The dollar was a beneficiary of the US PMI data yesterday, alongside a reversal in the risk mood. US indices in particular ended with losses after the day started out brightly on the back of Nvidia’s earnings boost. And that is leaving us with an air of caution in the final stretch of the week.

For now, major currencies are little changed with US futures also keeping more tentative. But the dollar might be looking to make more headway with EUR/USD testing waters below its 100-day moving average at 1.0807 and USD/JPY inching back above the 157.00 mark.

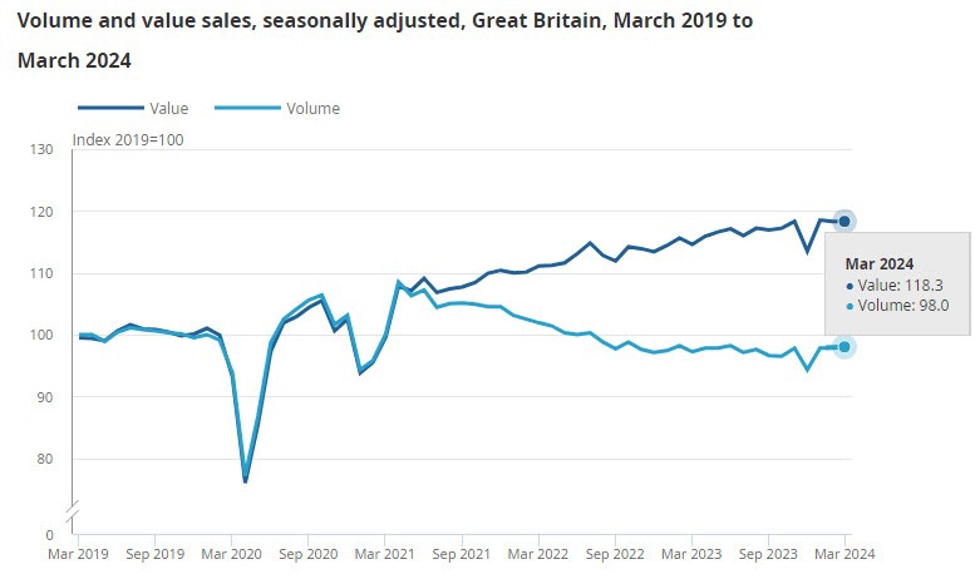

Looking to European trading, UK retail sales is the main event on the economic calendar. There’s always something about UK retail sales disappointing more often than not since last year. But the April readings today are already expected to show a monthly decline compared to March. And that’s another testament to the impact of inflation on UK households.

As you can see above, the stark divergence between the volume and value of retail sales continues to hold. In fact, volume sales are even lower when compared to the starting point of the ONS series in March 2019. That’s a real downer and it essentially reads that UK consumers are paying more for less.

The data today will be one to watch in impacting the BOE rates outlook, so that will keep sterling in focus.

0700 GMT – Germany Q1 final GDP figures

0700 GMT – UK April retail sales data

0745 GMT – France May business confidence

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.