We are in the midst of one of the all-time great divergences in markets right now.

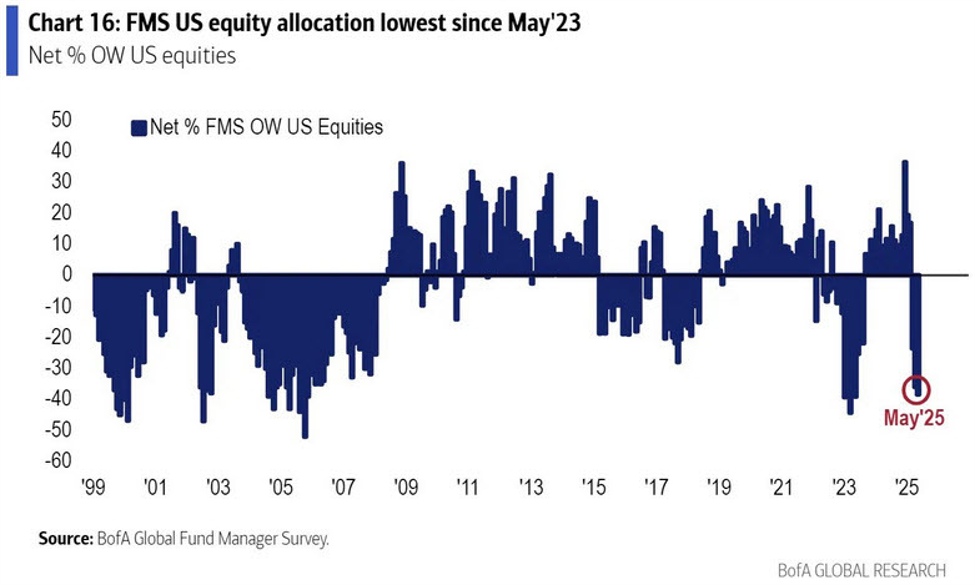

On the one hand, you have the BofA fund manager survey (and many other data points) showing that fund managers have been lightening up on the US and are as close to as bearish as they’ve been.

On the flipside, this was from a JPMorgan report yesterday:

“Retail accounted for 36% of all trading volume today. Highest ever. Retail has learned the hard way, getting left behind during previous stock recoveries supported by policy puts. There is almost an unwavering commitment from retail to never make that mistake again”.

Some jitters have kicked into stocks in the last half-hour and the S&P 500 is down 40 points, or 0.7%.

SPX intraday

ForexLive.com

is evolving into

investingLive.com, a new destination for intelligent market updates and smarter

decision-making for investors and traders alike.