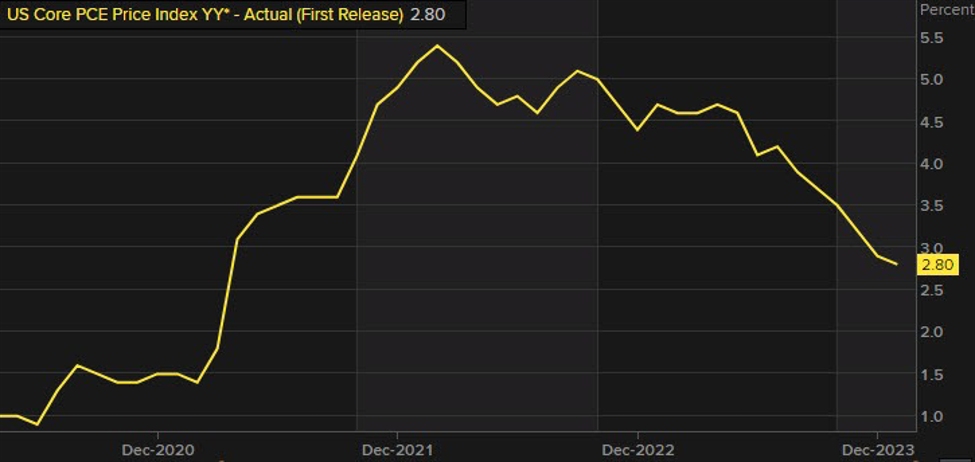

Core PCE

- Prior month 2.9%

- PCE Core 2.8% vs 2.8% anticipated. Final month 2.9%

- PCE core MoM 0.4% vs 0.4% anticipated

- Prior MoM core 0.2% revised to +0.1%

- Headline PCE 2.4% vs 2.4% anticipated (prior 2.6%). MOM 0.3% vs 0.3% anticipated

- Full report click here

3 month annualized 2.8%. 6 month annualized 2.6%.

Pre-Covid 2020, it was 1.5% for comparability.

Client spending and client earnings for January:

- Private earnings 1.0% versus 0.4%. Prior month 0.3%.

- Private spending 0.2% versus 0.2% anticipated. Prior month 0.7%

- Actual private spending -0.1% vs 0.6% final month revised from 0.5%).

1 minute previous to the report:

- Markets had been pricing 78 bps of cuts in 2024.

- 2- 12 months yield was at 4.689%.

- 10 12 months yield was at 4.311%.

- S&P index or implying a decline of -16.01 factors.

- NASDAQ index was implying a decline of -46.75 factors.

After the report:

- 2-year yield 4.666%

- 10 12 months yield 4.285%

- S&P index +12.0 factors

- NASDAQ +76.5 factors

The PCE knowledge is essentially as anticipated. Yields are decrease/shares are increased. The US greenback moved decrease however has retraced a few of these declines. Private earnings grew properly by 1.0%. Spending was average.

Persevering with claims confirmed some weak point with an increase to 1.905M from 1.860M final week.