The US dollar jumped in the aftermath of the PCE report, though I’m not sure that correlation equals causation. The PCE report was a touch low, highlighting the downtrend in inflation. That should have weighed on the dollar and did initially, albeit slightly.

A short time later the dollar rebounded and Treasury yields inched higher in what’s more-likely a case of month-end flows. It was a volatile month in the FX market and USD/JPY in particular. Right now is the most-liquid time of the day in FX and the move was likely an indication of strong flows ahead of the long weekend in the US, with some buy-stops run on the break of the weekly highs as well.

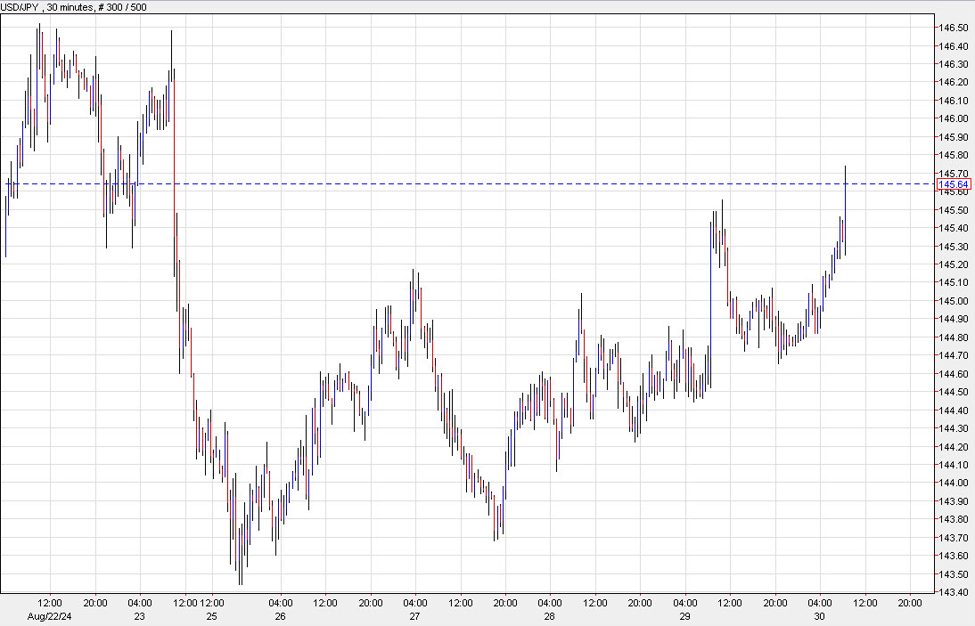

USD/JPY 30 mins