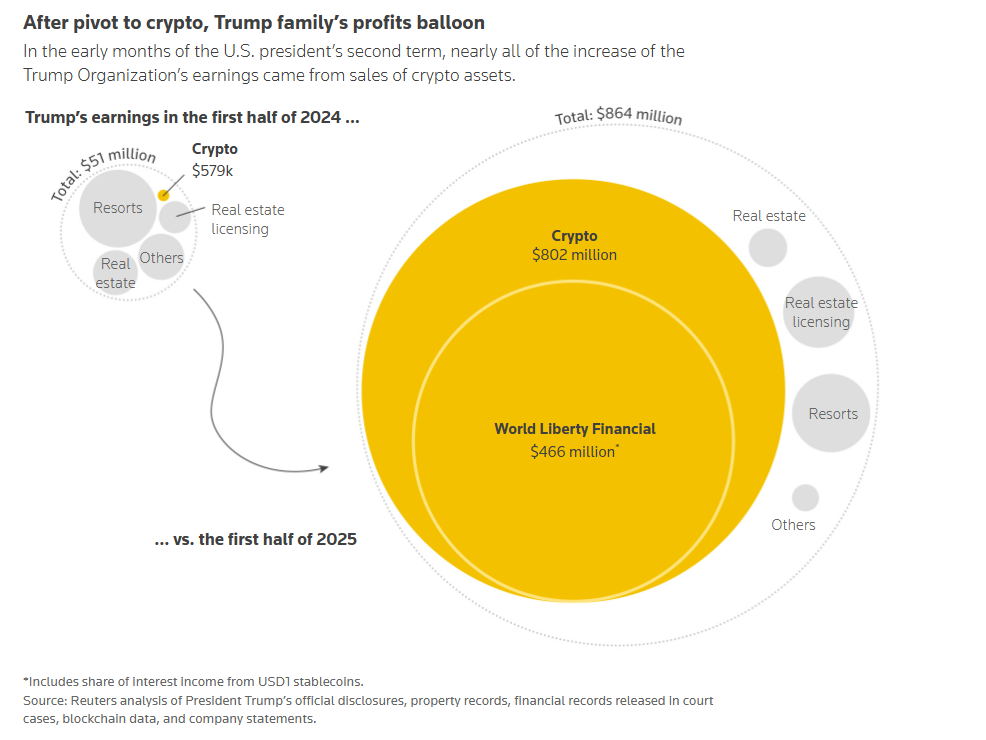

The Trump Organization’s income jumped to $864 million in the first half of 2025, a 17-fold increase from $51 million the previous year, according to Reuters on Tuesday. Cryptocurrency ventures accounted for $802 million, with the remainder from golf clubs, resorts and real estate licensing deals.

The crypto income came from two primary sources: $463 million from World Liberty Financial token sales and $336 million from TRUMP

TRUMP

$6.94

24h volatility:

4.7%

Market cap:

$1.38 B

Vol. 24h:

$1.53 B

meme coin sales, according to Reuters calculations based on financial disclosures, property records and crypto trade data.

The investigation found that Eric Trump and Donald Trump Jr. promoted the tokens on an international investor roadshow spanning Europe, the Middle East and Asia.

Trump’s crypto earnings | Source: Reuters.com

Foreign Investors Drive Token Sales

Eric Trump met with Chinese businessman Guren “Bobby” Zhou in Dubai in May during a cryptocurrency conference, according to a person familiar with the meeting who spoke to Reuters.

Zhou, who holds executive roles in multiple businesses, is under investigation in Britain for money laundering, according to the National Crime Agency and court documents reviewed by Reuters. Zhou did not respond to Reuters’ request for comment.

On June 26, Aqua1 Foundation, an entity linked to Zhou, announced a $100 million purchase of World Liberty Financial tokens. Crypto analytics firm Nansen told Reuters that 36 of the 50 largest token-holding wallets, valued at $804 million, were likely connected to overseas buyers.

Hong Kong-based crypto billionaire Justin Sun, who was charged by the SEC with fraud in 2023, purchased $75 million in World Liberty Financial tokens. Abu Dhabi’s state-controlled MGX used World Liberty’s USD1 stablecoin for a $2 billion investment in Binance

BNB

$1 099

24h volatility:

3.8%

Market cap:

$151.43 B

Vol. 24h:

$2.93 B

in May.

Regulatory Shifts and Pardons

According to Reuters, the Trump administration reversed several crypto policies after the president’s inauguration. The Justice Department eliminated its crypto enforcement team, regulators removed bank warnings about crypto risks, and the SEC paused or dropped lawsuits against crypto firms. Government ethics experts interviewed by Reuters described the alignment of the family’s business with US crypto policy as an “unprecedented conflict of interest.”

President Donald Trump granted a pardon to Binance founder Changpeng Zhao last week. Zhao served nearly four months in prison after pleading guilty to anti-money-laundering failures. The White House said the previous administration “severely damaged” US leadership in technology and innovation.

Following the pardon, Binance.US announced plans to list WLFI token and the Trump family’s USD1 stablecoin for trading, drawing criticism from Democratic lawmakers over potential conflicts of interest.

Rep. Ro Khanna (D-Calif.) announced on Monday he is introducing legislation to ban the president, his family, members of Congress, and all elected officials from trading stocks or cryptocurrency.

Khanna described the proposed ban as a direct response to what he called “blatant corruption” in interviews with MSNBC. The California congressman alleged that Zhao pledged support for World Liberty and claimed the arrangement was illegal.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

As a Web3 marketing strategist and former CMO of DuckDAO, Zoran Spirkovski translates complex crypto concepts into compelling narratives that drive growth. With a background in crypto journalism, he excels in developing go-to-market strategies for DeFi, L2, and GameFi projects.