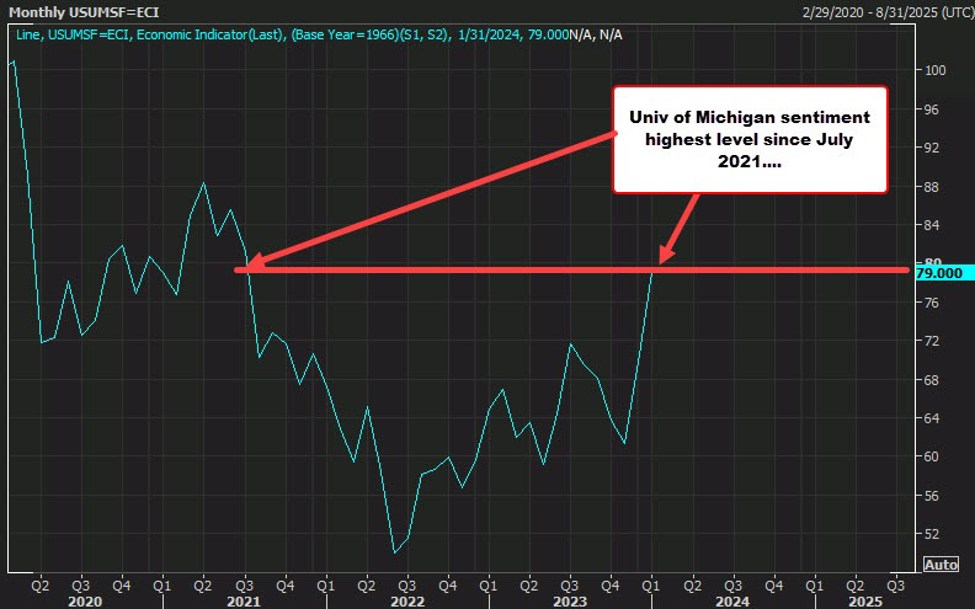

- Preliminary 78.8. Prior month (December) 69.7.

- Univ of Michigan sentiment 79.0 vs 78.8 preliminary Highest degree since July 2021

- Present circumstances 81.9 vs 83.3 preliminary and 73.3 prior

- Expectations 77.1 vs 75.9 preliminary and 66.4 prior

- 1 yr inflation expectations of two.9% versus a 2.9% preliminary 3.1% prior month

- 5-year inflation expectations 2.9% versus 2.8% preliminary and a pair of.9% prior month

There was little response to the information. The inflation expectations remained pretty regular. Present circumstances decrease vs preliminary. Expectations moved increased.

Highlights direct from the Univ. of Michigan:

- Shopper sentiment surged 13% to its highest degree since July 2021, indicating improved outlooks for inflation and private incomes.

- This enhance in shopper sentiment in January is notable, having been exceeded solely 5 instances since 1978, with a exceptional 14% enhance noticed within the earlier month.

- Customers reported optimistic views on their private funds and the macroeconomy, with the short-run enterprise outlook leaping 27%.

- After preliminary skepticism final fall, customers now really feel assured that inflation will proceed to melt, resuming the upward sentiment trajectory from the all-time low in June 2022.

- Regardless of the general optimism, there stays important disagreement in regards to the financial system’s future, with 41% anticipating good instances forward for enterprise circumstances and 48% anticipating dangerous instances.

- The present sentiment is 7% under the historic common since 1978, but it reveals huge enchancment from June 2022 when 79% anticipated difficult instances.

- Yr-ahead inflation expectations decreased to 2.9%, the bottom since December 2020, and throughout the pre-pandemic vary of two.3-3.0%.

- Lengthy-run inflation expectations remained regular at 2.9%, throughout the slender vary of two.9-3.1% noticed for 27 of the final 30 months, however barely increased than the pre-pandemic vary of two.2-2.6%.

This text was written by Greg Michalowski at www.forexlive.com.