Snippet from UBS on what’s ahead this week: CPI, FOMC, and more fresh S&P 500 record highs?

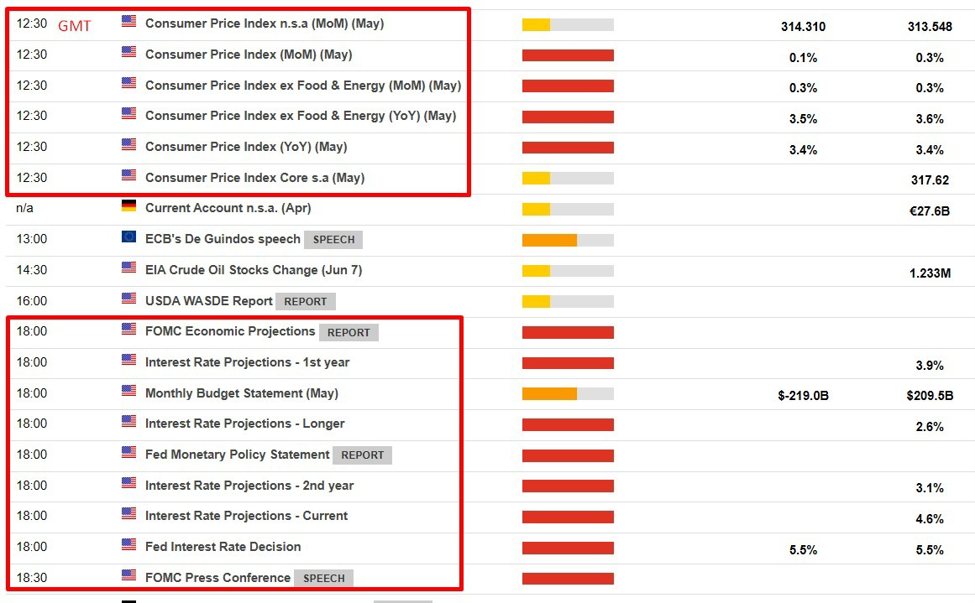

On the CPI (due Wednesday, 12 June 2024 at 8.30 am US Eastern time (1230 GMT)):

- A reading around the previous result (April @ 3.4% y/y) is likely to be enough to ensure investors remain confident in the outlook for continuing lower inflation:

- “It would take a sizeable upside beat, similar to those in 1Q, to shake investor confidence in that trend”

On the Federal Open Market Committee (FOMC) (statement due Wednesday, 12 June 2024 at 2pm US Eastern time (1800 GMT) with Powell’s media conference due a half hour later). US say:

- dot plot will almost certainly who two cuts to come this year (down from 3 shown at the March update)

- consumer spending is slowing, more notably on goods than services, but economy is still showing positive signs

On stocks, UBS warn that disappointment from the CPI or the Fed could slow the momentum for gains but expects further all time highs.

Wednesday brings the CPI and FOMC.

- no FOMC rate cut is expected at this meeting

- the “dot plot” (i.e. the FOMC members’ expected path for interest rates over coming next months and years) will be updated

Earlier:

- ICYMI: JP Morgan shifted their forecast for the first FOMC rate cut from July to November

- JP Morgan expect a dovish Federal Reserve Chair Powell after Wednesday’s FOMC statement

- Goldman Sachs preview the Federal Open Market Committee (FOMC) this week – no cut, but …

This article was written by Eamonn Sheridan at www.forexlive.com.