President-elect Donald Trump is poised to reshape the US government’s approach to crypto, actively seeking candidates with industry-friendly views for key regulatory positions.

According to the Washington Post, as part of his strategy to establish the United States as the “crypto capital of the world,” Trump’s transition team is consulting with cryptocurrency executives to explore potential changes to federal policy.

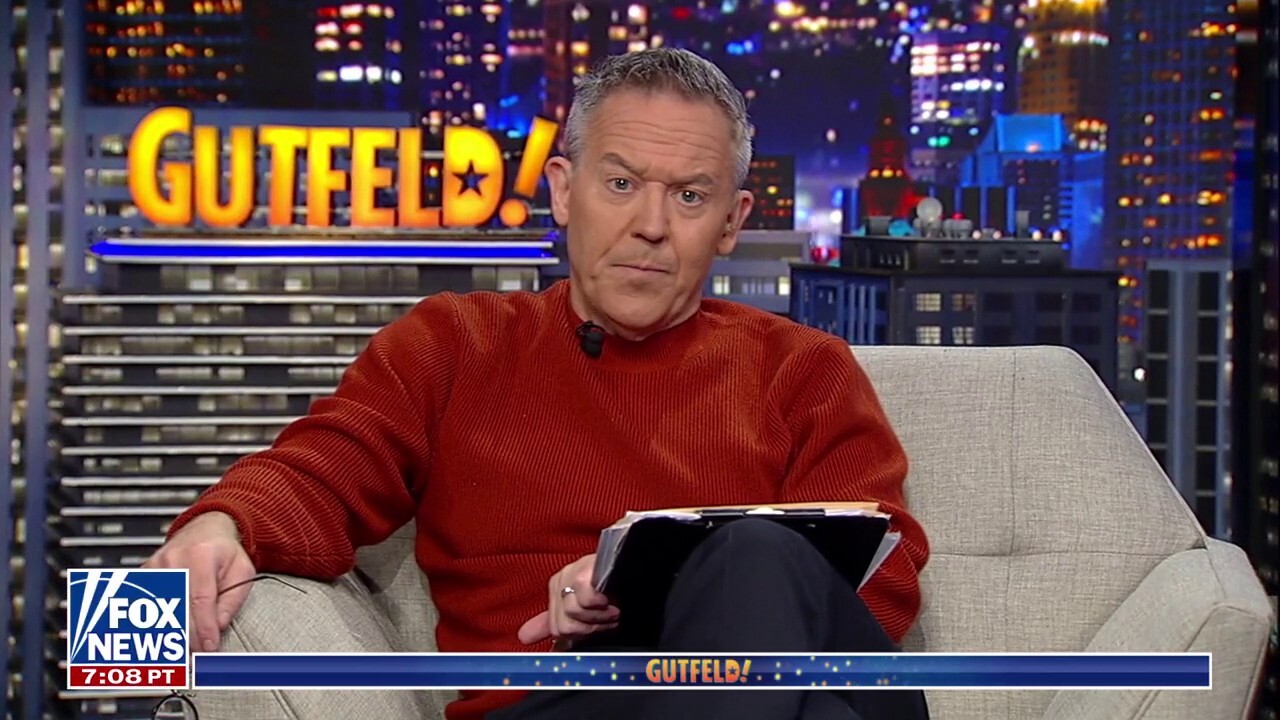

SEC Overhaul On The Horizon

Trump’s commitment to a more permissive regulatory environment is in line with his campaign promises, which have garnered significant support from the industry, as evidenced by the current uptrend in prices following his victory over Vice President Kamala Harris last Tuesday.

Early discussions among Trump’s advisers have reportedly focused on financial regulatory agencies, notably the Securities and Exchange Commission (SEC), where leadership choices will significantly influence the future of digital asset regulation.

The candidates under consideration include a mix of current regulators, former officials, and financial industry executives known for their pro-crypto stance.

Notable names include Daniel Gallagher, a former SEC official now at US-based cryptocurrency exchange Robinhood, and pro-crypto commissioners Hester Peirce and Mark Uyeda.

These individuals have publicly criticized the previous policies of the SEC and its chairman Gary Gensler under President Joe Biden, particularly the agency’s heavy-handed enforcement against digital asset firms, with ongoing investigations and lawsuits against key players in the past years.

Trump’s Crypto Advisory Team

Industry executives, including Ripple CEO Brad Garlinghouse, have noted that they expect the new Trump administration to focus on regulatory clarity, lacking amid a fragmented legal framework governing cryptocurrencies.

The digital assets sector has long called for comprehensive legislation to define the status of currencies such as XRP, Litecoin and Solana, to establish investor protections and to offer new investment products such as the spot exchange-traded funds (ETFs) investing in Bitcoin and Ethereum that were approved earlier this year.

Trump’s support has also attracted high-profile industry figures, including Elon Musk and Howard Lutnick, who are involved in shaping the administration’s crypto policies.

However, Lutnick, CEO and chairman of asset manager Cantor Fitzgerald, has raised concerns about potential conflicts of interest given his ties to stablecoin issuer Tether and other crypto-related companies.

As Trump moves forward with his transition, the Post reports that his team is exploring the establishment of a presidential council on digital currencies and considering the appointment of a dedicated crypto advisor within the National Economic Council.

Despite the optimistic outlook among supporters, some Democrats have expressed concerns about the potential implications of Trump’s pro-crypto policies.

Critics argue that the regulatory changes sought by the industry could undermine consumer protections and “expose investors to greater risks of fraud and market manipulation.”

While the now 47th president aims to implement a comprehensive agenda, including the possibility of creating a national Bitcoin reserve, the effectiveness of these plans will depend on regulatory authority.

However, with the Republican Party winning a majority in Congress, the path to these markers may be easier for Trump and the broader industry.

Featured image from AP,, chart from TradingView.com