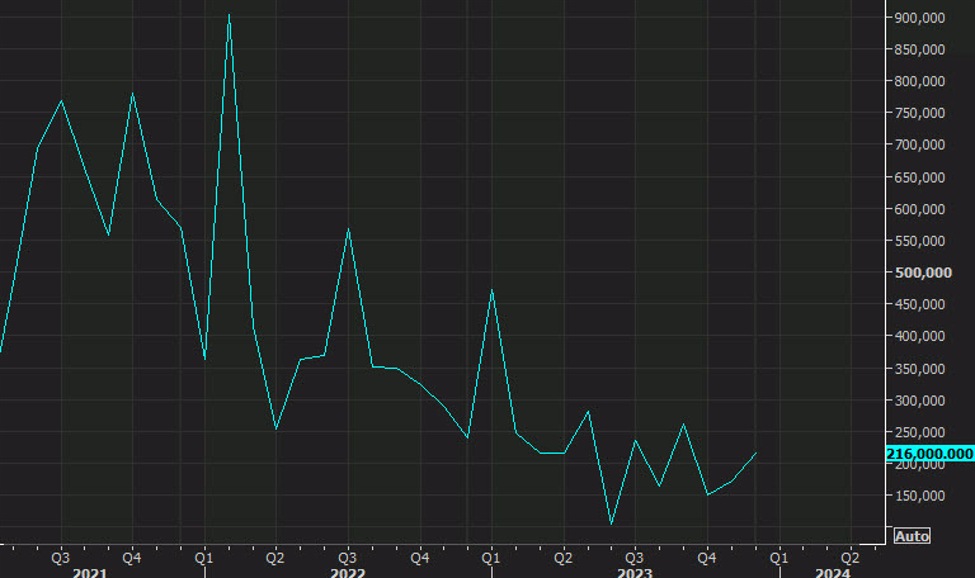

Non-farm payrolls

- Prior +199K (revised to +173K)

- Two-month internet revision -71K vs -35K prior

- Unemployment charge 3.7% vs 3.8% anticipated

- Prior unemployment charge 3.7%

- Participation charge 62.5% vs 62.8% prior

- U6 underemployment charge 7.1% vs 7.0% prior

- Common hourly earnings +0.4% m/m vs +0.3% anticipated

- Common hourly earnings +4.1% y/y vs +3.9% anticipated

- Common weekly hours 34.3 vs 34.4 anticipated

- Change in non-public payrolls 164K vs +130K anticipated

- Change in manufacturing payrolls +6K vs +5K anticipated

- Family survey -683K vs +747K prior

- Delivery-death adjustment -52K vs +4K prior

USD/JPY was buying and selling at 145.13 forward of the info with 10-year yields at 4.04% and Fed funds pricing in a 68% probability of a March charge lower and 136 bps in cuts for 2024. The US greenback jumped on the info with USD/JPY as much as 145.80 and a 58% probability of a March lower and 127 bps for the yr.

The family survey was revised for the yr and that led to a comparatively massive drop within the participation charge, which is one thing that put downward stress on the unemployment charge. Furthermore, there methodology is altering for inhabitants estimates in subsequent month’s report, which can result in one other skew. Lastly, the institution will even be hit by benchmark revisions subsequent month.