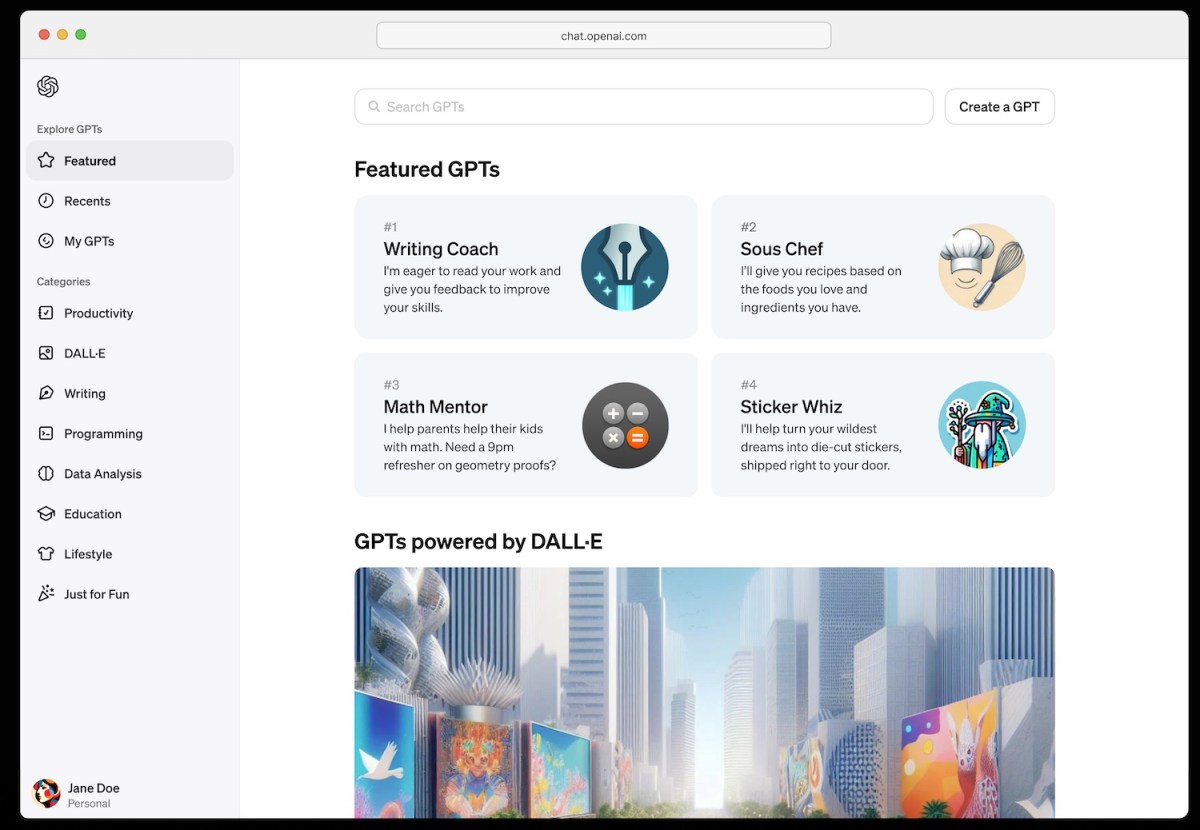

Dara Khosrowshahi, CEO of Uber, talking on Squawk Field on the WEF in Davos, Switzerland on Jan. 18th, 2023.

Adam Galica | CNBC

Uber shares rose 5% in prolonged buying and selling on Friday after the ride-hailing firm was added to the S&P 500 Index, changing Sealed Air Corp.

The change will happen previous to the open of buying and selling on Monday, Dec. 18, in keeping with a press launch.

An organization’s inventory value usually rises on information that it is becoming a member of the S&P 500 as a result of fund managers who observe the benchmark, which will get up to date every quarter, have to amass the shares. Corporations even have to fulfill sure valuation and profitability necessities.

Uber shares debuted on the New York Inventory Alternate in 2019, however the firm was burning money because it needed to pay drivers sufficient cash to remain aggressive in a low-margin enterprise. Its most well-liked metric was adjusted earnings earlier than curiosity, tax, depreciation and amortization, or EBITDA.

Most of Uber’s adjusted EBITDA comes from mobility, however the firm made its supply enterprise worthwhile sooner than deliberate, after recession-fearing traders turned extra averse to investing in money-losing firms. Rising promoting income has additionally contributed to Uber’s profitability.

Uber eliminated greater than 3,500 jobs in 2020, and executives have since labored to enhance its value construction. For instance, they decreased the price of deliveries. Uber reported internet earnings of $221 million on $9.29 billion in income within the third quarter, and prior to now 4 quarters altogether, it generated over $1 billion in revenue.

“Nelson [Chai, Uber’s outgoing finance chief] and my goal is to build a company that can compound top line rates at very, very attractive rates and continue to improve margins over a period of time,” Uber CEO Dara Khosrowshahi advised UBS analyst Lloyd Walmsley at an investor assembly in December 2021. “You’ve seen those long-term compounders and margin increasers and, you know, the greats of the world, the Googles, the Facebooks, the Microsofts of the world, and we aspire for no less.”

In response to S&P’s guidelines, members of the index will need to have constructive earnings in the newest quarter and over the prior 4 quarters in complete. Constituents of the index will need to have an adjusted market cap of at the least $14.5 billion.

Uber has a market cap of about $118 billion, whereas the median market cap of firms within the S&P 500 is simply over $31 billion.

WATCH: Uber into the S&P 500