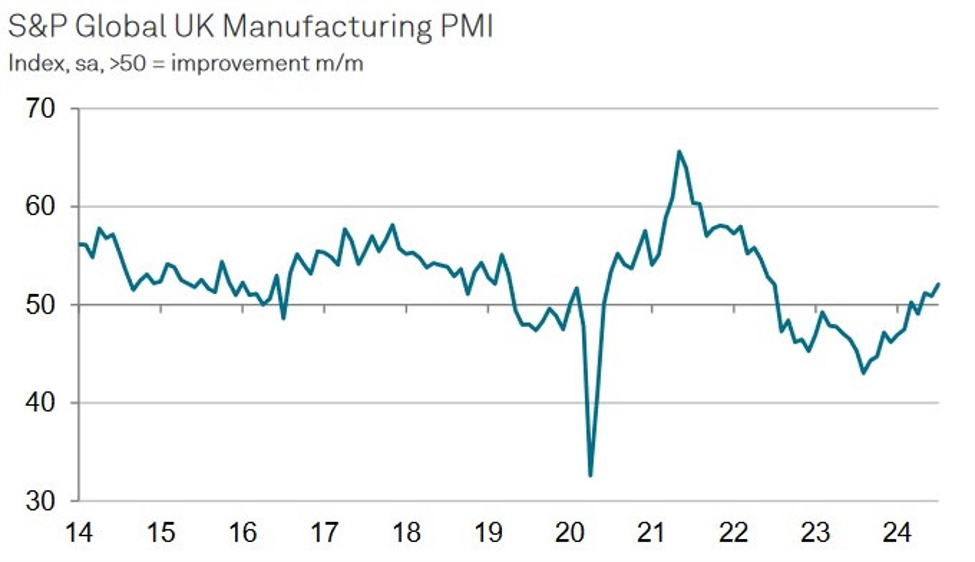

- Final Manufacturing PMI 52.1 vs. 51.8 expected and 50.9 prior.

Key findings:

- Production growth fastest since February 2022.

- Input price inflation rises to 18-month high.

Comment:

Rob Dobson, Director at S&P Global Market Intelligence:

“UK manufacturing has started the second half of 2024

on an encouragingly solid footing. July saw growth of

production and new orders strengthen and staffing

levels rise for the first time since September 2022.

Hopes for an economic revival and reduced political

uncertainty took confidence to one of its highest

levels for two-and-a-half years, with 60% of companies

surveyed now forecasting output will rise over the

coming 12 months. There were also further signs that

the trend in new export business is close to stabilising

following a prolonged period of decline.”

“Inflationary pressures remain a blot on the copybook,

however, with input costs rising to the greatest extent

in one-and-a-half years. The ongoing Red Sea crisis and

associated freight issues are having a severe impact on

prices which are then sustaining a focus on cost-caution

and cash flow protection at manufacturers. This is

leading to cutbacks in purchasing and a drive to leaner

inventory holdings.”

“Selling prices are also rising at the quickest rate since

mid-2023. Policymakers are likely to take a cautious

approach to loosing monetary policy amid these signs

that inflationary pressures may be pivoting away from

services and towards manufacturing.”

UK Manufacturing PMI