Stefonlinton/iStock Editorial via Getty Images

If ifs and buts were candy and nuts, we’d all have a Merry Christmas.

Introduction

In this article, I want to discuss a “what if” situation regarding a company I haven’t covered since August 12, 2022. That company is Ryder System, Inc. (NYSE:R), a transportation giant that has returned 58% since then.

Back then, I called the company a “good dividend investment” but refrained from investing due to my focus on other transportation companies and the fact that Ryder had to prove itself.

After rejecting a takeover offer, the company was on a very uncertain path.

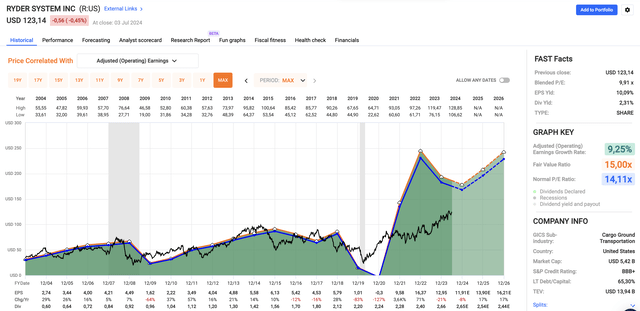

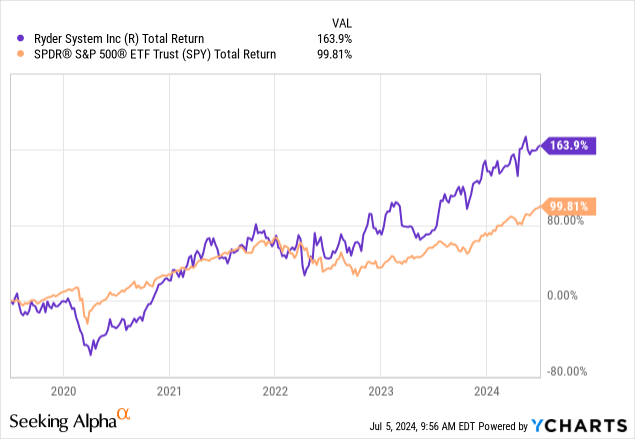

The good news is that Ryder is indeed showing that its transition is going smoothly. This also explains its great performance. Although Ryder lagged the S&P 500 (SP500) by almost 150 points over the past ten years (233% vs. 87%), it returned 164% over the past five years.

After almost two years, I’ll update my thesis and explain the “what if” situation using recent developments, including its recent 2024 Analyst/Investor Day.

If the company can execute its growth plans, it could unlock much more shareholder value.

So, as we have a lot to discuss, let’s get right to it!

The “New” Ryder Is Impressive

What’s Ryder System?

Even if you have read my articles in the past, after almost two years, it won’t hurt to briefly discuss how this company makes its money.

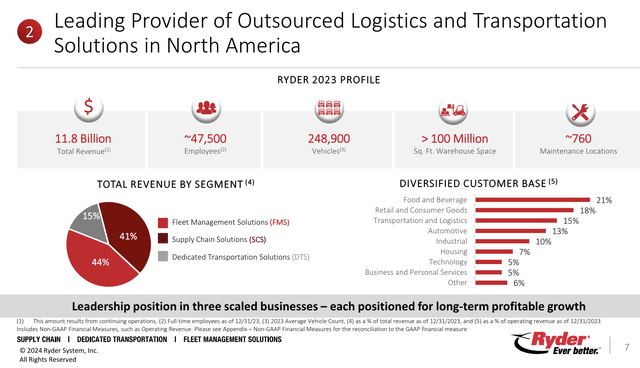

Essentially, the company is a provider of outsourced logistics and transportation services. It provides a wide range of services.

To quote the company’s 10-K (emphasis added):

- Fleet Management Solutions (“FMS”), which provides full service leasing that includes our contractual maintenance offering, commercial rental and maintenance services of trucks, tractors and trailers to customers principally in the United States (U.S.) and Canada-

- Supply Chain Solutions (“SCS”), which provides fully integrated port-to-door logistics solutions, including distribution management, dedicated transportation, transportation management, freight brokerage, e-commerce fulfillment, last-mile delivery, contract packaging, and contract manufacturing in North America.

- Dedicated Transportation Solutions (“DTS”), which provides turnkey transportation solutions in the U.S., including dedicated vehicles, professional drivers, management, and administrative support. Dedicated transportation services provided as part of an operationally integrated, multi-service supply chain solution to SCS customers are primarily reported in the SCS business segment.

Currently, the company serves more than 40 thousand commercial customers, generating almost $12 billion in revenue last year.

Moreover, it has 760 truck maintenance locations and more than 300 distribution centers to provide it with an edge that is difficult to replicate.

