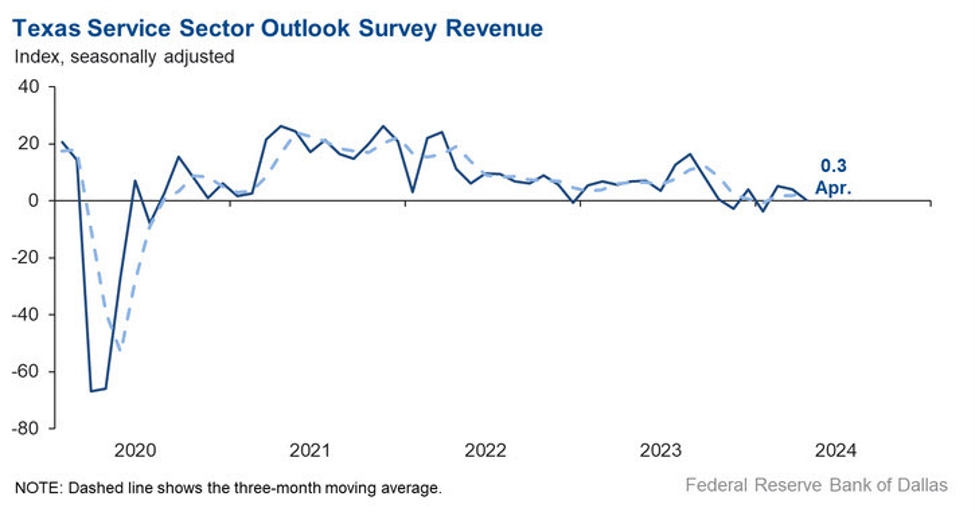

- Prior was -5.5

- Revenues index -0.3 vs +4.0 prior

- Employment -2.6 vs -1.2 prior (lowest since 2020)

- Wages and advantages +14.2 vs +19.5 prior

- Promoting costs +3.9 vs +7.7 prior

Feedback within the report:

Truck transportation

- We restore long-haul vans. The quantity simply retains taking place,

which implies everyone seems to be holding again on repairs, so we have now no work.

Inflation retains driving our prices up. It isn’t trying fairly for

trucking.

Help actions for transportation

- We’re seeing an uptick in charges and exercise. The surplus capability slowly bleeding out of the market is inflicting this.

Publishing industries (besides web)

- Momentum continues to be based mostly on intuitive smarter software program revisions.

Business curiosity can be lastly growing with higher relationship

contacts to hurry credible traction and curiosity for adoption going

ahead. We’re extra centered now on advertising and gross sales. - The impression of the upper charge setting appears to be catching

up, with normal buy intent amongst clients flattening out. On the

similar time, price range cuts and political uncertainty have impacted our

public sector enterprise as nicely, creating extra uncertainty throughout

our enterprise.

Credit score intermediation and associated actions

- The stress of an election yr provides to the priority residents have in regards to the course of our economic system.

- We not too long ago renegotiated our $600 million debt facility. Our

value of funds went from 9 % to 14 %—that is a reasonably large hit

to our backside line and resulted in us growing costs to our

clients. Our enterprise focus has been on forecasted easing; nonetheless,

the fact of charges staying greater longer is creating uncertainty. - Business actual property transactions are down by 70-80 %

in line with the brokers we discuss to, and our mortgage origination quantity

displays that as nicely. Debtors are involved about future enterprise

prospects. We not too long ago had a consumer resolve to not take a mortgage to

refinance a warehouse used of their enterprise as a result of they had been involved

about their future enterprise prospects. On the similar time, the price of

every little thing we purchase, from paper to electrical energy, is rising. - The Federal Reserve signaling it’s going to maintain the speed on the

present degree for longer has affected our outlook negatively. One among our

largest points with inflation is the price of housing. These excessive charges

don’t assist that, and costs of every little thing else should not declining or

remaining secure.

Securities, commodity contracts and different monetary investments and associated actions

- Latest motion in long-term charges, mixed with the Fed

holding charges longer, have delayed the anticipated worth of funding

restoration till 2025 or later.

Insurance coverage carriers and associated actions

- We’re recruiting skilled insurance coverage professionals, and there

is a small pool to attract from, sadly. We are going to hold trying. - Property insurance coverage and affordability are slowing our progress alternatives.

Actual property

- The rise in treasury yields since final fall has negatively impacted deal-making exercise within the revenue property business

- We’re an actual property dealer firm and we have now about 350

brokers. They’re unbiased brokers not salaried staff. Our enterprise

slows throughout election years, and excessive rates of interest have damage

first-time consumers. - Value of capital is weighing on our clients and reducing quantity.

