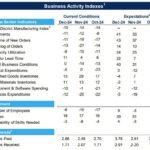

The US main inventory indices surged greater at the moment led by the NASDAQ index which rose over 2.0%.

The catalyst was decrease than anticipated core PCE information launched by the Federal Reserve. That inflation measure is the favor measure of inflation by the Fed. Given the GDP day yesterday with the quarterly core PCE information greater than expectations, the concern was a shock to the upside at the moment. The MoM got here in as anticipated 0.3%. There was rumblings of a +0.4 – +0.5% degree after the information yesterday.

The ultimate numbers at the moment are exhibiting:

- Dow Industrial Common common of 153.84 factors or +0.40% at 38239.67.

- S&P index up 51.54 factors or 1.02% at 5099.95.

- NASDAQ index up 316.14 factors or 2.03% at 15927.90.

The small-cap Russell 2000 rose 20.8 factors or 1.05% at 2001.99.

For the buying and selling week, the S&P and NASDAQ indices had their finest week since October 30, 2023.

- Dow Industrial common rose 0.67%

- S&P index rose 2.67%

- NASDAQ index rose 4.23%

- Russell 2000 rose 2.79%.

Beneficial properties at the moment had been led by:

- Snap, +27.46% after beating earnings

- Alphabet, +10.22% after its earnings

- Tremendous Micro Computer systems +8.9%. They may announce earnings subsequent week.

- Nvidia, +6.18%. Nvidia will not announce till later in Could.

- Broadcom, was 3.84%

- Amazon, +3.43% (Amazon will announce subsequent week)

The massive losers at the moment included:

- Intel, -9.2% after disappointing earnings.

- Exxon Mobil -2.60%. It too missed on earnings

- Paramount -2.60%

- Ford Motor -2.07%

- American Airways -1.77%

Subsequent week, the next corporations will announce their earnings (* after the shut):

Monday, April 29

- Domino’s Pizza

- Phillips

- Paramount*

- Logitech*

Tuesday, April 30

- PayPal

- Lily

- 3M

- McDonald’s

- Coca-Cola

- Amazon *

- AMD*

- Tremendous Micro Computer systems*

- Starbucks*

Wednesday, Could 1

- Pfizer

- CVS

- MasterCard

- Marriott

- Qualcomm *

- Carvana *

Thursday, Could 2

- Peloton

- Moderna

- Apple *

- Coinbas *

- Block *

- DraftKings *

- Fortinet *

Friday, Could 3