- Prior month -3.4% revised from -3.6% beforehand reported

- Sturdy items orders 5.4% vs 5.4% preliminary. Final month -5.1%

- Sturdy items ex protection 6.5% vs 6.5% preliminary. Final month -6.4%

- Non protection Cap ex air 0.4% vs 0.5% preliminary. Final month -0.6%

- Ex Transportation 0.1% vs -1.3% final month (was -1.2%).

- Shipments rose 0.5% after falling -1.3% in October.

- Unfilled orders, up 11 of 12 months, elevated $17.1B or 1.3%. In October it elevated 0.4%

- Inventories, up 5 consecutive months, elevated $0.6 billion or 0.1 p.c to $857.1 billion. This

adopted a nearly unchanged October enhance. The inventories-to-shipments ratio was 1.48, unchanged

from October.

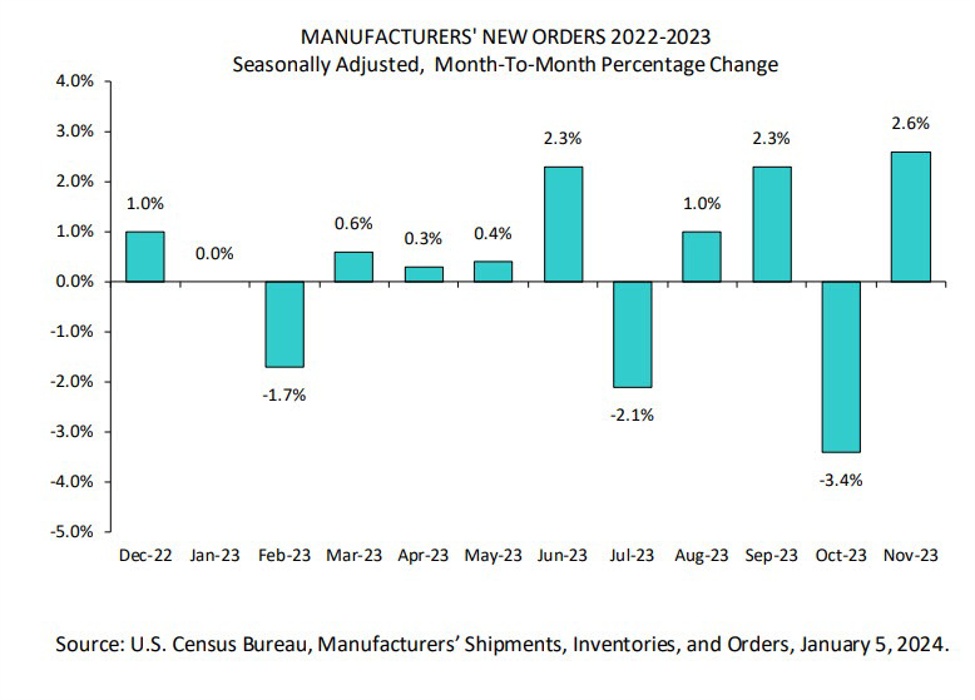

It’s exhausting to interpret the information as it’s impacted by giant ticket gadgets. Nonetheless, orders are up 3 of the final 4 months.

Extra focus is being placed on the ISM providers which is extra well timed and was weak. The USD is shifting sharply decrease on the decline and US yields are actually decrease on the day after being up 10 foundation factors within the 10 yr as much as 4.101%. The ten yr yield is now buying and selling at 3.96% down -3.0 foundation factors.

This text was written by Greg Michalowski at www.forexlive.com.