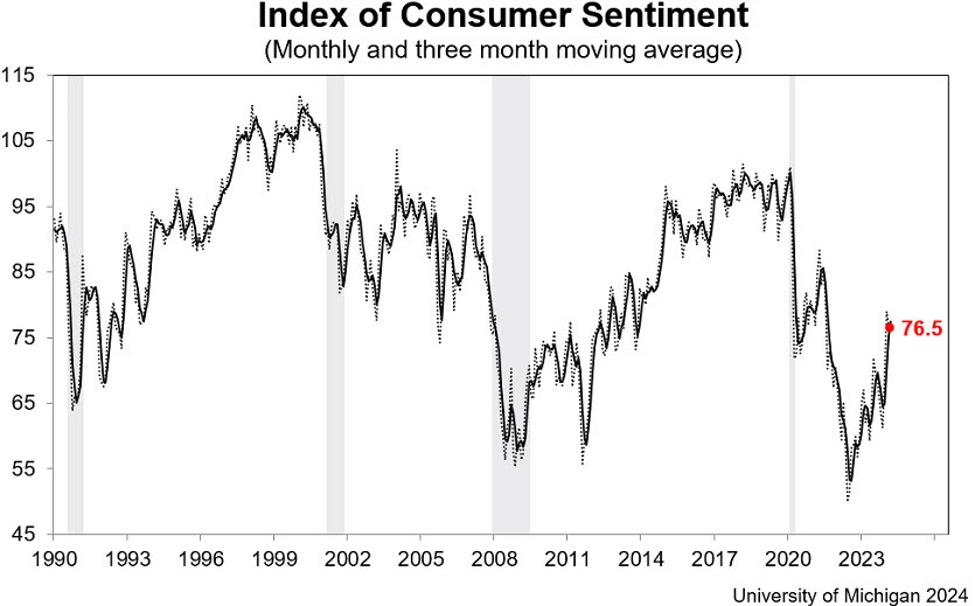

- Prior was 76.9

- Present situations 79.4 vs 79.2 anticipated (prior was 79.4)

- Expectations 74.6 vs 75.1 anticipated (prior was 75.2)

- One-year inflation 3.0% vs 3.0% prior

- 5-year inflation 2.9% vs 2.9% prior

These numbers are all near expectations. The report stated:

“Small enhancements in private funds have been offset by modest declines

in expectations for enterprise situations. After sturdy good points between

November 2023 and January 2024, client views have stabilized right into a

holding sample; shoppers perceived few alerts that the economic system is

at present enhancing or deteriorating. Certainly, many are withholding

judgment concerning the trajectory of the economic system, significantly within the lengthy

time period, pending the outcomes of this November’s election.”

Final month’s studying was the very best since 2021 so the dip is hardly catastrophic.

I discover this information sequence to be largely ineffective and is extra of a sign of the political temper and gasoline costs than spending.

This text was written by Adam Button at www.forexlive.com.