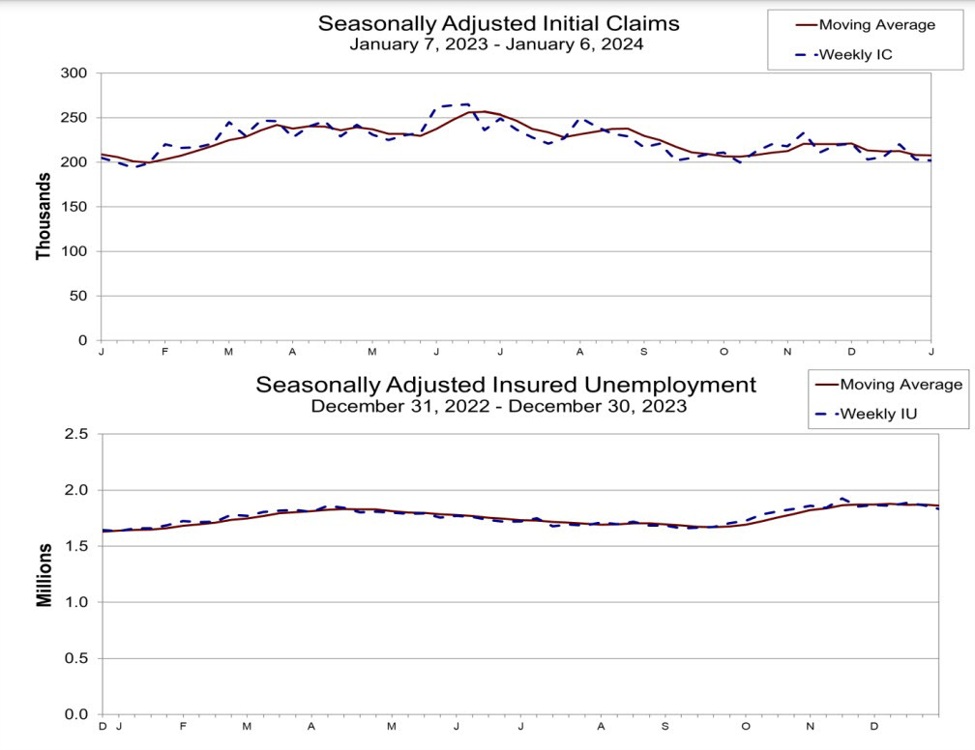

- Prior week 202K revised to 203K

- Preliminary jobless claims 202K vs 210K estimate

- 4-week shifting common preliminary jobless claims 207.75K vs 208.0K final week

- Persevering with claims 1.834M vs 1.871M estimate

- Prior week persevering with claims 1.855M revised to 1.868M

- 4-week MA persevering with claims 1.863M vs 1.870M final week.

Click HERE for the total report.

The premarket shares forward of the discharge and the present reveals a adverse response due primarily to the stronger CPI information:

- Dow, +38 The Dow is now down -55 factors

- S&P, 8. The S&P is now down -10.45 factors

- Nasdaq, +79. The Nasdaq is now down -9.8 factors

The USD is larger however now falling again decrease.

Yields have moved larger however stays in adverse territory.

- 2 yr 4.347% -2.3 foundation factors

- 5-year 3.956% -2.1 foundation factors

- 10 yr 4.015% -1.5 foundation factors

- 30-year 4.200%, unchanged

The variety of cuts in 2024 is now 137 bp vs about 143 bp earlier than the information.

Replace: US shares are reversing declines 9 minutes after the discharge.

- Dow Industrial Common -12 level

- S&P index -3 level

- Nasdaq index +8 factors