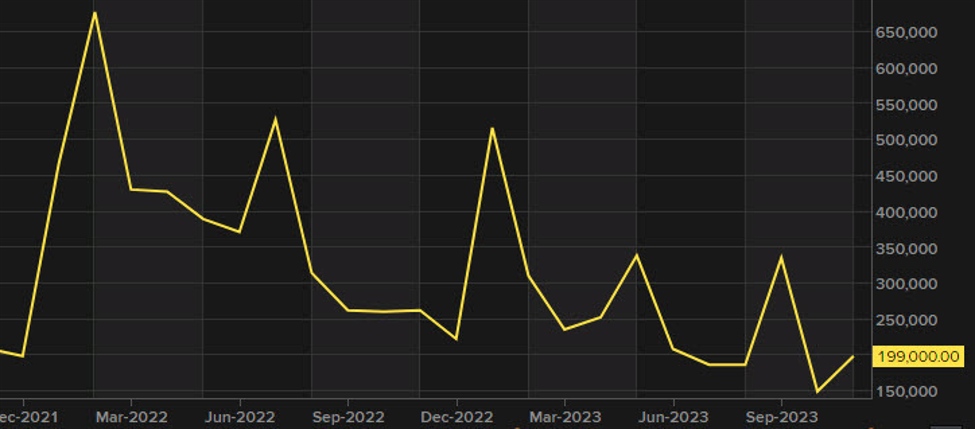

nonfarm payrolls

- Prior +180K (unrevised)

- Two-month web revision -35K vs -101K prior

- Unemployment charge +3.7% vs 3.9% anticipated

- Prior unemployment charge 3.9%

- Participation charge 62.8% vs 62.7% prior

- U6 underemployment charge 7.0% vs 7.2% prior

- Common hourly earnings +0.4% m/m vs +0.3% anticipated

- Common hourly earnings +4.0% y/y vs +4.1% anticipated

- Common weekly hours 34.4 vs 34.3 anticipated

- Change in non-public payrolls +150K vs +153K anticipated

- Change in manufacturing payrolls +28K vs +30K anticipated

- Family survey +747K vs -348K prior

- Start-death adjustment +4K vs +412K prior

The market was pricing in 121 foundation factors in Fed charge cuts subsequent 12 months forward of this report and USD/JPY was buying and selling at 144.35. The pricing has instantly dropped to 112 foundation factors with USD/JPY as much as 145.00.

The family survey has been lagging all 12 months and it was an open query whether or not it will catch as much as the institution survey or if the institution survey would catch down. With an enormous acquire within the family survey and a drop within the unemployment charge, regardless of increased participation, it appears just like the survey are extra in line now.

It is a huge dent within the concept of a slowdown in hiring. A March lower is all the way down to round 50% from 70%. There are three extra jobs reviews earlier than then and for those who’re anticipating a lower, you’d need to assume all three might be weak.

Unemployment charge

![LinkedIn Shares Insights into B2B Advertising Traits of Focus [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/01/bG9jYWw6Ly8vZGl2ZWltYWdlL2xpbmtlZGluX3RlY2hfaW5mbzEucG5n-600x421.jpg)