Key Notes

- Wyoming DUNA structure would provide legal clarity for Uniswap DAO operations and compliance requirements.

- Fee switch activation could redirect transaction revenues from liquidity providers to UNI token holders.

- $16.5 million in UNI tokens allocated for treasury to cover retroactive taxes and operational expenses.

On August 11, the Uniswap Foundation posted a “Request for Comment (RFC)” on the Uniswap Governance Forum to adopt a Wyoming-registered Decentralized Unincorporated Nonprofit Association (“DUNA”) as the legal structure for the DAO.

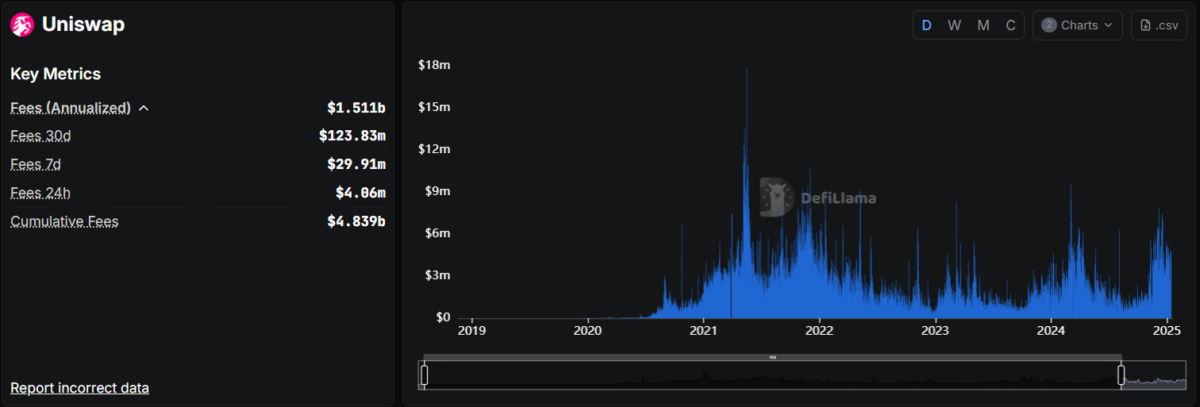

If approved, the legal entity would be called ‘DUNI, and could finally enable the distribution of Uniswap’s generated fees, which surpassed $100 million from last month’s swaps, according to data from DefiLlama. The legal clarity could also bring other benefits and obligations to the organization in the physical world, which the proposal refers to as “off-chain.”

Uniswap Fees and Revenue | DefiLlama

As of this writing, the “[RFC] – Establish Uniswap Governance as ‘DUNI,’ a Wyoming DUNA” proposal only had 447 views, eight links, five likes, and one comment in the forum, suggesting it is still in its early phases and more is expected to develop from here.

![[RFC] - Establish Uniswap Governance as](https://www.coinspeaker.com/wp-content/uploads/2025/08/unnamed-2-1.png)

[RFC] – Establish Uniswap Governance as “DUNI,” a Wyoming DUNA | Source: Uniswap Governance Forum

What Changes for Uniswap Governance?

If this proposal passes, which will be decided in a DAO vote, DUNI will be registered under Wyoming’s DUNA legal framework.

Notably, the Uniswap Foundation claims to have “worked closely with a firm called Cowrie, founded by David Kerr,” which had active participation in the DUNA’s law. David Kerr is also nominated as Cowrie’s representative, who is named as DUNI’s “Administrator” under an Administrator Agreement, holding special powers to legally represent the organization when needed. Something similar applies to the Uniswap Foundation, nominated as DUNI’s “Ministerial Agent.”

The Ministerial Agent and Administrator roles, as outlined in the proposal, are distinct, non-discretionary positions designed to execute specific operational and administrative tasks on behalf of Uniswap Governance while maintaining decentralization.

First, the Ministerial Agent, initially the UF, performs procedural functions such as executing documents, coordinating with third-party service providers, transmitting approved funds, and communicating administrative updates, all strictly within the bounds of governance-approved instructions without the ability to set policy or act independently.

Similarly, Administrators handle essential compliance, financial, and reporting tasks, such as preparing tax returns, managing financial accounts, and filing regulatory documents, with Kerr specifically reviewing and signing tax returns. Both roles lack discretionary authority, are subject to governance oversight, and can be revoked or extended via governance proposals, ensuring DUNI meets legal and financial obligations while preserving Uniswap Governance’s exclusive control over policy and decisions.

DUNI Could Unlock $90 Million in Monthly Fee Distribution

One interesting aspect of this proposal for UNI investors is that, with the legal clarity, Uniswap’s “fee switch” could finally be activated, distributing fee rewards to participants. The “fee switch” refers to a governance mechanism within the Uniswap protocol that, if activated, would redirect a portion of the transaction fees—currently paid entirely to liquidity providers (LPs)—to a protocol-controlled treasury or UNI token holders.

This could fund community initiatives, development, or potentially reward UNI holders, though it risks reducing LP incentives, which might impact liquidity. The proposal has been debated since 2020, with a 2022 pilot vote targeting select pools to test its impact without increasing swapper costs, but concerns over regulatory risks and liquidity drainage persist.

The $91 million in swap fees collected by Uniswap in July 2025, as reported by DefiLlama, highlights the potential revenue at stake if the fee switch were activated. However, legal clarity under Wyoming DUNA’s framework would also require compliance in other areas, like taxes. Therefore, the proposal plans to transfer $16.5 million worth of UNI to DUNI’s treasury to pay for retroactive and future taxes, plus $75,000 to pay for Cowrie’s services.

These tokens will be converted to a dollar balance in operations carried out by the Uniswap Foundation and could potentially impact the markets.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.