The U.Okay.’s Competitors and Markets Authority (CMA) has confirmed that it’s launching a proper “phase 2” investigation into the deliberate merger between Vodafone and Three UK.

The CMA says that the deal might result in increased costs for customers, whereas additionally affect future infrastructure investments. Nevertheless, the CMA has given each events a token 5 working days to handle its issues with “meaningful solutions” earlier than it formally progresses the investigation.

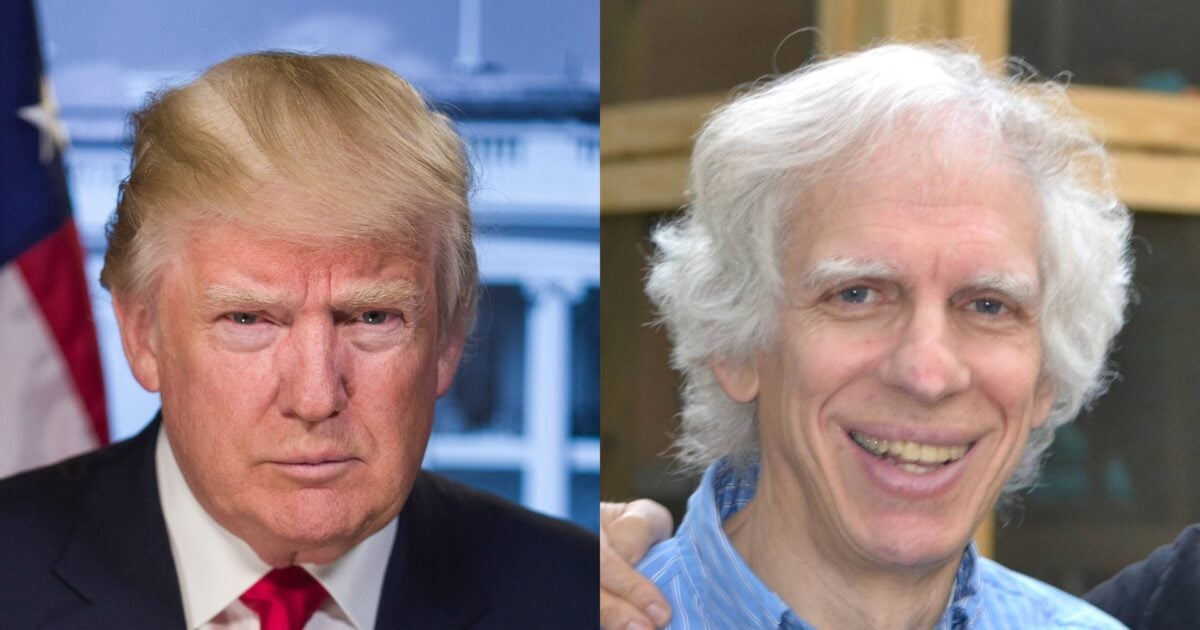

“Our initial assessment of this deal has identified concerns which could lead to higher prices for customers and lower investment in U.K. mobile networks,” Julie Bon, the CMA’s deputy chief financial adviser, stated in an announcement. “These warrant an in-depth investigation unless Vodafone and Three can come forward with solutions.”

The information comes some 9 months after plans of the $19 billion deal first emerged, in a transfer that might successfully scale back the U.Okay.’s primary cell community operators from 4 to a few (the others being EE and O2). The duo clearly anticipated regulatory headwinds, having already allowed till the tip of 2024 to conclude the transaction. The preliminary “phase 1” probe kicked off at the tail-end of January, with the CMA conducting a market evaluation to garner suggestions from a mess of stakeholders earlier than deciding whether or not a proper investigation was warranted.

A deal of this dimension and consequence was all the time prone to go the complete distance so far as regulatory scrutiny was involved, so in the present day’s information comes as little shock. The CMA now has six months to hold out the investigation earlier than reaching a last conclusion.

