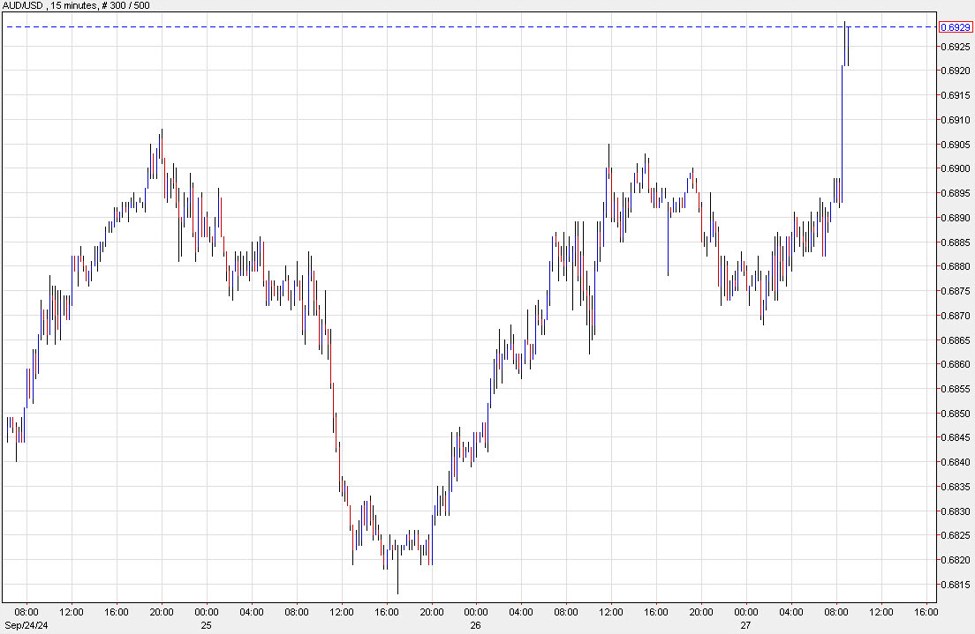

The Australian dollar is at the highest levels since February 2023 as part of a broad selloff in the US dollar following softer US inflation data and China cutting lending rates.

The definitive break above 0.6900 in AUD/USD cracks the June 2023 high and a series of highs in that range. It’s accelerated higher since.

AUDUSD 15 mins

The Australian dollar is particularly leveraged to a better Chinese economy and the market is enthusiastic this week about a series of monetary and fiscal announcements to alter China’s middling trajectory.

Zooming out, the weekly chart for AUD/USD is showing a breakout.

AUD/USD weekly

On the US dollar side, the slide in inflation gives the Fed more leeway to quickly lower rates. The market is almost-evenly divided between 50 and 25 basis points for the November 7 FOMC decision. We still have two non-farm payrolls reports before that decision but it will swing based on incoming economic data and comments from policymakers.

At the moment, the larger theme is China and a potential cyclical pickup in the global economy. That’s generally a bad thing for the US dollar, particularly at a time when the market was pricing in higher US interest rates that G10 peers, like Australia.