Oklahoma-based Huge Financial institution, as soon as boasting the title of the primary US financial institution to combine crypto buying and selling instantly into its checking accounts, has officially exited the cryptocurrency market.

The closure of their crypto-friendly cell app, “Vast Crypto,” marks a major growth within the evolving relationship between conventional banks and the risky world of cryptocurrency.

Early Entry And Fast Development

Huge Financial institution first dipped its toes into the crypto pool in 2019, partnering with US crypto trade Coinbase and German software program agency SAP to create a novel banking expertise.

By 2021, the launch of their devoted “Vast Crypto” app allowed prospects to purchase, promote, and maintain cryptocurrencies alongside their conventional checking accounts. This revolutionary method reportedly contributed to a 50% progress in Huge’s retail buyer base inside solely eight weeks, highlighting the potential attraction of crypto integration for some banks.

Regulatory Hurdles And Market Volatility

Nonetheless, Huge Financial institution’s crypto ambitions confronted scrutiny from the Workplace of the Comptroller of the Forex (OCC) in late 2023. The regulatory physique issued a consent order citing considerations about “unsafe or unsound practices,” together with these associated to capital ratios, threat administration, and expertise controls particularly linked to Huge’s crypto actions. This intervention coincided with the collapse of main crypto trade FTX, which plunged all the market into turmoil.

Complete crypto market cap at $1.604 trillion on the every day chart: TradingView.com

Strategic Exit And Unsure Future

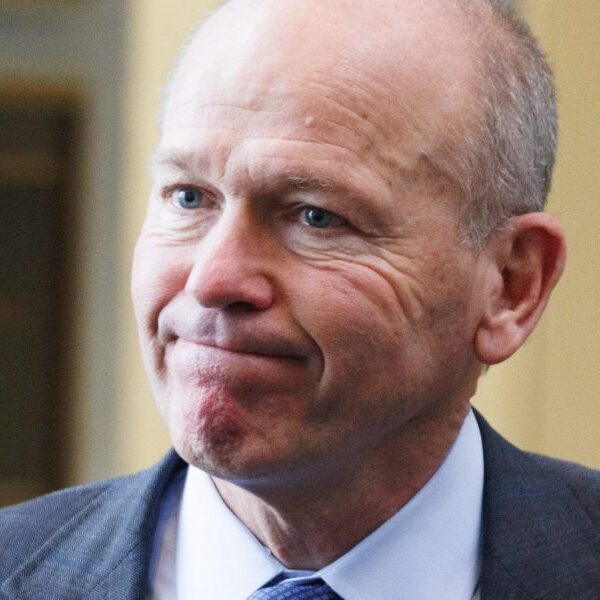

In a latest report by American Banker, Huge Financial institution’s Chief Government, Tom Biolchini, revealed that the choice to exit the cryptocurrency market was a strategic transfer directed by the Workplace of the Comptroller of the Forex (OCC).

Biolchini, in an interview with native information station Information on 6, make clear the financial institution’s response to the OCC order, stating that it was particularly geared toward their involvement within the cryptocurrency sector.

Lingering Questions And Market Influence

Huge Financial institution’s exit raises a number of questions on the way forward for conventional financial institution involvement in cryptocurrency. Will different establishments comply with go well with, deterred by regulatory hurdles and market volatility? Or will some persevere, looking for revolutionary methods to navigate the complexities of this rising monetary panorama? Solely time will inform.

This growth highlights the regulatory uncertainty surrounding crypto inside the banking sector. Whereas the potential advantages of integration are simple, banks face important challenges in making certain compliance and mitigating dangers.

What Does This Imply For Crypto Traders And Shoppers?

Traders and shoppers fascinated with crypto ought to rigorously take into account the regulatory panorama and inherent volatility earlier than making any funding selections. Banks seeking to enter the crypto area might want to display strong threat administration and compliance methods to navigate this advanced and evolving market.

Featured picture from Adobe Inventory, chart from TradingView