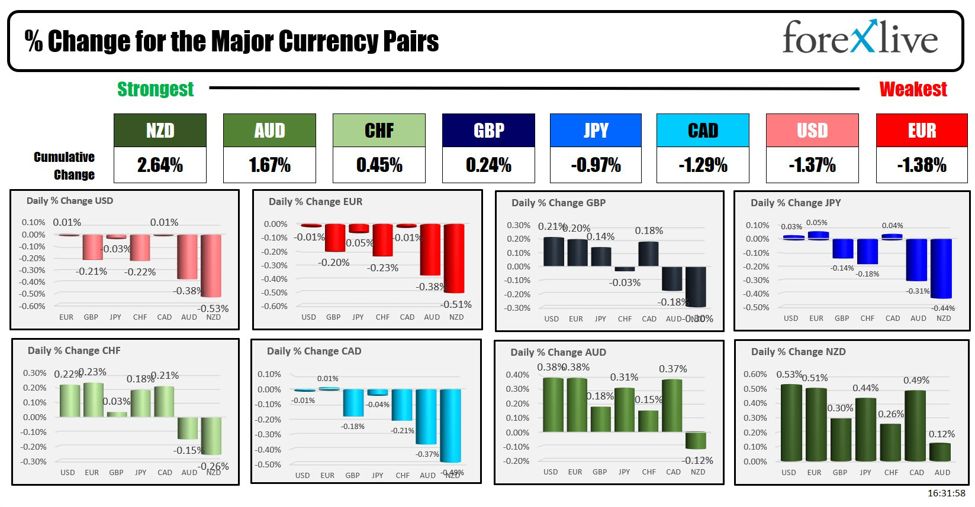

US shares get well from declines seen within the final hour of buying and selling to shut the broader indices larger. Atlanta Fed Pres. Bostic mentioned that he can not get rid of the chance that charge cuts transfer even additional out however then reversed course saying if disinflation pays resumes, may pull cuts ahead.

That reversed the NASDAQ index from 16183 to 16306.64 on the shut – a change of 123 factors (or 0.76%) within the final 50 minutes of the day. The S&P moved from 5174 to 5209, or a transfer of 35 factors (or 0.68%).

The ultimate numbers are exhibiting:

- Dow Industrial Common fell -9.15 factors or -0.02% at 38883.66

- S&P index rose 7.54 factors or 0.14% at 5209.92

- NASDAQ index rose 52.68 factors or 0.32% at 16306.64.

The small-cap Russell 2000 achieve 7.08 factors or 0.34% at 2080.79

Though the broader indices moved larger, Nvidia was not a part of that rally. Different chip producers like Intel and Google touted new chips that they are saying would rival Nvidia chips at cheaper costs. The worth of Nvidia fell $-17.79 or -2.04% at $853.54. Nonetheless at Lowe’s, the value was down $-41.11 for -4.7%.

Meta Platforms additionally was decrease declining by -0.45%. Apple rose 0.71%. Google/Alphabet rose 1.13%, in Microsoft rose 0.40%. Intel shares rose 0.92% after their announcement. Boeing stays beneath stress with a decline of -2.09%.

Tomorrow US CPI knowledge might be launched at 8:30 AM. That can set the tone for the day.