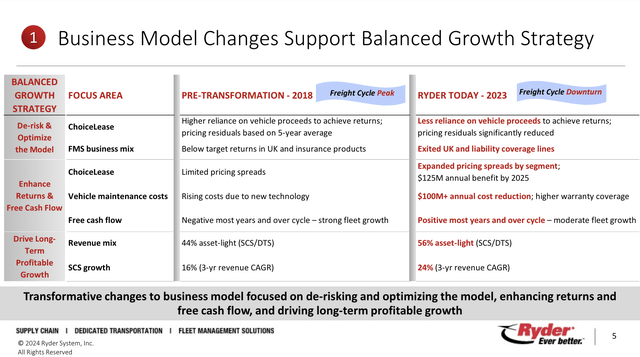

As I already briefly mentioned, over the past five years, the company has focused on improving its growth strategy, including optimizing operations.

According to its 2024 Investor/Analyst Day, this has been key in achieving significant transformation milestones.

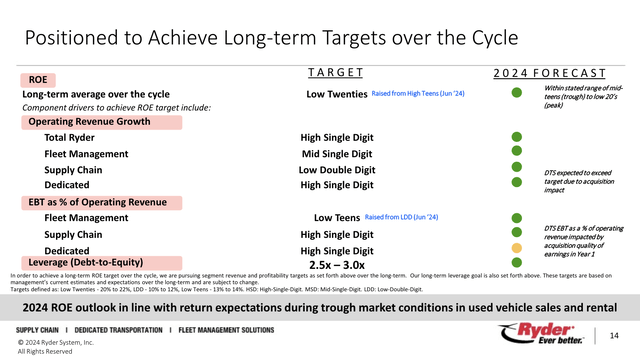

By lowering residual values on leased vehicles and raising lease prices, Ryder reduced its dependency on the volatile used truck market. This strategic shift has led to more stable and predictable returns. It also cut maintenance costs by $100 million.

The company also divested from underperforming regions, like the United Kingdom, to concentrate on its core North American market.

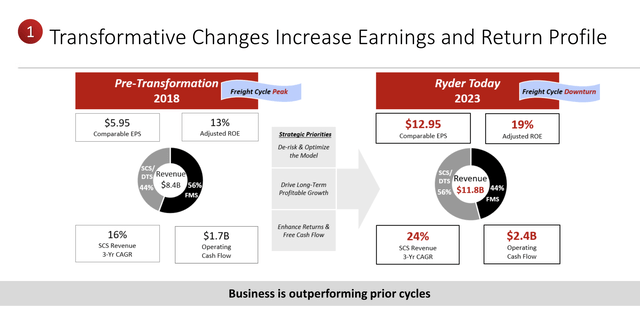

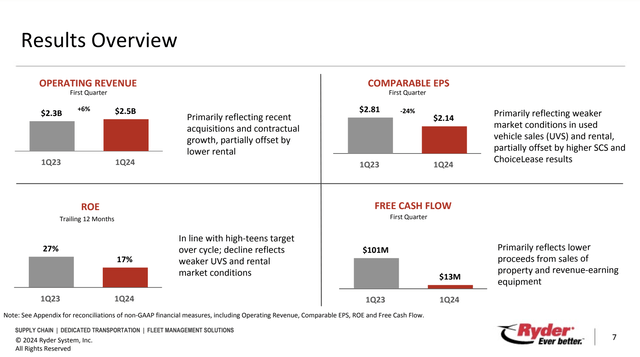

As a result, between 2018 and 2024, Ryder’s comparable earnings more than doubled, and the return on equity improved from 13% in a “peak environment” to 16% in a “trough environment.” Last year, the ROE was 19%.

Moreover, as we can see above, the supply chain and dedicated transportation segments, which now account for 60% of Ryder’s revenue, have seen substantial growth. This growth shift came with a 40% increase in operating cash flow to $2.4 billion.

To stay ahead in what has always been a highly competitive industry, the company continues to invest in technology and innovation.

Essentially, the company is leveraging its massive logistics network and technological improvements to provide end-to-end supply chain solutions, from e-commerce fulfillment to last-mile delivery.

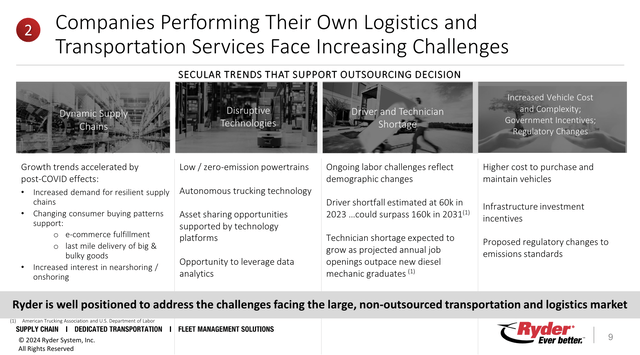

In a world where most companies want to become lean and outsource these tasks, Ryder is at the right place at the right time.

Speaking of a changing environment, the company also makes the case that the increasing complexity of supply chain management and the ongoing shortage of professional drivers and technicians further boost the demand for its outsourcing services. I agree with that.

Additionally, 85% of its revenues are long-term contractual revenues, which increases revenue visibility.

