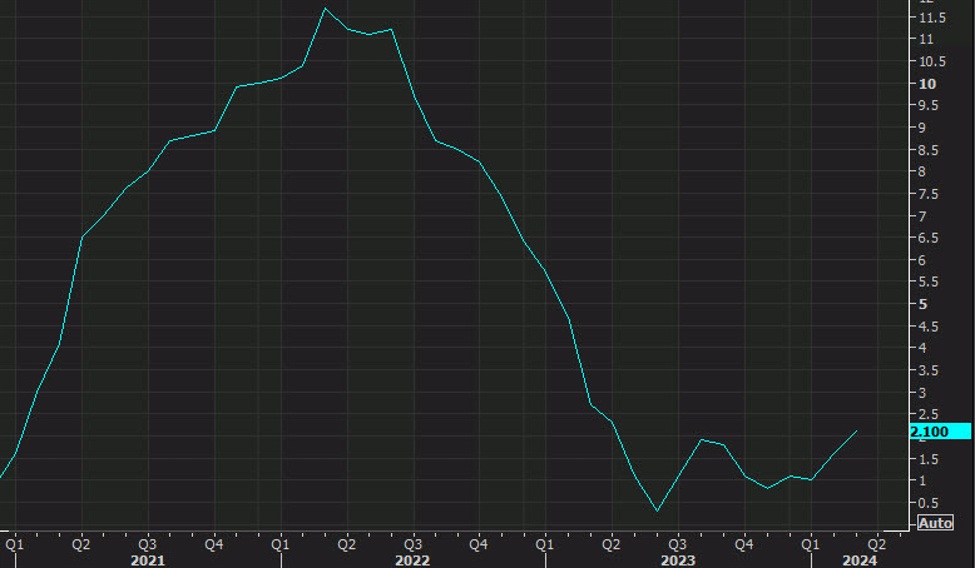

- Prior was +2.1% y/y

- PPI final demand +0.5% vs +0.3% expected

- Prior was +0.2% (revised to -0.1%)

- PPI ex food/energy +2.4% vs +2.4% y/y expected

- PPI ex food/energy +0.5% vs +0.2% m/m expected

- Prior ex food/energy +0.2% (revised to -0.1%)

The market reacted to the m/m reading but the hot number was entirely due to a revision lower to the March data. If you net those out, it’s right in line and that’s reflected in the year-over-year numbers. Ultimately, the price level is where economists thought it was. Now, you can argue there is some acceleration there but this is mostly commodity prices and oil has given some back this month.

This article was written by Adam Button at www.forexlive.com.