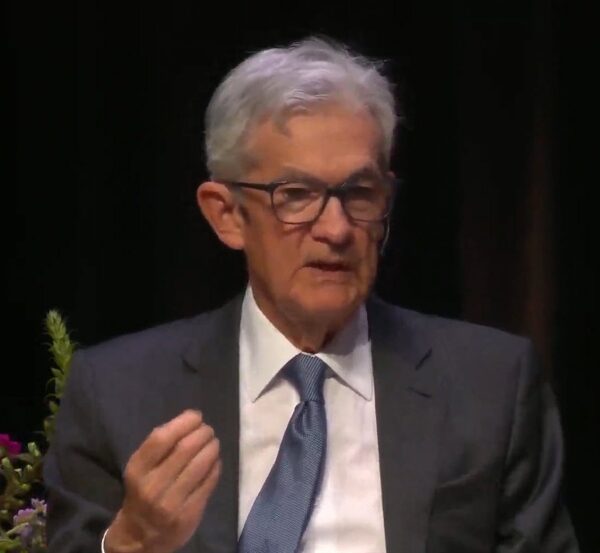

Fed’s Williams

The US greenback rose round 30 pips throughout the board as NY Fed President John Williams spoke on CNBC. US fairness futures additionally gave up positive aspects.

Right here is strictly what he stated:

“We aren’t really talking about rate cuts right now. We’re very focused on the question in front of us, which is– as Chair Powell said — the question is: Have we gotten monetary policy to a sufficiently restrictive stance to ensure that inflation comes back down to 2%. That’s the question in front of us and that’s the question we’ve been thinking about for the past five months and that’s the question we will be thinking about for some time. That’s the topic of discussion for the committee….the discussion really at the FOMC right now is about ‘do we have monetary policy at the right place’ not speculating about what will happen in the next year’.”

He later added that “it’s premature to be even thinking about March cuts”. The market is pricing in a 76% probability of a March minimize, down from 80% yesterday.

I take this as the standard meeting-by-meeting mantra from the Fed and attempting to protect optionality however the market is taking it as a pushback on Powell. I am undecided I agree however the market definitely did get out on its skis a bit.

He additionally stated “if we get the progress I’m hoping to see on monetary policy it will be kind-of natural to lower rates”.

Evaluate this to what Powell stated on Wednesday:

“So the way in which we’re taking a look at it

is admittedly this. After we began out, proper, we stated the primary query is how briskly to maneuver, and we

moved very quick. The second query is, , actually, how excessive to lift the coverage price, and

that is actually the query that we’re nonetheless on right here. We’re very centered on that. As I discussed,

individuals usually assume that we’re at or close to that and assume it is unlikely that we’ll hike, though they do not take that risk off the desk. In order that’s — while you get to that query,

and that is your reply, there is a pure — naturally it begins to be the subsequent query, which is

when it’ll change into applicable to start dialing again the quantity of coverage restraint that is in

place. In order that’s actually the subsequent query, and that is what individuals are fascinated by and speaking

about. And I might simply say this, we’re seeing, , sturdy development that seems to be

moderating, We’re seeing a labor market that’s coming again into steadiness by so many measures,

and we’re seeing inflation making actual progress. These are the issues we have been eager to see.

We will not know — we nonetheless have a methods to go. Nobody is declaring victory. That will be

untimely, and we won’t be assured of this progress. So, we’re shifting fastidiously in making

that evaluation of whether or not we have to do extra or not. And that is actually the query that we’re

on, however in fact, the opposite query, the query of when will it change into applicable to start

dialing again the quantity of coverage restraint in place, that begins to come into sight, and is clearly

a subject of dialogue out on the planet and in addition a dialogue for us at our assembly immediately.”

Q: Can you gives us some color on that discussion:

“Positive. So it comes up on this manner immediately. All people wrote down an

SEP forecast. So many individuals talked about what their price forecast was, and there was no again and

forth, no try to type of attain settlement, like that is what I wrote down, that is what I believe,

that type of factor. And a preliminary type of dialogue like that, not all people did that, however

many individuals did. After which, and I might say there is a normal expectation that this can be a subject

for us trying forward. That is actually what occurred in immediately’s assembly. I can not do the top depend

for you in actual time, however that is usually what occurred immediately.”