Rental and leasing companies

- We’re a development equipment and materials dealing with

dealership. Our enterprise within the first quarter of 2024 was down 2

%, and the business was down 12.3 %. Our manufacturing

shoppers appear virtually on the verge of panic, and there’s stuff in

stock. We’d like a guest-worker program to satisfy our skilled-labor

wants long run.

Skilled, scientific, and technical companies

- Persistent inflation and the Fed doubtlessly delaying charge cuts are inflicting uncertainty for the second half of 2024.

- We’re nonetheless nervous in regards to the election inflicting uncertainty in

our shoppers and prompting a slowdown later this yr. Some shoppers are

nonetheless nervous about inflation and are stalling tasks due to the

volatility within the provide market. Total, it’s powerful to make any

forecast proper now. Our backlog is powerful for the following couple of months,

however not as far sooner or later as we wish. - The market was slower within the first quarter, however it’s now in restoration.

- We’re more and more seeing small skilled companies shrinking or

merely closing up store. The labor scarcity is a significant purpose for giving

up the combat. There’s loads of demand for skilled companies, however

there’s not sufficient skilled employees. Retaining employees is a significant headache.

House owners nearing retirement are giving it up sooner quite than later. - Burdensome federal laws are growing the fee to do

enterprise, such because the so-called “Corporate Transparency Act” and minimal

wage will increase that simply proceed to drive inflation. - Basic outlook has improved primarily attributable to our elevated

funding in advertising and a rise usually enterprise exercise. - We see a slight uptick in transactional issues.

- Making an attempt to think about how remote-work scheduling impacts the necessity for house and sources is difficult.

- Aggressive labor market stays; it’s tougher to recruit nice expertise; medical insurance is growing.

- We’ve not been this gradual for the reason that Nice Recession. This

consists of Covid. We can not understate how horrible the potential actual

property market is. Persons are not submitting zoning instances, that means in two

years there is not going to be development. Volumes have gone down within the

automotive business. It appears they’re starting to show round, so

we’re hoping. - This actual property market is tough to determine. With the 10-year

charge nonetheless shifting within the fallacious course, and the chance of a charge

reduce not coming this yr attributable to inflation and the power of the

economic system, we simply cannot see the market bettering till subsequent yr. - The Fed is now unlikely to chop rates of interest; considerations over recession proceed.

Administration of firms and enterprises

- Overregulation takes away quite a lot of money and time.

Administrative and help companies

- Continued excessive rates of interest, inflation and normal financial

malaise has brought on employers to be very reluctant to rent skilled

degree expertise. They could substitute expertise if they’ve attrition, however in

normal, they’re very gradual to make any new rent choices. - There was a marked decline in requests for quotes for the month. This decline doesn’t slot in our regular seasonal modifications.

- The depth of worldwide battle and growing long-term charges definitely elevate considerations.

- Geopolitical tensions are creating an unsure setting.

Additionally, upcoming elections and the way this may increasingly have an effect on the Fed’s financial

coverage is a priority. -

Excessive rates of interest have drastically hindered our skill to develop our

enterprise, and it seems like a charge reduce shouldn’t be doubtless taking place in 2024.

Texas Retail Outlook Survey

Lodging

- Between growing inflation, excessive rates of interest and

instability within the Center East, we’re rising extra involved that the

upcoming summer season journey season can be depressed in comparison with prior years. - March 2024 is considered as a contradiction in that we had a number of

areas carry out at or near expectations and others that had been far

under. That appears to be the identical in April. Obscure what

is occurring.

Meals companies and consuming locations

- The stalled return to workplace and the decline of weekday enterprise

journey to downtown stay drags on income. We see a softening in different

meal intervals, and we consider it’s because of the improve in menu costs.

Hiring skilled employees with information stays very troublesome. The place

did seasoned staff go? Value of products bought continues to extend. - We’re nonetheless hanging on by a thread after closing one enterprise final month.

- The vitality sector continues to be sturdy, which positively

impacts my enterprise. Midland continues to draw a youthful inhabitants.

Motorized vehicle and elements sellers

- The margin on new automobiles bought per unit declined 50 %

yr over yr in March 2024, which was a direct profit to the

client. - We’re persevering with to see labor shortages within the workforce and a

lack of effort to pursue the positions accessible from these candidates

responding to open positions.

Electronics and equipment shops

- Constructing exercise is down nonetheless and appears to be getting worse.