JHVEPhoto/iStock Editorial via Getty Images

Thesis

TCW Strategic Income Fund (NYSE:TSI) is a fixed income class closed-end fund managed by TCW Investment Management. We first started covering the name last year, when we assigned it a ‘Buy’ rating. In our initial article, we highlighted how the fund had an overweight position in mortgage backed securities, an asset class which we found to be priced very attractively at the time. TSI has delivered a very robust total return since our article:

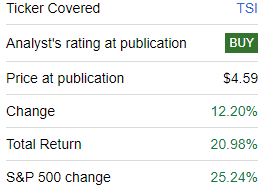

Prior Rating (Seeking Alpha)

The CEF is up over 20% since our article, almost matching the S&P 500 performance, which is highly unusual for a fixed income fund.

In today’s article, we are going to revisit TSI and its holdings, and highlight why the fund does not present an attractive entry point anymore given the narrowing in rates in the past months. We nonetheless still find the CEF appealing, but a name to hold at this stage of the cycle rather than buy into.

Analytics

- AUM: $0.24 billion.

- Sharpe Ratio: -0.17 (3Y).

- Std. Deviation: 6 (3Y).

- Yield: 4.66%.

- Premium/Discount to NAV: -2.6%.

- Z-Stat: 3.

- Leverage Ratio: 0%.

- Effective Duration: 3 yrs

- Composition: Fixed Income Multi Asset

Collateral composition – still overweight MBS bonds

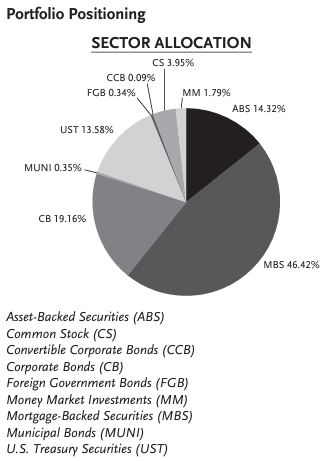

The fund continues to be overweight MBS securities, both Agency and Non-Agency:

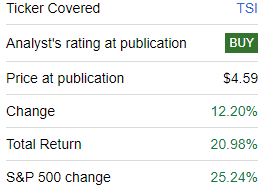

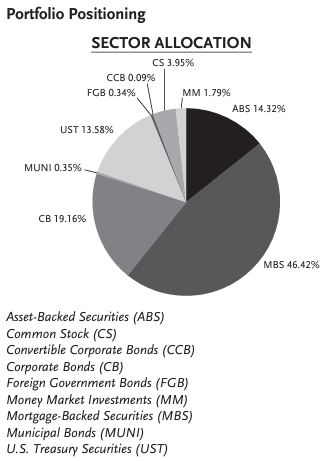

Sectors (Annual Report)

Mortgage Backed Securities represent 46% of the holdings, followed by corporate bonds at 19% and ABS at 14%. To note, this CEF has the mandate to hold common stock as well, but equities make up only 3.9% of the collateral currently.

When parsing the MBS allocation, one will see that Non-Agency represents the largest positioning:

- Non-Agency MBS: 45%

- Agency: 39%

- CMBS: 16%

While Non-Agency MSB securities are not guaranteed by the U.S. government, they nonetheless come with credit enhancements via subordination and cash flow diversion provisions.

What is interesting regarding this CEF is the fact that it currently chooses to run no leverage. It has the ability to have a gearing ratio up to 30%, but currently does not run any. That is a conservative take, build, which has not impeded it to generating a very high total return in the past year.

From a credit rating standpoint, the CEF focuses on investment grade names:

- AAA names 27%

- AA names 7%

- A names 8%

- BBB names 19%

- BB names 12%

- B names 7%

- CCC names 6%

- CC and below 8%

- Not rated 5%

- residual is in cash

The fund composition highlights yet again that rates represent the main risk factor here, not credit spreads.

