A storm of controversy has erupted after the Securities and Trade Fee (SEC) approved the primary wave of spot bitcoin exchange-traded funds (ETFs), pitting lawmakers towards one another in a heated debate over cryptocurrency regulation.

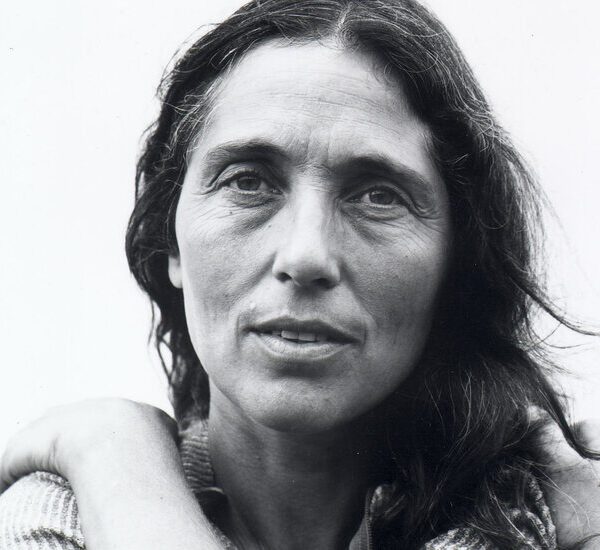

Main the cost towards the SEC’s choice is Senator Elizabeth Warren (D-MA), a longtime voice of warning within the digital asset house.

Warren Challenges SEC On Bitcoin ETF

“The SEC is wrong on the law and wrong on the policy,” she declared in a scathing public assertion.

Her main concern stems from the company’s alleged failure to adequately handle the authorized and coverage implications of integrating unstable cryptocurrencies like bitcoin deeper into the monetary system.

The @SECgov is flawed on the regulation and flawed on the coverage with respect to the Bitcoin ETF choice.

If the SEC goes to let crypto burrow even deeper into our monetary system, then it’s extra pressing than ever that crypto observe primary anti-money laundering guidelines.

— Elizabeth Warren (@SenWarren) January 11, 2024

“If the SEC is going to let crypto burrow even deeper into our financial system, then it’s more urgent than ever that crypto follow basic anti-money laundering rules,” she emphasised, pushing for harder AML rules on crypto miners, validators, and pockets suppliers.

However not all lawmakers share Warren’s apprehension. Senator Cynthia Lummis (R-WY) sees the transfer as a win for American buyers, praising the ETFs for providing “easier access to crypto assets with the benefit of professional management and competitive fees.”

Lummis, alongside Sen. Kirsten Gillibrand (D-NY), is championing their very own invoice to ascertain clearer rules for the crypto sector, aiming to steadiness innovation with shopper safety.

Bitcoin at present buying and selling at $45,724 on the every day chart: TradingView.com

Equally, Home Monetary Providers Committee Chair Patrick McHenry (R-NC) welcomed the SEC’s motion, viewing it as a optimistic shift in the direction of clearer guidelines.

The motion represents a “significant improvement” from the SEC’s prior strategy of regulation by enforcement, he remarked, hinting on the company’s previous historical past of cracking down on crypto by way of focused enforcement actions.

Picture: Bitcoinsensus

SEC’s Inner Wrestle Fuels Crypto Debate

Including intrigue to the saga is the SEC’s personal inner battle. Regardless of approving the ETFs, Chair Gary Gensler, a identified crypto skeptic, stays cautious. He highlighted the authorized constraints imposed by a current courtroom ruling as the first driver behind the choice, underscoring his private considerations about bitcoin’s volatility and potential function in illicit actions.

This pivotal moment in US crypto regulation raises crucial questions. How can we foster innovation whereas safeguarding shoppers? What function ought to authorities companies play in overseeing rising monetary merchandise? And the place does the crypto market head from right here?

Whereas the solutions stay hazy, one factor is evident: the battle strains are drawn. Traders, lawmakers, and regulators will proceed to grapple with these complicated points because the digital asset panorama evolves at breakneck velocity.

Featured picture from Getty Pictures