The most important US inventory indices are opening decrease with the five-week successful streak in jeopardy.

- Dow Industrial Common is buying and selling down 11 factors or -0.03% at 36108.25

- S&P index buying and selling down 5.73 factors or -0.13% 4579.23

- Nasdaq index down -50 factors or -0.34% at 14292

For the buying and selling week:

- Dow Industrial Common is down -0.40%

- S&P index is down -0.30%

- Nasdaq index is now down -0.03% just under unchanged on week

The Magnificent 7 are buying and selling largely decrease with Apple and Nvidia the one gainers.

- NVIDIA (NVDA): +0.64%, +2.97 at 468.93

- Apple (AAPL): -0.01%, -0.02 at 194.15

- Tesla (TSLA): -0.39%, -0.94 at 241.70

- Microsoft (MSFT): -0.40%, -1.47 at 369.48

- Meta Platforms (META): -0.46%, -1.50 at 325.09

- Amazon (AMZN): -0.77%, -1.13 at 145.67

- Alphabet (GOOGL): -1.50%, -2.05 at 134.88

Lululemon introduced disappointing earnings after the shut. It is inventory is down -0.29% at $463.65. Broadcom (AVGO) opened larger however is now buying and selling above and beneath unchanged on the day.

Wanting on the US debt markets, yields are larger however after highest ranges after the stronger US jobs report:

- 2-year yield 4.691% +11.2 foundation factors

- 5-year yield 4.225% +11.3 foundation factors

- 10-year yield 4.219%, +9.1 foundation factors

- 30-year yield 4.311%, +6.6 foundation factors

In different markets:

- Crude oil is up $1.32 or 1.9% at $70.64

- Spot gold is buying and selling down $22.47 or -1.11 cent at $2005.85 because it reacts to the upper greenback and better charges.

- Spot silver is down $0.46 or -1.98% to $23.30

- Bitcoin is buying and selling at $43,861

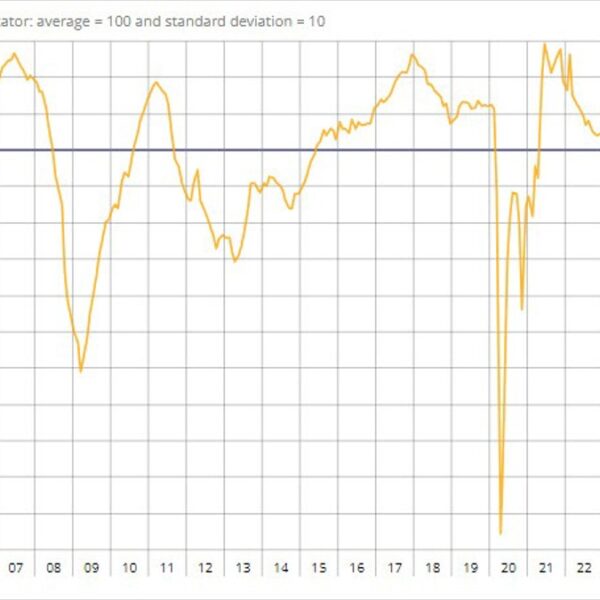

The EURUSD stays beneath its 100-day transferring common at 1.0763 and the 50% of the transfer up from the November 1 nicely at 1.0766. The worth trades at 1.0745. On the draw back, getting beneath 1.0725 ought to open the door and provides sellers extra confidence for a rotation down towards the 61.8% retracement at 1.0707. For the buying and selling week, the EURUSD is down -1.21% as merchants react to the expectations that the ECB will look to chop charges sooner and to indicators of decrease inflation (right now German ultimate CPI got here in at -0.4%). The stronger US jobs report can be serving to that bias swing and technicals have been destructive with the value remaining beneath its 100-hour transferring common (blue line within the chart beneath).

EURUSD stays beneath it 100-day MA and 50% midpoint

USDJPY merchants are taking the value larger on the day with the value extending to the 61.8% retracement of the weeks buying and selling vary close to 145.255 quickly after the US jobs report. Nevertheless, the value has since rotated again beneath eight swing space between 144.399 and 144.54. The 50% midpoint of the week’s buying and selling ranges at 144.564. That stage will probably be a barometer for patrons and sellers now.

USDJPY again beneath the 50% of the vary this week