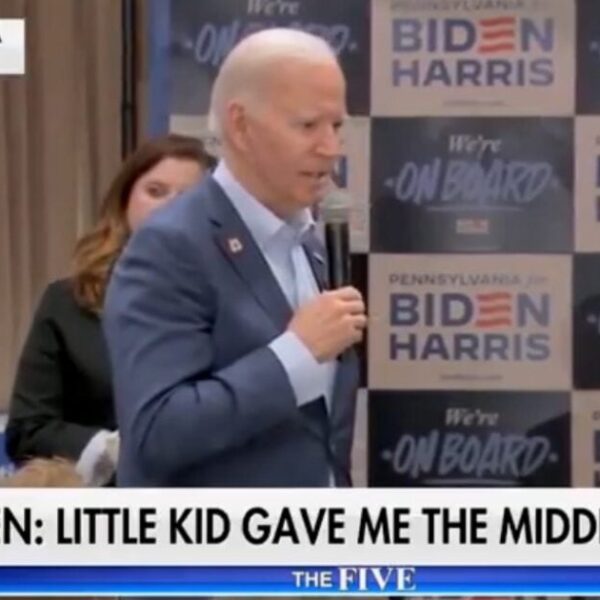

Pedestrians stroll via the festively adorned Burlington Arcade luxurious buying arcade in London, UK, on Monday, Dec. 4, 2023. Inflation in UK retailers has fallen to a 17-month low as retailers struggle to draw buyers forward of the essential vacation interval. Photographer: Jason Alden/Bloomberg by way of Getty Pictures

Bloomberg | Bloomberg | Getty Pictures

LONDON — U.Okay. inflation unexpectedly nudged upwards to 4% year-on-year in December.

Economists polled by Reuters had anticipated a modest decline within the annual headline shopper value index to three.8%, after November’s sharper-than-expected fall to 3.9%.

Month-on-month, the headline CPI rose by 0.4%, above a consensus forecast of 0.2% and up from -0.2% in November.

“The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from alcohol and tobacco while the largest downward contribution came from food and non-alcoholic beverages,” the Workplace for Nationwide Statistics mentioned.

The carefully watched core CPI determine — which excludes unstable meals, power, alcohol and tobacco costs — got here in at an annual 5.1%, above a 4.9% Reuters forecast and unchanged from November.

“As we have seen in the U.S., France and Germany, inflation does not fall in a straight line, but our plan is working and we should stick to it,” British Finance Minister Jeremy Hunt mentioned in a press release.

“We took difficult decisions to control borrowing and are now turning a corner, so we need to stay the course we have set out, including boosting growth with more competitive tax levels.”

The Bank of England will maintain its subsequent financial coverage assembly on Feb. 1, after mountain climbing rates of interest quickly over the previous two years in a bid to tame runaway inflation.

A contemporary spherical of jobs information on Monday additionally highlighted the tough path forward for the British central financial institution, because it decides when, and the way sharply, to chop rates of interest in 2024. Markets are at present pricing greater than 100 foundation factors of cuts to the benchmark fee throughout the 12 months.

The variety of vacancies posted declined by 49,000 over the ultimate quarter of the 12 months, whereas the unemployment fee remained largely flat at 4.2%.

Pay development, a key information level for the Financial institution, slowed considerably within the three months to the tip of November. As inflation is falling sooner than that fee, common pay remains to be rising in actual phrases.