In a big growth for the cryptocurrency market, america Securities and Alternate Fee (SEC) has initiated proceedings on Grayscale Investments’ utility for a spot Ethereum ETF and prolonged the decision deadline.

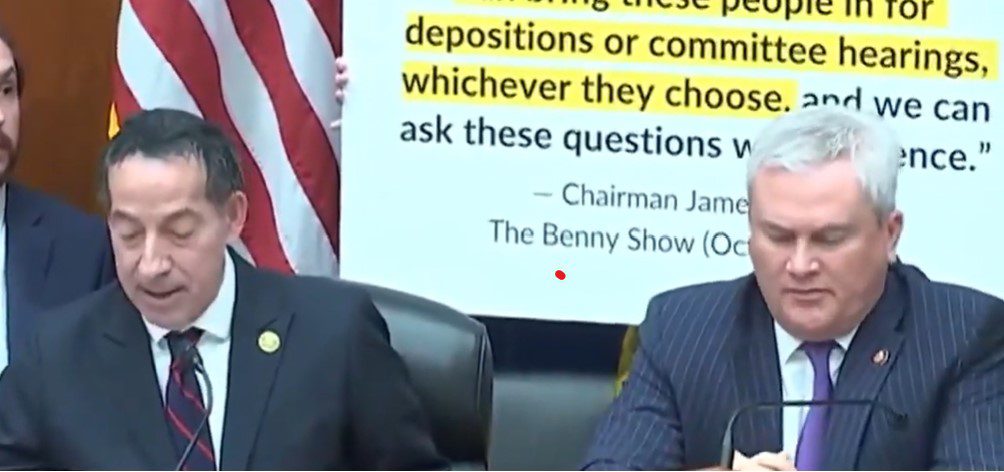

Evaluation Interval For Grayscale’s Ethereum ETF

Grayscale’s utility, filed with the SEC on October 10, 2023, sought approval for itemizing and buying and selling shares of the Grayscale Ether Trust on the New York Inventory Alternate (NYSE) Arca underneath the Commodity-Primarily based Belief Shares rule.

The proposed rule change was revealed for public remark within the Federal Register on October 27. In response, the SEC supplied an prolonged interval to approve, disapprove, or institute proceedings on the proposed rule change, much like the Fee’s steps earlier than approving the Bitcoin Spot Alternate Traded Funds on January 11.

With the initiation of proceedings, the SEC stated that it could “thoroughly” analyze whether or not to approve or disapprove the proposed rule change. The Fee’s determination to institute proceedings doesn’t point out any preconceived conclusions.

As an alternative, it displays the necessity for additional examination of the authorized and coverage points related to the Ethereum ETF utility.

The SEC particularly highlights the necessity to think about the proposed rule change’s consistency with Part 6(b)(5) of the Securities Alternate Act of 1934, which requires nationwide securities alternate guidelines to stop fraudulent and manipulative acts, defend buyers, and serve the general public curiosity.

events are inspired to supply feedback addressing the sufficiency of the Alternate’s statements supporting the proposal and some other considerations associated to the proposed rule change.

SEC Requests Suggestions

The Fee poses a number of questions for commenters to handle, together with the appropriateness of itemizing and buying and selling the shares underneath NYSE Arca Rule 8.201-E, given the character of the underlying property held by the Belief.

The SEC additionally references the Alternate’s arguments for itemizing and buying and selling spot Bitcoin exchange-traded merchandise (ETPs), in search of additional input.

people and organizations of Ethereum ETF functions are invited to submit written knowledge, views, and arguments in regards to the proposed rule change’s consistency with the Act and its rules. Though oral shows are usually not deemed needed at this stage, the Fee will think about requests for such shows.

In mild of the current approval of 11 Bitcoin spot exchange-traded funds, the Fee’s future actions relating to the approval of Ethereum ETF functions stay unsure.

It is usually value contemplating the classification of Ethereum as a “security” by the SEC and the way this classification would possibly affect the decision-making strategy of the 12 Ethereum ETF functions. You will need to observe that the SEC views Bitcoin as the only real commodity inside the cryptocurrency market.

In keeping with Bitcoin’s trajectory, Ethereum (ETH) has undergone a big correction, witnessing a decline of over 14% within the final 14 days and 11% prior to now seven days. In consequence, its present worth stands at $2,217.

Featured picture from Shutterstock, chart from TradingView.com