“It was inevitable that this case would be given an in-depth assessment by the CMA,” Tom Smith, accomplice at London-based legislation agency Geradin Companions and former authorized director on the CMA, advised TechCrunch. “The real work now starts for the companies in trying to prove the benefits of the merger to the CMA panel.”

Competitors vs consolidation

One main bone of competition right here is the affect that decreasing a four-horse race to a few may have when it comes to client costs — because the CMA notes, “competitive pressure can help keep prices low.”

In its market examine, the CMA concluded {that a} mixed Vodafone and Three would grow to be the most important service by income, with a market share of almost a 3rd. And on account of this, it believes the mixed firm would have “less incentive to compete aggressively compared to each Party on a standalone basis.”

But additionally, the necessity to present a differentiated service may spur further funding to enhance community protection and high quality. With diminished rivalry, there may be additionally much less incentive to take action.

“Millions of people in the U.K. depend on effective competition in the mobile market in order to access the best deals for them,” Bon famous. “Whilst Vodafone and Three have made a number of claims about how their deal is good for competition and investment, the CMA has not seen sufficient evidence to date to back these claims.”

Whereas Vodafone and Three have pointed to related “four to three” merger research to assist claims that it gained’t considerably affect costs, one other notable examine carried out within the wake of Vodafone Hutchison Australia and TPG’s merger in 2020 indicated that the three remaining cell community operators all elevated their costs — and general, funding by the Australian carriers dropped by 45% between 2018 and 2023.

Individually, a report by anti-monopoly group Balanced Economic system Venture drew on seven worldwide research to conclude {that a} Vodafone / Three merger would result in client worth will increase from £5 to £25 a month

“The CMA’s pricing analysis will show that a post-merger price rise is likely, so the companies will need to persuade the CMA that they will pass on any cost savings to customers to offset the incentive to raise prices,” Smith continued. “They will face a CMA that is sceptical of arguments that mergers boost investment incentives — the CMA rightly believes it is competition that drives better outcomes for consumers, not consolidation.”

As two of the primary 4 U.Okay. telcos, each Three and Vodafone additionally make their infrastructure accessible for cell digital community operators (MVNOs) — basically including additional service competitors to the combination. Nevertheless, the CMA famous that it’s involved {that a} merger would possibly make it harder for MVNOs to barter good wholesale offers which in flip will affect pricing for their very own prospects.

One different doubtlessly contentious challenge pertains to the truth that Three is owned by Hong Kong-based conglomerate CK Hutchison Holdings, an organization that’s topic to a national security law introduced by China in 2020 — Unite the Union argues that because the subsidiary of a Hong Kong firm, Three may very well be compelled to share delicate information with the Chinese language state. Such a situation is exactly why the U.Okay. launched the Nationwide Safety and Funding Act again in 2022, with previous form in blocking deals between U.Okay. entities and Chinese language corporations.

Nevertheless, that isn’t a matter for the CMA to take care of, and the 2 corporations are reportedly cooperating with the Authorities as a part of its nationwide safety overview processes.

Authorized wrangles

It’s value noting that Three has already been concerned in one other latest failed acquisition effort, after its mum or dad Hutchison tried to purchase one of many different 4 main U.Okay. carriers O2 in a £10.25 billion deal — nevertheless, this was blocked by EU regulators eight years in the past. Then 18 months in the past, a European court adviser suggested that unique court docket ruling ought to be dismissed, so it’s not clear how that may affect this newest merger try.

Elsewhere, the U.Okay. has latest type in blocking big-bucks acquisitions, with Adobe and Figma pulling the plug on their $20 billion deal because of regulatory pushback each within the U.Okay. and the broader E.U. And Microsoft needed to make some notable concessions to get its $68.7 billion Activision acquisition over the line.

Vodafone and Three is a distinct animal although — it includes core infrastructure, with the 2 corporations estimated to currently control nearly half the available radio spectrum.

“This case has more moving parts than the CMA’s other recent big decisions, and is arguably more important for the U.K. economy,” Smith stated. “There will be difficult issues for the merging companies to get past.”