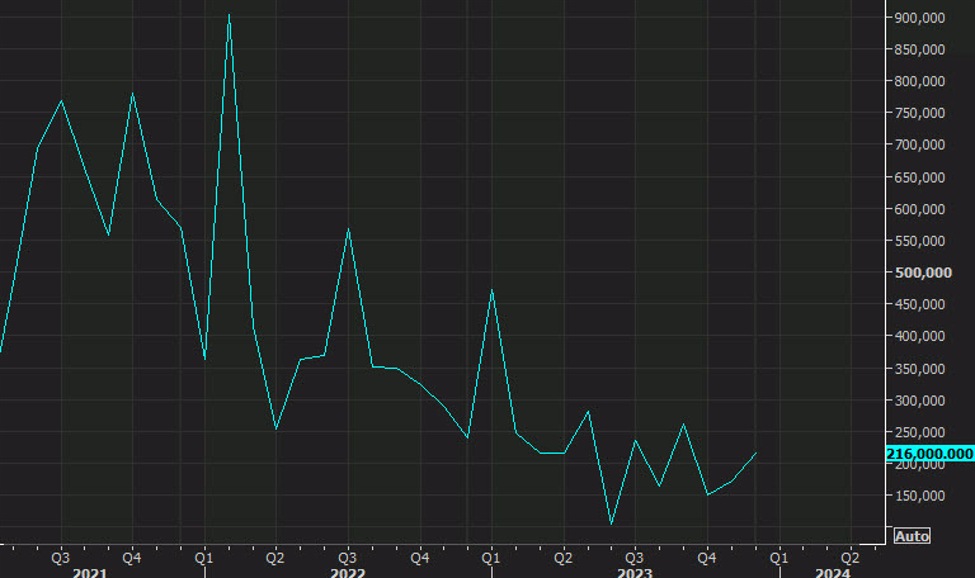

Non-farm payrolls

- Prior +216K (revised to +333K)

- Two-month web revision -Okay vs -71K prior

- Unemployment price 3.7% vs 3.8% anticipated

- Prior unemployment price 3.7%

- Participation price 62.5% vs 62.5% prior

- U6 underemployment price 7.2% vs 7.1% prior

- Common hourly earnings +0.6% m/m vs +0.3% anticipated

- Common hourly earnings +4.5% y/y vs +4.1% anticipated

- Common weekly hours vs 34.3 anticipated

- Change in non-public payrolls +317K vs +164K anticipated

- Change in manufacturing payrolls +23K vs +5K anticipated

- Family survey Okay vs -683K prior

- Beginning-death adjustment -121K vs -52K prior

USD/JPY was buying and selling at 146.67 forward of the info and the market was pricing in 142 bps in cuts by yr finish and a 34% likelihood in March of a lower.

That is undoubtedly hawkish and USD/JPY is as much as 147.54 instantly with March right down to 21% and 127 bps on the yr.

This report is paying homage to final January’s report the place there was additionally an enormous beat. There are large seasonal changes in January and I feel the BLS is battling that, one thing I wrote about at first of the week.