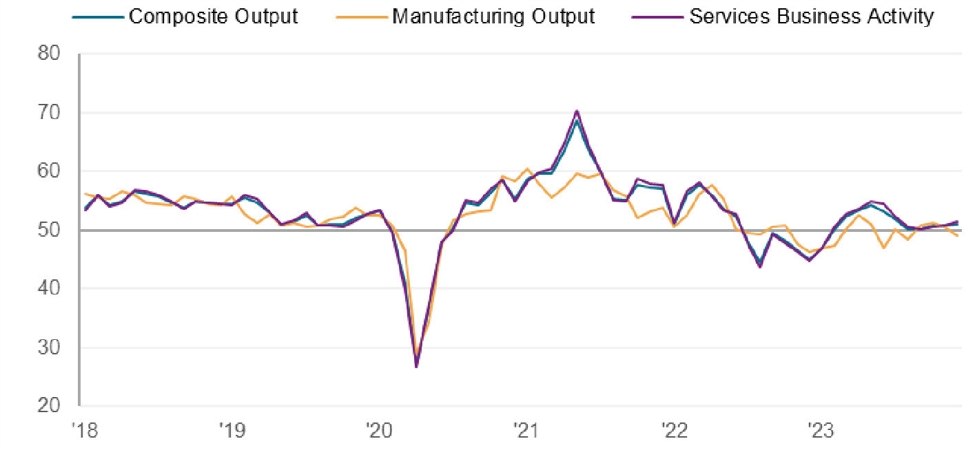

- Prior was 49.4

- Manufacturing 48.2 vs 49.3 anticipated (prior 49.8)

- Composite index 51.0 vs 50.7 prior

- Value pressures gained momentum as enter

costs elevated on the quickest tempo since September - Though corporations continued to cross by way of increased prices to

clients, and at a robust price, the general tempo of costs

charged inflation softened from November - Employment improves, highest since Sept

The companies PMI hit a five-month excessive on a bounce in new orders. Eyes are on inflation and there was a small uptick right here. That is not transferring in the best path nevertheless it’s robust to get excited a couple of small uptick.

The companies PMI hit a five-month excessive on a bounce in new orders.

Feedback within the report from Chris Williamson, Chief Enterprise

Economist at S&P International Market Intelligence:

“The early PMI information point out that the US financial system picked

up a little bit momentum in December, closing off the yr

with the quickest progress recorded since July.

“Looser monetary situations have helped increase demand,

enterprise exercise and employment within the service sector,

and have additionally helped raise future output expectations

increased. Nevertheless, the elevated price of dwelling and

cautious strategy to spending by households and

companies means the general price of service sector

progress stays far wanting that witnessed through the

journey and leisure revival again within the spring and summer time.

“Manufacturing in the meantime stays a drag on the

financial system, with an elevated price of order e book decline

prompting factories to cut back manufacturing, reduce on

headcounts and reduce their enter shopping for.

“Regardless of the December upturn, the survey subsequently

indicators solely weak GDP progress within the fourth quarter.

“The survey’s promoting worth gauge, which tends to steer

adjustments in shopper worth inflation, stays sticky however at

a degree which is indicative of CPI operating solely modestly

above 2%. Service sector enter price inflation, a key

gauge of core inflation, as soon as once more remained notably elevated by historic requirements, although even right here the

common price of improve within the fourth quarter has been

the bottom since mid-2020.”

The market response to this report has been minimal.