Uniswap Labs, the developer behind one of many prime decentralized exchanges (DEX), Uniswap, notes that the variety of customers leveraging its platform on Optimism and Base has greater than doubled within the final 12 months.

Extra Swapping Taking place On Base And Optimism

Optimism and Base, two extensively used layer-2 scaling options for Ethereum, provide distinct benefits for merchants. When swapping tokens on Uniswap, which is deployed on both of those platforms, merchants profit from significantly decrease transaction charges.

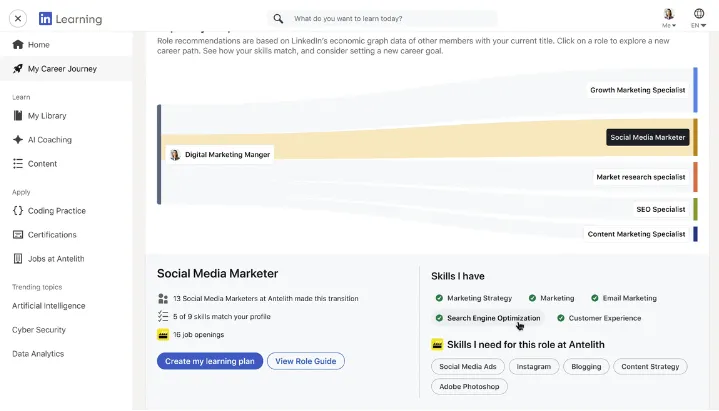

Uniswap Labs reports a notable surge in swappers on Optimism and Base. Over the previous 12 months, the quantity has doubled from 124,970 in February 2023 to 310,050 in February 2024, indicating a rising curiosity in these layer-2 options.

This progress mirrors an upward pattern in DeFi exercise, as evidenced by the rising complete worth locked (TVL) throughout varied protocols, particularly from Q3 2023.

DefiLlama knowledge on March 7 shows that the full DeFi TVL throughout all protocols is over $96 billion. At one level in 2023, it was lower than $40 billion.

Uniswap is energetic throughout a number of platforms, together with the BNB Chain. Nonetheless, most exercise stems from Ethereum and Ethereum-compatible networks, together with Optimism and Base.

Knowledge shows that Uniswap is the seventh largest protocol, with a TVL of $5.8 billion. A big chunk of belongings beneath administration is targeting Ethereum, Arbitrum, and Polygon. Base and Optimism are additionally standard, however Uniswap manages $67 million and $80 million, respectively.

Although Uniswap was initially launched on Ethereum in November, it has since been deployed on 13 different networks. Uniswap Labs sought to reinforce consumer expertise, escaping the excessive fuel charges on Ethereum.

Layer-2 options and sidechains like Optimism, Base, and Polygon supplied a channel for customers to commerce nonetheless whereas having fun with low charges and quick throughput.

Uniswap Continues to Construct

Uniswap Labs introduced the deployment of Uniswap v2 throughout varied layer-2 platforms in late February 2024. Uniswap v2 is likely one of the earliest variations however stays standard.

Uniswap v3 is energetic, and its model has been duplicated in different protocols, primarily PancakeSwap, a competing DEX standard within the BNB Chain.

Uniswap Labs is engaged on Uniswap v4. It can introduce extra options, together with Hooks, meant to enhance flexibility.

The spike within the variety of customers throughout varied platforms has been optimistic for UNI, Uniswap’s native token. Thus far, the token is up roughly 110% from late February. As of March 7, it was altering fingers at round $15.

Function picture from Canva, chart from TradingView