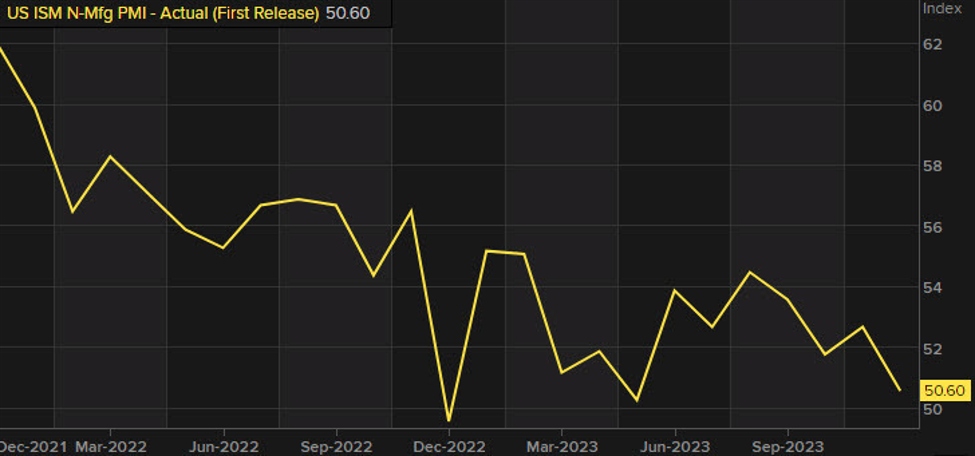

- Prior was 52.6

Particulars:

- Employment index 43.3 versus 50.7 prior

- New orders 52.8 versus 55.5 prior

- Costs paid index 57.4 versus 58.3 prior

- New export orders 50.4 versus 53.6 prior

- Imports 49.3 versus 53.7 prior

- Backlog of orders 49.4 versus 49.1 prior

- Inventories 49.6 versus 55.4 prior

- Provider deliveries 49.5 versus 49.6 prior

- Stock sentiment 49.6 versus 62.2 prior

That is some dovish stuff. Bear in mind, the ISM providers report is a superb forward-looking knowledge level whereas non-farm payrolls is a laggard.

The costs paid and employment numbers are significantly dovish.

Feedback within the report

- “Pricing has develop into extra favorable, in increments. Nonetheless, beef

costs are nonetheless excessive. Petroleum continues to fluctuate. Providers has

come down barely, however hourly charges are nonetheless greater than pre-pandemic

(ranges).” [Accommodation & Food Services] - “Congestion on the Panama Canal is predicted to proceed for the subsequent

a number of months. The impact of that is rerouting marine cargoes on the

expense of price and schedule.” [Construction] - “Business conditions are generally good, except for a short supply of major electrical components.” [Educational Services]

- “Revenues stay sturdy however labor continues to be constrained, and

suppliers are floating value will increase starting January 1, which is able to

probably additional cut back already low working margins. Provide chains

seem like working nearer to pre-pandemic norms and stay principally

steady. Our major aim for calendar yr 2024 is expense discount

throughout the board, together with for provides and providers in addition to by way of

eliminating non-value-added pursuits.” [Health Care & Social

Assistance] - “If interest rates go down, investment borrowing will increase, as will orders for services.” [Information]

- “Production and sales are up, and prices are down.” [Mining]

- “Hiring of direct workers, consultants and contract staff

stays flat throughout most industries as the vacation season is in full

swing and financial issues persist. Firms are taking a wait-and-see

strategy to growing labor prices as they proceed to attempt to do extra

work with much less individuals.” [Professional, Scientific & Technical

Services] - “Final push for the holidays. The supply chain and sales are strong — pricing stable.” [Retail Trade]

- “Now we have seen a typical gradual seasonal change in enterprise. That is

not surprising and stays at the next stage than within the earlier two

years.” [Transportation & Warehousing] - “There may be extra stability within the provide chain for the primary time

since early 2020. Total stage of enterprise exercise continues to be comparatively

excessive.” [Utilities] - “Enterprise continues to be strong in our space, regardless of the traditional vacation

lull. We must always see enterprise resume after the primary of the yr if good

climate prevails. Mortgage charges are persevering with to fall, which is aiding

in affordability. I believe the primary quarter will yield good demand.”

[Wholesale Trade]

This text was written by Adam Button at www.forexlive.com.