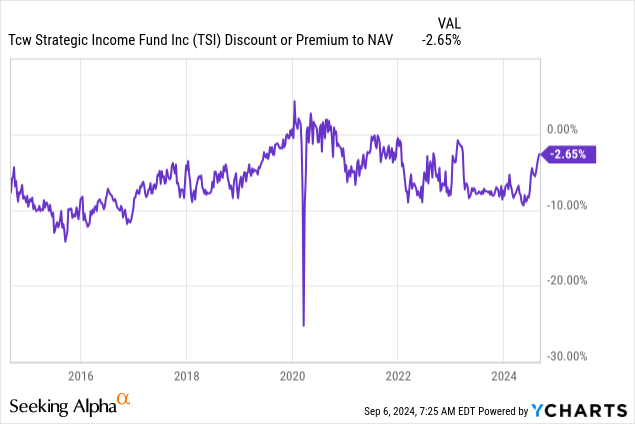

Discount to NAV – very narrow historically

The fund has a very well-defined historical range for its discount to NAV:

The CEF has seen its discount vacillate between -10% to flat to NAV in the past decade. After posting an outstanding result in the past year, the market has bid the discount close to flat, which is towards the top of the range. We can see this from the z-statistic for the discount, which is currently at a large 3.11:

A Z-Score is a statistical measurement of a score’s relationship to the mean in a group of scores. A Z-score can reveal to a trader if a value is typical for a specified data set or if it is atypical. In general, a Z-score of -3.0 to 3.0 suggests that a stock is trading within three standard deviations of its mean.

A large z-score means a stretched relationship in either direction. In our case, the z-stat shows the discount narrowing has gone too far too fast. Expect a mean reversion if rates start widening again.

