-

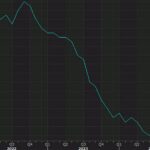

US oil manufacturing is anticipated to maintain booming in 2024, presumably hitting a recent excessive of 13.3 million barrels a day.

-

That comes as Exxon Mobil and Chevron are boosting their capital expenditure budgets for 2024.

-

Extra US provide may put additional stress on Saudi Arabia to regain contol over crude costs.

US oil manufacturing is having a blockbuster yr, and 2024 may see recent highs, placing extra stress on Saudi Arabia to regain management over crude costs.

Analysts at Rapidan Vitality estimate US output will common 13.3 million barrels a day subsequent yr, up from 2023’s common of 13 million and above the present all-time report of 13.2 million reached in September.

That comes as US oil giants Exxon Mobil and Chevron lately introduced will increase of their capital expenditure budgets for 2024 as they pour more cash into the Permian Basin, the epicenter of the shale increase.

The report provide of US oil has coincided with output cuts from OPEC+ nations like Saudi Arabia and Russia, which have been struggling to lift oil prices.

That’s bought some specialists warning that the Saudis might reverse course and as a substitute flush the oil market with a flood of supply like they did in 2014, when Riyadh sought to drive out US producers from the market by sinking costs and making output much less worthwhile.

Different analysts have echoed that view, as Doug King, chief funding officer of the Service provider Commodity Fund, told Bloomberg that “OPEC’s strategy looks fragile” and a extra “logical plan” would come with unleashing a flood of provide to depress costs once more.

For its half, Rapidan Vitality doesn’t see it that approach.

“Currently we do not expect OPEC+ will flood the market to stifle US shale growth,” Bob McNally, president of Rapidan Vitality, wrote in an e-mail to the Enterprise Insider. “Ministers remain optimistic that supply-demand fundamentals will be together than many traders expect, helping to support prices.”

Even so, the roaring progress in US oil is simple. Along with their elevated spending, Exxon and Chevron have introduced mega-mergers this yr to purchase prime shale producers.

“The Permian is going to be the engine of growth not only this year, but in years going forward,” Hunter Kornfeind, an oil analyst at Rapidan, mentioned in an interview.

Shifting tides

Whereas the amped budgets of the vitality behemoths spotlight the surge in US oil manufacturing, they’re additionally an indication of the shifting panorama within the American vitality business.

Development isn’t as excessive in comparison with prior cycles, when oil corporations would reinvest about 100% of the money they generated into capital expenditures to drill extra oil, Kornfeind mentioned. Now, the quantity they spend is about 40% to 50% of the cash they make.

That displays a change within the priorities of US oil corporations as they focus extra on shareholders returns via buybacks and dividends.

In the meantime, US shale manufacturing — which Saudi Arabia focused in 2014 — isn’t the principle threat dealing with OPEC over the long run, McNally mentioned.

“OPEC is more concerned about inadequate investment in supply than too much shale,” he mentioned. “It’s important to note that OPEC does not share the IEA’s peak demand view and therefore thinks shale oil growth is less of a threat.”

Learn the unique article on Business Insider