So, what does this mean for shareholders?

There’s Room For Juicy Returns!

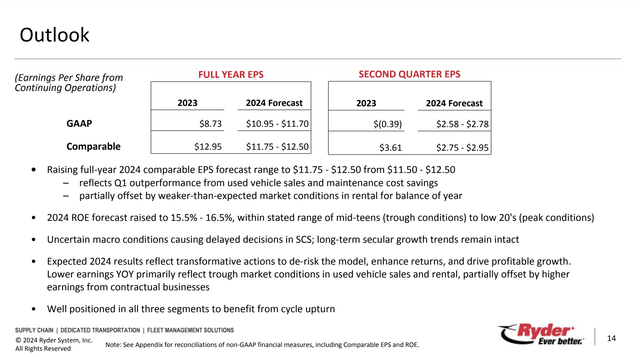

During its 1Q24 earnings call, the company noted that it expects to achieve significant long-term earnings growth despite expecting trough conditions in used vehicle sales and rental markets this year.

On a full-year basis, the company expects comparable EPS of $11.75 to $12.50 for 2024, which would be a substantial increase from $5.95 in 2018. Last year, when economic conditions were better, the EPS number was $12.95.

While we’re “waiting” for the economy to recover, the company maintains a healthy balance sheet with an investment grade BBB+ credit rating, just one step below the A range.

It uses this balance sheet for buybacks and dividend growth.

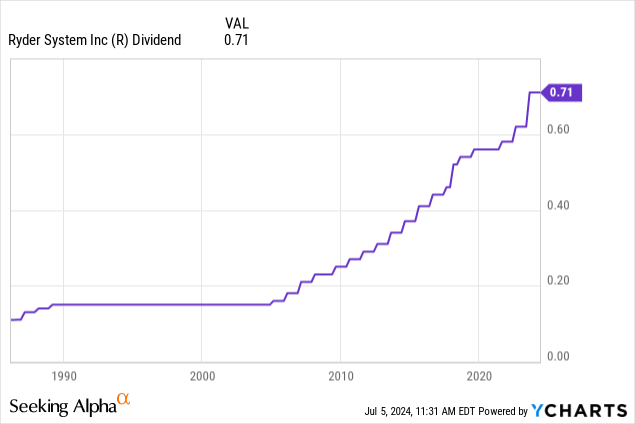

- Over the past ten years, the company’s annual dividend growth has averaged 8%. The most recent hike was 14.5% on July 13. Currently, Ryder shares yield 2.3%. These dividends have a 22% payout ratio.

- Since 2021, the company has bought back roughly 16% of its shares.

On a long-term basis, we can expect this to continue, as Ryder is guiding for high-single-digit annual revenue growth. As of June 2024, the company is sticking to this guidance.

This bodes well for its valuation.

Currently, Ryder trades at a blended P/E ratio of just 9.9x. Not only is this below its long-term normalized P/E ratio of 14.1x, but it also comes with very positive analyst expectations.

Using the FactSet data in the chart above, analysts are looking for 17% EPS growth in both 2025 and 2026, after a potential decline of 8% in 2024.

As such, the stock has a theoretical price target of $229, 86% above the current price. The current price target is $142.

The big difference is mainly caused by investors not willing to bet on a freight recovery yet. This opens up opportunities for long-term investors looking to hold Ryder for at least 4–5 years.

While I don’t know what the next 1–2 years will look like, I believe Ryder will have a very bright future if it can execute its growth plans.

The only reason why I don’t invest in Ryder is that I started a full position in Old Dominion Freight Line (ODFL) earlier this year. That’s a less-than-truckload operator. I also own three railroads.

Needless to say, investors need to be aware of the cyclical risks that come with Ryder. If the economy further deteriorates, we could see potential guidance cuts and a weaker stock price.

Takeaway

Ryder System, Inc. has shown impressive growth and strategic transformation over the past few years, achieving significant milestones and improving its financial stability.

By focusing on core North American markets, optimizing operations, and leveraging technology, Ryder has doubled its comparable earnings and significantly improved its return on equity.

Despite economic uncertainties, the company’s healthy balance sheet, consistent dividend growth, and long-term revenue projections make it an attractive option for long-term investors.

While cyclical risks remain an issue, the company’s solid strategy and execution could unlock substantial shareholder value for many years to come.

Pros & Cons

- Strong Performance: Ryder has returned 164% over the past five years, significantly outperforming the S&P 500.

- Strategic Transformation: The company’s shift to more predictable revenue streams by optimizing operations and focusing on high-growth markets has paid off.

- Growth Potential: Analysts predict 17% EPS growth for 2025 and 2026, which bodes well for its valuation.

- Revenue Visibility: 85% of Ryder’s revenues come from long-term contracts, which provide stable and predictable income.

Cons:

- Cyclical Risks: Ryder’s performance is tied to the broader economic environment.

- Competition: The transportation and logistics industry is highly competitive.

- Market Volatility: Ryder’s reliance on the used truck market and rental segments comes with revenue volatility.