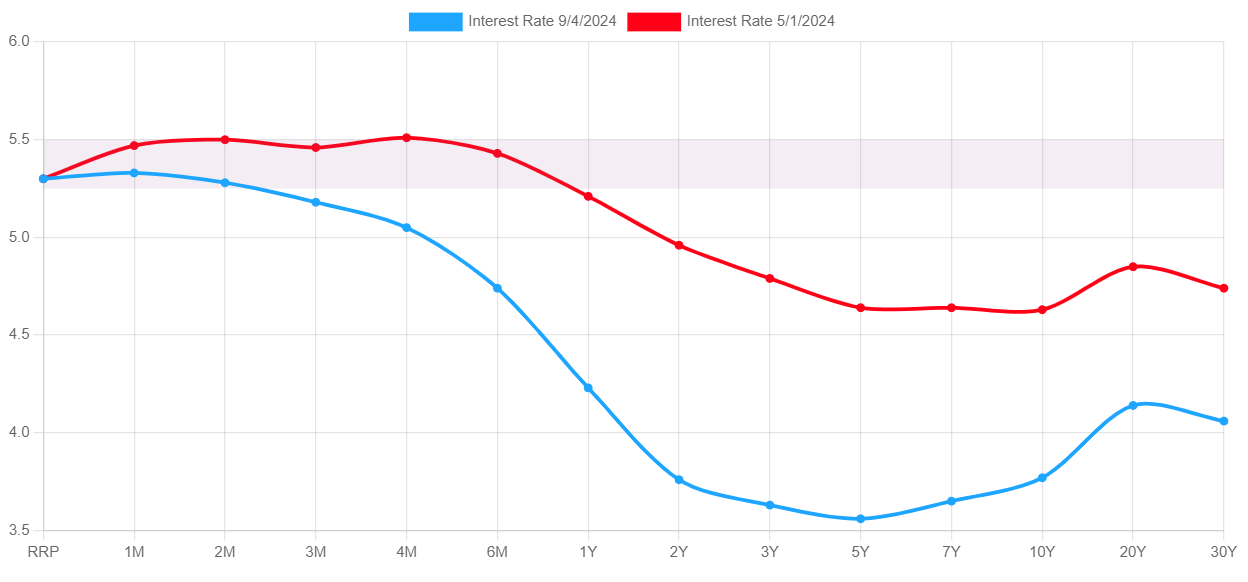

The yield curve has shifted lower

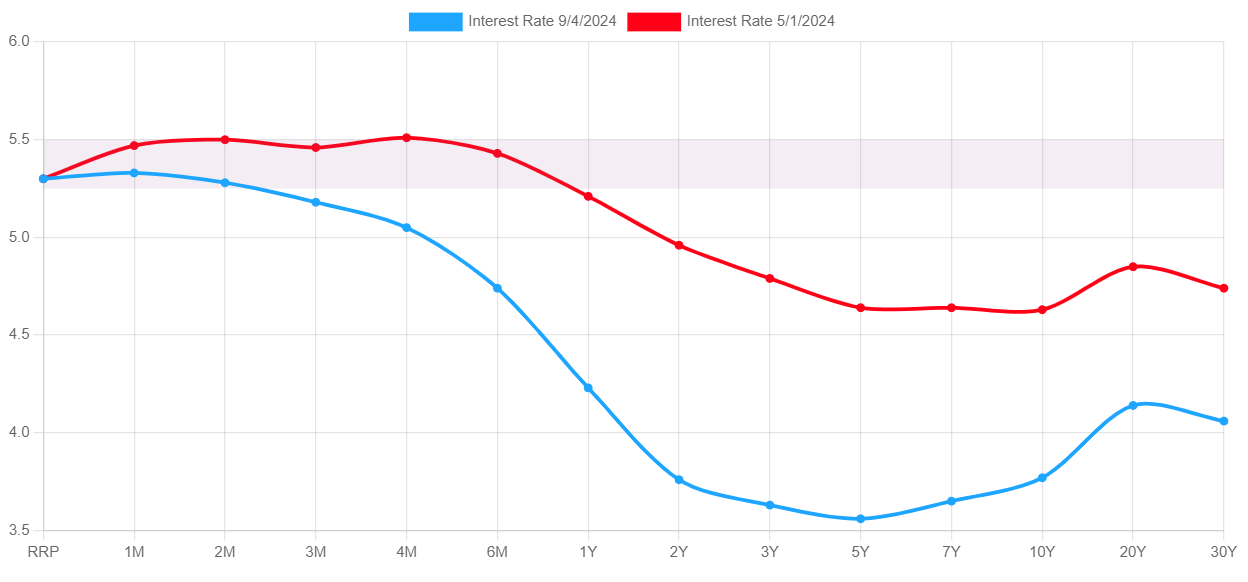

As highlighted above in the ‘Analytics’ section, the fund runs a 3-year duration. This translates into the fund’s profit and loss to be driven by the 3-year node in the yield curve:

Yield Curve (UsTreasuryYieldCurve)

In the past three months, we have seen a shift lower by 100 bps for that tenor node. That has been a huge move which has helped the pricing for all assets in the fund. Fixed income, especially Agency MBS, is very much rates driven. The move lower in the yield curve has provided a significant tailwind for the fund, accounting for both its NAV accretion as well as the narrowing of the discount to net asset value.

The significant move lower in the curve is, in our opinion, stretched. The market is currently pricing an ultimate Fed Funds rate of 3%, which makes the intermediate portion of the curve very much towards the terminal rate. Via the concept of term premium and upward sloping yield curve, we would expect to have the intermediate portion 50 to 75 bps wider than Fed Funds. We are currently here. Hence we do not see much scope for further narrowing here unless we get a severe recession.

A severe recession is not the base case right now, with the market pricing for a soft landing. In a soft landing scenario, there will not be a need to cut rates aggressively. Thus the current market implied future path for fed funds is what is to be expected.

What is next for TSI

TSI is an actively managed fund, and TCW will shift its allocations around to capture profit making asset classes, as it aptly describes:

Its investment objective is to seek total investment returns comprised of current income and capital appreciation. TSI has the ability to invest in a mix of fixed income and equity investments including mortgage-backed securities, asset-backed securities, value and growth equities, convertible securities, high yield bonds, and equity investments in collateralized debt obligations (CDOs). TSI will shift and reallocate its investments on an opportunistic basis and may invest in additional asset classes other than those identified above.

In its current format, which is overweight IG MBS and corporate bonds, we feel the CEF has gotten to a good valuation point, helped by tighter rates and a narrow discount to NAV. The current fund price is no longer cheap, and does not provide for an attractive entry point. We actually feel that a September 2024 cut of only 25 bps by the Fed and a balanced language will actually disappoint some market participants, thus leaving scope for some rates retracement, a negative for TSI.

Conclusion

TSI is a fixed income CEF. The name is actively managed and has a multi-asset approach, but is currently overweight MBS bonds and IG corporates. The fund is up over 20% since our buy rating last year, helped by much lower rates for its 3-year duration and tighter spreads. The CEF has also seen its discount narrow by over 5%, moving it towards the top of its historic range. We no longer find the fund attractively priced for an entry point, and thus are downgrading the name to ‘Hold’.