Greenwash activists participate within the last day of 4 days of The Large One local weather protest actions organised by Extinction Revolt (XR) on 24 April 2023 in London, United Kingdom.

Mark Kerrison | In Photos | Getty Photographs

The top of the United Nations Surroundings Programme Finance Initiative believes there’s nonetheless a “real challenge” in scaling the circulate of funding to corporations which might be transitioning to develop into greener.

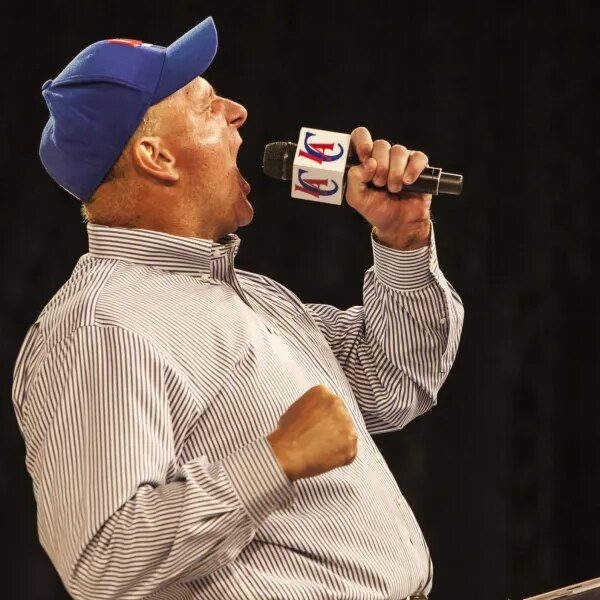

Eric Usher, who heads up the UN partnership with banks, insurers and traders, stated that there are areas extra clearly understood to be inexperienced investments — reminiscent of renewable vitality — that are “mobilizing a lot of capital today.”

“The money is starting to move away from the really non-green stuff. But the real challenge is everything in between — some would say the ’50 shades of green’,” Usher stated throughout a “IOT: Powering the Digital Economy” panel moderated by CNBC’s Steve Sedgwick at this yr’s World Financial Discussion board in Davos, Switzerland.

This refers to corporations nonetheless working towards making their companies extra sustainable, making them tougher to label as really inexperienced investments, in response to Usher.

“If you’re going to work in helping deal with heavy emitting sectors and you’re going to put more capital in to help them reduce [emissions], that’s going to increase your emissions profile,” he defined.

“So there’s a lot of definitional stuff that’s needed before the capital is going to flow really at scale,” Usher added.

The UNEP FI was based in 1992 and says on its web site that it was the primary group to have interaction the finance sector on sustainability. Amid the onset of the Covid-19 pandemic, sustainability points and funding moved firmly into the highlight as traders poured cash into newly arrange funds.

Increasingly companies strived to make their companies extra sustainable amid extreme climate occasions throughout the globe. However indicators of a so-called “greenlash” have been rising throughout locations just like the U.S. and Europe as the price of implementing environmental insurance policies has confronted resistance from residents, prompting some governments to water down their targets.

Web-zero work ‘hasn’t stopped’

The rise of synthetic intelligence dominated discussions at this yr’s WEF summit earlier this month. In truth, a WEF report ranked AI-derived misinformation and disinformation prime of an inventory of the biggest risks for 2024, forward of local weather change.

Throughout Wednesday’s panel, Usher acknowledged that the dialogue at Davos round net-zero emissions had been “a little bit less prominent than maybe in recent years but what we see under the hood is that the work hasn’t stopped.”

Usher recommended that whereas a extra difficult geopolitical atmosphere was additionally extra in focus for traders, sustainability was nonetheless a precedence as a result of it targeted on the way forward for their companies.

He stated that “this is about doing business and this is about how a bank, or an investor, or an insurer, or actors in [the] real economy say, ‘well this is about our future’ … And the question is: Are you going to be a future taker or are you going to be a future maker?”

Talking individually to CNBC at Davos, Mark Carney stated that he believed sustainability “hasn’t slipped down the agenda of investors.”

Carney, who’s presently the United Nations particular envoy on local weather motion and finance and previously the governor of the Financial institution of England, stated that funding in clear vitality grew by 50% in 2023 to $1.8 trillion, up from $1.2 trillion in 2022.

“There’s a huge surge in investment in clean energy, in EVs, [electric vehicles] in the whole supply chain,” he stated.