Billing itself as “Stripe for emerging markets,” Turkish Fintech Sipay has raised a $78 million Series B funding round, claiming a valuation of $875 million in the process.

This round is significant, as Sipay plans to expand into markets outside of Turkey, offering additional services like remittances that Stripe currently does not offer in those regions.

The all-equity round was led by U.S.-based Elephant VC, with participation from Revolut co-founder Nik Storonsky’s VC firm, QuantumLight.

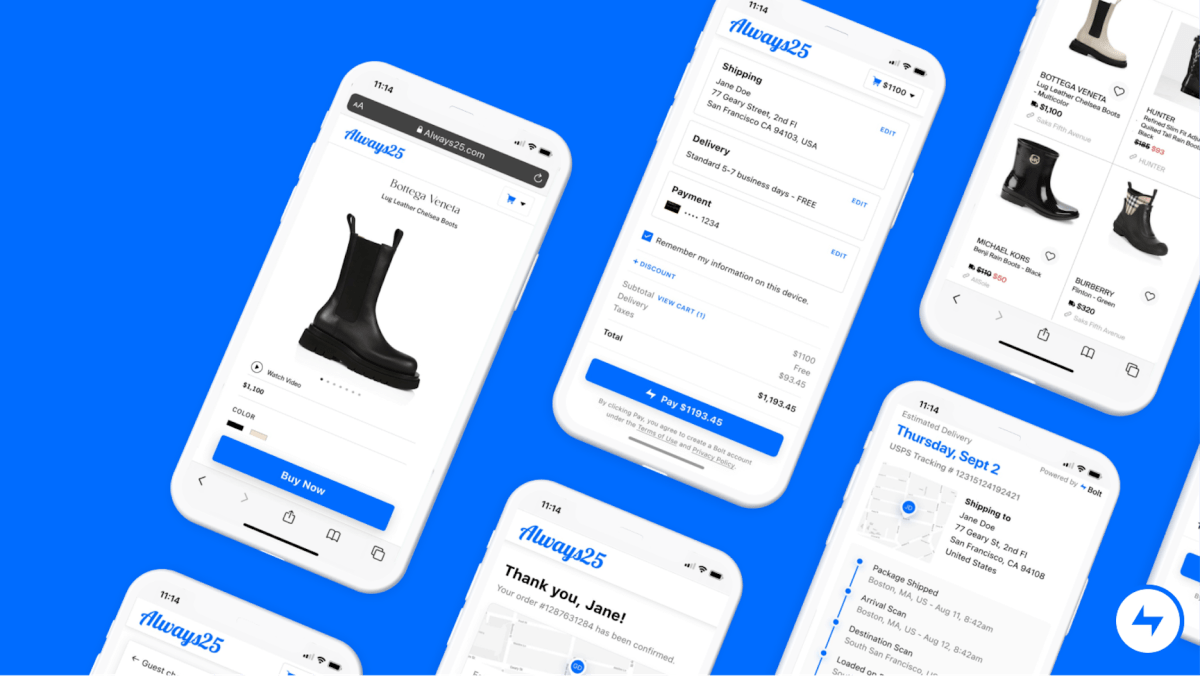

Founded in 2019, Sipay operates an all-in-one app for managing digital wallets, investments and loyalty schemes, and offers embedded finance, FX transactions and other products. It works with partners including Visa and Mastercard, integrating with Turkish banks as well as large e-commerce providers such as Trendyol in Turkey. It has 6.3 million wallet users and 25,000 registered merchants.

Sipay claims it’s been profitable since 2023, and its revenue has increased 5x year-on-year. The company says it ended last year with run-rate revenue of $600 million.

“Stripe is sorting out one single problem, but there is no all-in-one fintech solution in our markets,” Nezih Sipahioğlu, founder and global CEO of Sipay, said. “So that’s why we have different products.”

“Our services run as a white label, similar to Solaris Bank in the U.K. So any fintech that wants to issue their own card or wallet can do it through us,” he said.

He added that the startup bootstrapped its growth until June 2024, when it raised a $15 million Series A funding round that was led by Anfa.

“As markets become more globalized, Sipay’s focus on cross-border payment solutions will help drive international growth and trade,” Peter Fallon, general partner at Elephant VC, said in a statement.