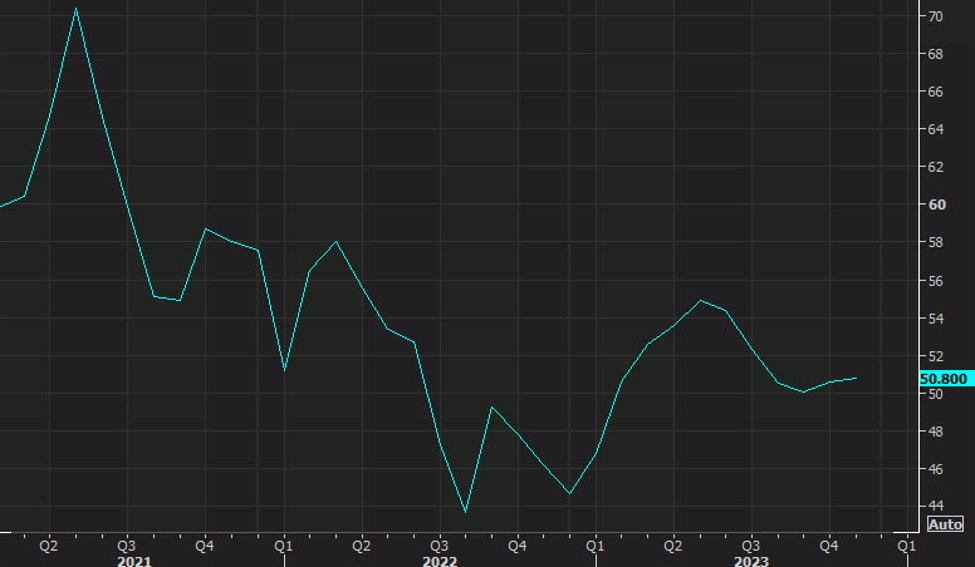

- Prelim was 51.3

- Prior was 50.8

- Composite PMI vs 51.0 prelim (50.7 prior)

- New orders rose on the sharpest fee since

June - Service suppliers recorded a steeper rise in enter prices as increased wages and meals

costs drove inflation however there was a slower uptick in output expenses

The ultimate studying is never a shock nevertheless it units up the ISM providers report, which usually comes quarter-hour later however resulting from calendar quirks comes tomorrow. It is anticipated at 52.6 from 52.7 in November.

Chris Williamson, Chief Enterprise Economist at S&P

International Market Intelligence, mentioned:

“Some New 12 months cheer is offered by the PMI signalling

an acceleration of development within the huge providers financial system,

which reported its largest rise in output for 5 months

in December. The development overshadows a downturn

recorded in manufacturing to point that the general

tempo of US financial development seemingly accelerated barely

on the finish of the 12 months.

“Some assist to monetary providers particularly is

coming from the latest loosening of monetary situations

amid rising hopes of rate of interest cuts in 2024.

Progress nonetheless stays subdued by requirements

seen over the spring and summer season, with the struggling

manufacturing sector dampening demand for business-

to-business providers and customers remaining far

much less inclined to spend on luxuries equivalent to journey and

recreation than earlier within the 12 months.

“The more difficult demand surroundings has

dampened companies’ pricing energy, squeezing service sector

promoting value inflation to the bottom for over three years

on common throughout the fourth quarter. With sticky service

sector inflation being a key space of concern amongst

Fed policymakers, the slower fee of value enhance in

December is welcome information.”

Another interesting dynamic was in new export orders, with S&P Global reporting: “The general upturn in new enterprise was dampened by a

renewed contraction in new export orders, nevertheless. The autumn

was the primary since September and reportedly pushed by decrease

buying energy amongst clients in key export markets.”

That highlights the dichotomy between the US and elsewhere that would finally result in much less inflation within the US.