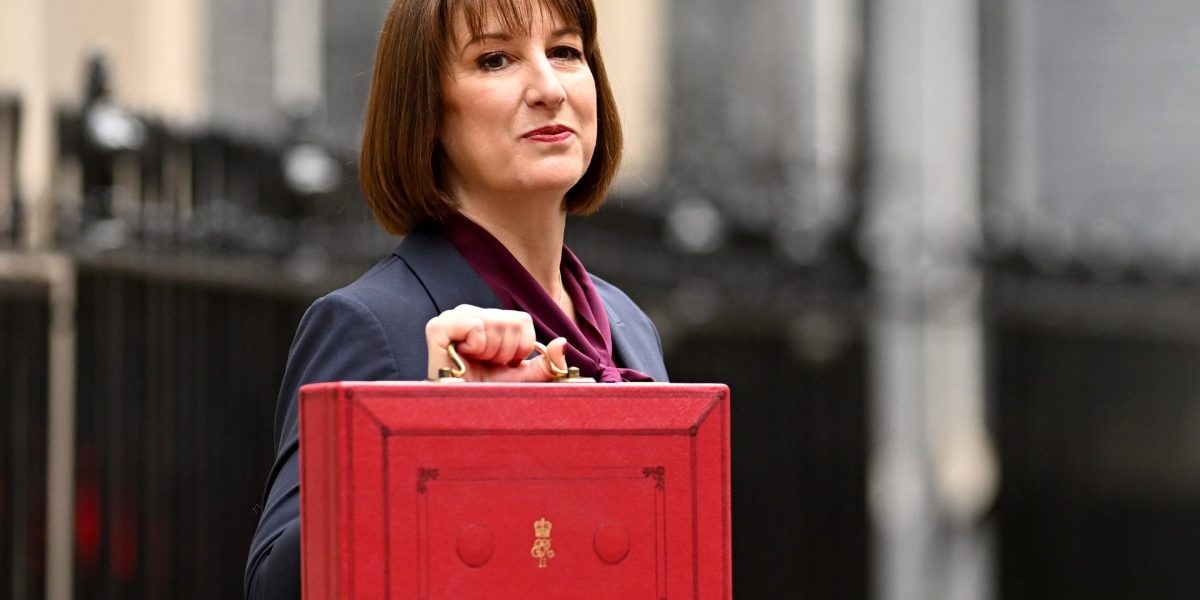

U.K. Chancellor Rachel Reeves delivered the widely-anticipated Autumn Budget, setting out her lofty investment aims and an historic £40 billion increase in taxes.

Reeves, who blamed her predecessors for passing on a “broken” public finance system, said the Labour Party’s first budget in 14 years will mark “an end to short-termism.”

“A strong economy depends on strong public finances,” Reeves said. “There will be no return to austerity.”

With that mission came changes to the country’s capital gains tax and non-dom tax regime, which will help shore up the country’s finances by targeting some of the wealthiest.

Capital Gains Tax changes

Reeves announced capital gains tax, which is a charge applied to assets like buy-to-let property and company shares when they are disposed of, will be increased to 18% and 24% (from up from 10% and 20%) depending on your income tax band.

Subsequently, the Business Asset Disposal Relief and Investors’ Relief avenues to access lower capital gains tax rates for entrepreneurs will also rise from next year, making it more costly for those selling their companies.

“It feels like the rules have changed dramatically overnight. Such a sudden shift really breaks down trust within the business community,” said Andy Aitken, CEO of mobile network company Honest.

“It’s no wonder some founders are looking to relocate their businesses—and even their personal tax residencies.”

The anxiety among businesses is palpable, prompting founders to consider moving their base outside the U.K. Andreas Adamides, the CEO of startup founder community Helm, is concerned businesses would think twice before they sell. “Many who have been considering selling their business are much more likely to put off a sale as too much of what they built up over ten to twenty years, will go directly to tax,” he said.

Vishal Marria, CEO of software platform Quantexa, is more cautious as “the long-term implications of the increases to Capital Gains Tax remain uncertain.”

While the measures could have big ramifications for startups, Leigh Sayliss, partner and head of tax at law firm Memery Crystal, argues that Reeves had primed investors with many hints ahead of the Budget to help them prepare.

“By giving warning of increases being phased in over the next couple of years, the Chancellor appears to be giving investors, and especially business owners, time (and encouragement) to crystallize gains generating a steady flow of tax into the Treasury,” he said.

End of the non-dom regime

Among Reeves’ changes is scrapping the controversial non-dom regime, a tax status for U.K. residents who have permanent homes outside the country.

The system, of which former Prime Minister Rishi Sunak’s wife Akshata Murty is a beneficiary, has attracted criticism for letting wealthy individuals make big tax savings on overseas income.

Stefan Rousseau—PA Images/Getty Images

74,000 people held non-dom status in 2022-23, according to HM Revenue & Customs.

A new residency system will soon replace this regime, and although Reeves didn’t provide much detail on it, she announced that the package of changes would generate a whopping £12.7 billion over five years.

The shake-up of the non-dom system and capital gains tax could discourage businesses and investment-driving individuals, driving “the existing community to the welcoming arms of Milan, Barcelona, Frankfurt and Paris.”

“Non-doms hoping for succor today will have been bitterly disappointed, with no new proposals to encourage international wealth creators to remain in the U.K. or for new entrepreneurs to arrive,” said law firm Withers’s partner, Christopher Groves.

Being wealthy, ironically, is becoming more expensive in other parts of Europe, too. Norway green-lit an increase in taxes earlier this year, causing its affluent to flee to Switzerland to dodge taxes. France recently voted in favor of a new wealth tax, affecting the crème de la crème of the country. In the summer, Italy doubled the flat tax paid by wealthy individuals on their income earned overseas.

That’s not all that might hurt wealthy residents in the U.K.—Reeves is also making private jet fliers pay 50% more as part of air passenger duty.

“That is equivalent to £450 per passenger for a private jet to, say, California?” Reeves remarked, seemingly mocking Sunak, who has links to the American state, where he previously worked and even owns a home.