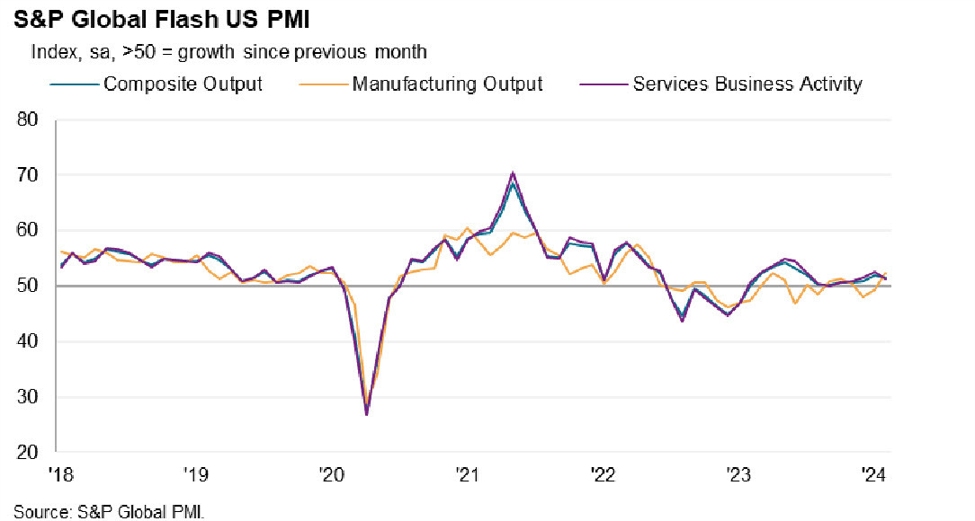

- Prelim was 51.1

- Prior was 50.7

- Enter costs rose at a slower tempo

- Promoting costs elevated on the steepest tempo

since April 2023 - Home and international consumer demand

strengthened, driving whole gross sales increased and on the sharpest

tempo since Could 2022

This provides upside dangers to the ISM manufacturing survey at 10 am ET and highlights a robust backdrop within the US.

Chris Williamson, Chief Enterprise Economist at S&P

International Market Intelligence, mentioned:

“Manufacturing is exhibiting encouraging indicators of pulling

out of the malaise that has dogged the goods-producing

sector over a lot of the previous two years. After a protracted spell

of decreasing inventories as a way to reduce prices, factories

at the moment are more and more rebuilding warehouse inventory ranges,

driving up demand for inputs and pushing manufacturing

increased at a tempo not seen since early 2022. There are additionally

indicators of stronger demand for client items, linked in

half to indicators of the price of residing disaster easing.

“Corporations are consequently investing in additional employees and

extra tools, laying the foundations of additional

manufacturing beneficial properties within the coming months to hopefully

drive a stronger and extra sustainable restoration of the

manufacturing financial system.

“Issues with transport disruptions and provide chains

earlier within the yr have eased, taking some stress off

enter costs, although manufacturing facility gate costs are recovering

amid stronger buyer demand, which will likely be an space

to observe carefully within the coming months as policymakers

assess the appropriateness and timing of any curiosity

price cuts.”

This text was written by Adam Button at www.forexlive.com.