Jakub Porzycki | Nurphoto | Getty Photographs

The world’s largest contract chipmaker Taiwan Semiconductor Manufacturing Company on Thursday posted better-than-expected revenue and income on the again of weaker macroeconomic circumstances.

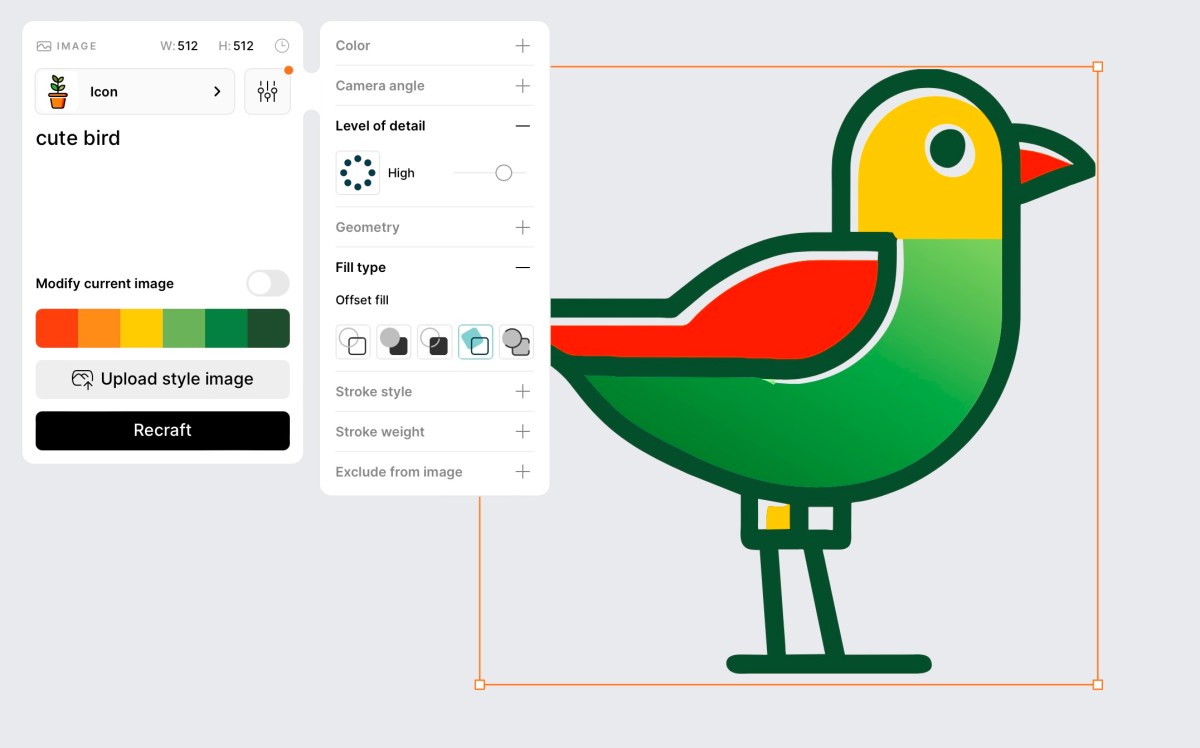

Listed here are TSMC’s fourth-quarter outcomes versus LSEG consensus estimates:

- Income: 625.53 billion New Taiwan {dollars} ($19.62 billion), vs. NT$618.31 billion anticipated

- Web earnings: NT$238.71 billion, vs. NT$225.22 billion anticipated

TSMC reported income slipped 1.5% from a yr in the past to NT$625.53 billion, whereas web earnings dropped 19.3% from a yr in the past to NT$238.71 billion. That compares with TSMC’s guidance for fourth-quarter income between $18.8 billion and $19.6 billion.

“In the fourth quarter, revenue increased 14.4% sequentially [from the third quarter], supported by the continued strong ramp of our industry-leading 3-nanometer technology,” mentioned TSMC in its fourth-quarter earnings report.

TSMC counts Apple and Nvidia amongst its largest purchasers. TSMC produces essentially the most superior processors present in Apple’s iPhones.

Through the agency’s earnings name on Thursday, CEO C.C. Wei acknowledged that 2023 was a “challenging year for the global semiconductor industry” due to macroeconomic circumstances and a list adjustment cycle.

Chipmakers reminiscent of Samsung Electronics and SK Hynix have reported declines in quarterly income because of a post-pandemic plunge within the demand for client electronics like smartphones and laptops. That resulted in smartphone and PC makers grappling with extra inventories of chips.

However analysts say chip inventories at smartphone and PC makers are working down and count on restocking demand to choose up.

Wei mentioned that regardless of the challenges, the agency was “well positioned to capture high performance computing-related growth opportunities” from the rising emergence of generative AI functions in 2023.

“We expect 2024 to be a healthy growth year for TSMC, supported by continuous strong ramp-up of our industry-leading three nanometer technologies, strong demand for the five nanometer technologies and robust AI-related demand,” mentioned Wei.

TSMC expects first-quarter income to come back in between $18 billion and $18.8 billion this yr.

However he additionally flagged persisting macroeconomic headwinds that might weigh on client sentiment and market demand.

“TSMC’s strong ramp-up in N3 and AI applications positions it as a major beneficiary in AI semiconductors,” Brady Wang, affiliate director at Counterpoint Analysis, mentioned Tuesday. N3 refers to TSMC’s most superior node, which produces 3-nanometer chips.

“Nanometer” in chips refers back to the measurement of particular person transistors on a chip. The smaller the scale of the transistor, the extra of them might be packed onto a single semiconductor. As such, smaller nanometer sizes sometimes yield extra highly effective and environment friendly chips.

“The anticipated surge in AI-based PC applications in 2024 underscores TSMC’s crucial role, solidifying its dominance and best positioning in providing sophisticated 5-nanometer and 3-nanometer technologies for AI-enhanced computing devices,” mentioned Wang in a notice on Jan. 16.

TSMC at present manufactures 3-nanometer chips and plans to start 2-nanometer mass manufacturing by 2025.