The US greenback touched the lows of the day following a dovish shift from Mester and a Beige E book that highlighted a slowdown and disinflation within the US.

The autumn within the greenback matches with the shift in charge differentials as Fed funds futures worth in 116 bps in cuts subsequent yr, up from 100 bps yesterday and 87 bps initially of the week. Nonetheless it hasn’t stayed down as some greenback patrons have emerged, probably on month-end flows.

Others could also be taking the view that the market has gone too far, too quick on pricing in Fed charge cuts. The Fed blackout begins on the weekend and the intrigue across the upcoming FOMC can be on whether or not they transfer to an express impartial bias. It could be too quickly for that and that would result in some US greenback patrons to wade in.

There’s additionally a gentle stream of financial information to come back. The Beige E book highlighted a slowing financial system however slowing is not essentially stalling and there are many methods to technology +2% inflation with progress at simply 2%. Tomorrow’s slate contains the preliminary jobless claims report and PCE. On Friday we get the ISM manufacturing report.

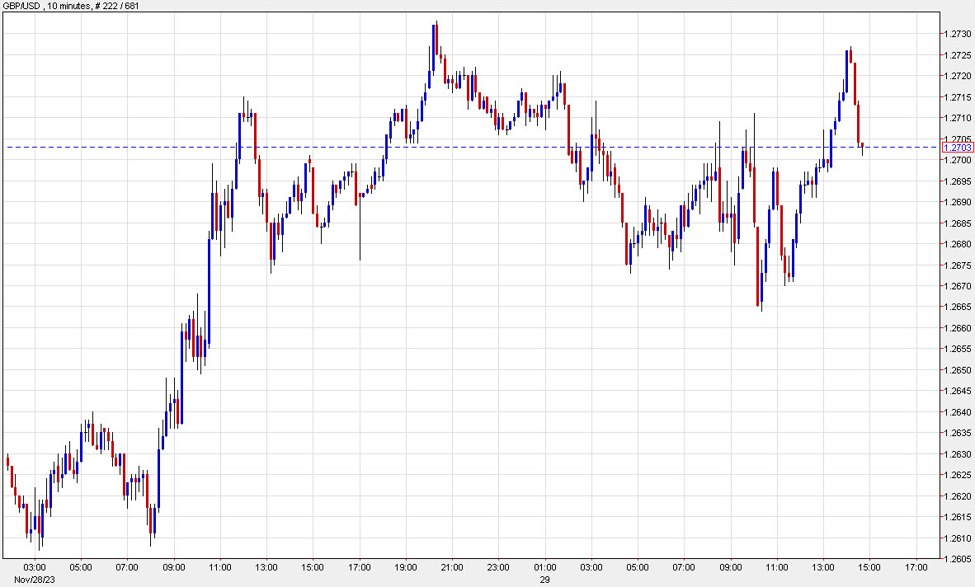

cable 10 minutes